Planning a holiday? These five credit cards offer the best deals on travel bookings

Travel credit cards are popular among those flying frequently on vacations or business trips

1/8

The holiday season is about to begin and everyone is geared up to make the most of the period, in the aftermath of the pandemic. To help you save on your travel bookings and to make the most of your holidays, Paisabazaar has listed the best travel credit cards available in the market for both domestic and international travel. Pick the one that meets your travel requirements.

2/8

Image Source: HDFC Bank | HDFC Regalia Credit Card offers air accidental death cover of up to Rs 1 crore and emergency overseas hospitalization of up to Rs 15 lakh. It has a foreign currency markup fees of 2 percent. It offers complimentary airport lounge access: 12 in India and six overseas, and other benefits. The annual fee is Rs 2,500 on this card.

3/8

Image Source: Axis Bank | Axis Vistara Signature offers complimentary club Vistara membership to customers, complimentary access to Vistara Lounges within India and air accident cover of up to Rs. 2.5 crore to its customers. It also offers bonus club Vistara points and complimentary Premium Economy Tickets on achieving milestone spends and other benefits. The annual fee is Rs 3,000 on this card.

4/8

Image Source: SBI Card | Air India SBI Signature Credit Card offers up to 30 reward points for every Rs 100 spent on Air India tickets booked through Air India portals, complimentary membership of the Air India Frequent Flyer program-Flying Returns, access to over 600 airport lounges with complimentary Priority Pass Program and more. The annual fee is Rs 4,999 on this card.

5/8

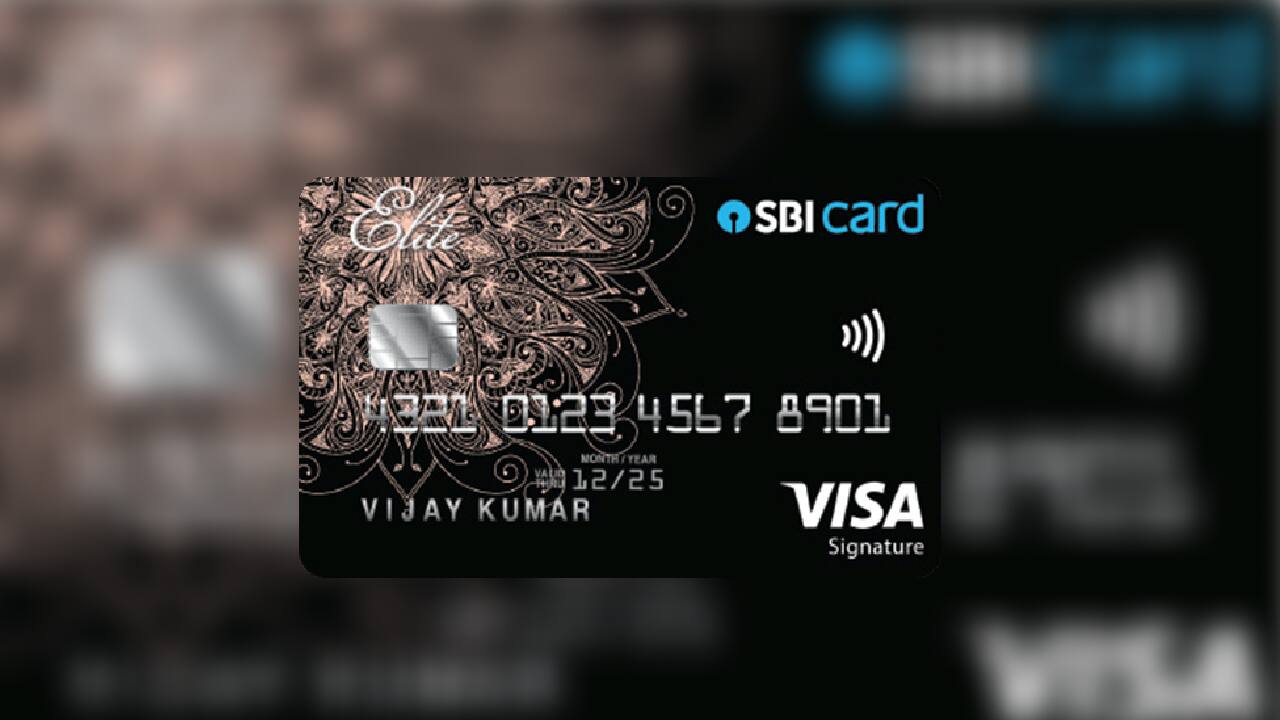

Image Source: SBI Card | SBI Card Elite offers complimentary Trident Privilege Membership and Club Vistara membership with one upgrade voucher. It has a foreign currency markup fees of 1.99 percent. It offers six complimentary airport lounge access internationally and two complimentary domestic lounge access and other benefits. The annual fee is Rs 4,999 on this card.

6/8

Image Source: Citibank | Citi Premier Miles Credit Card offers air accident insurance cover up to Rs 1 crore, complimentary airport lounge access and 20 percent savings at partner restaurants. You get to earn 10 miles per Rs 100 spent on airline expenses and 4 Miles per Rs 100 spent on other categories. You can redeem miles over 100 hotels and airline partners and accumulated air miles never expire. They communicate the annual fee at the time of application.

7/8

Have a disciplined approach to your credit behavior. It is critical that you use your travel credit cards smartly and responsibly. Since credit cards offer a significant interest-free period, there may be a tendency to over-spend while traveling with a family on vacations. If you spend more than you can repay and cannot pay your credit card bill timely, you will incur hefty interest charges ranging from 28-49 percent p.a., along with late payment fees.

8/8

To shortlist the top five travel credit cards, Paisabazaar compared the features of all credit cards available within the segment. All the cards are selected based on the primary travel benefits offered by each card for both domestic and international travel. All credit card information is sourced and updated as of November 25, 2021. The travel credit cards are arranged according to the least annual fees.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!