A year ago the country was forced to accept — or at least attempt to accept— digital payments when the government deemed invalid banknotes worth Rs 15.44 lakh crore overnight. Pitched as a move to clamp down on terror funding, black money, counterfeiting and corruption, the goal post of demonetisation shifted to online payments.

Cashless now, citizens who knew only one form of barter — cash for services — were left with no choice but to look at online payments. Though the Prime Minister Narendra Modi-led government incentivised the masses with discounts and prizes for using e-payments in the weeks to come — even BHIM, an all-inclusive payments app, was launched — digital payments are still a cause of discomfort to shopkeepers.

Several smaller shopkeepers operating kirana stores and paan shops that Moneycontrol spoke to are uncomfortable using mobile wallets to accept payments from customers.

It was just after demonetisation that the word “mobile wallets” started to ring in households. The likes of Mobikwik and Paytm went on a marketing blitz to make the most of the cash crisis India was facing.

As cash became scarce and queues at ATMs and banks grew kilometres-long, the tech-savvy started resorting to e-wallets. Meanwhile, those not familiar with digital payment technologies made an effort to learn from their peers, just because they had to sustain in the days of demonetisation.

A year later, many shops across urban India allow customers to pay for services through e-wallets.

Kolkata-based software engineer Panchali Kar had already found the perks of using a mobile wallet through Paytm. When demonetisation hit the economy, she taught a small food joint owner outside her office about how to use the mobile wallet.

“Initially, he was accepting old notes to maintain his customer base. He tendered change for Rs 500 notes and people flocked to his shop. After a few days he realised it was a bad idea and people were using his shop as a money-exchange counter,” she said.

When the café owner overheard Kar giving her friend instructions on setting up a mobile wallet account, he sought the patron’s help. “The next day, I saw a white paper stuck to the shop front — ‘Paytm Accepted’ — with his mobile number on it,” Kar said.

Mobile wallets seemed to be the new players who were gaining the most out of demonetisation as the cash-strapped Indians tried to find a way for daily transactions.

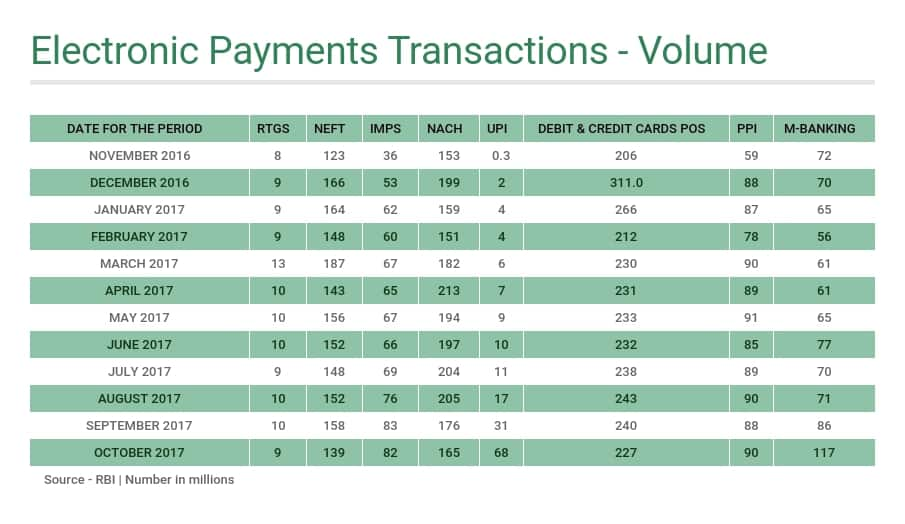

The volume of prepaid payment instrument (PPI) based transactions, including mobile wallets, gift cards and vouchers, spiked from 59 million to 87.8 million in between November and December last year, as per Reserve Bank of India data. Since then, it has hit a plateau.

Volume of PPI transactions fell 2.5 percent to 87.5 million in September this year from 89.7 million in August, as per RBI data. It rose 2.7 percent to 90 million last month as compared to September.

However, the value of total PPI transactions has increased from Rs 1,300 crore in November 2016 to Rs 3,100 crore in October this year.

Paytm, possibly India’s most used mobile wallet, saw a steep rise in its user base after demonetisation and added 55 million new users at the end of 2016, the company said in a blog post. In February, the company claimed to have on-boarded over 200 million users.

Mahesh Kumar, who runs a paan-cigarette shop in the busy commercial area of Mumbai’s Lower Parel, switched to Paytm right after the note ban. He was also told to sign up with Paytm by one of his customers belonging to the tech-savvy office crowd.

Kumar did not suffer much in terms of business, but he still prefers cash. “Small transactions are better in cash. It also helps as we buy our daily supplies in cash,” he said.

The 43-year-old shop-owner claimed that people started paying less by mobile wallets once cash began to flow into the economy after the new Rs 500 and Rs 2,000 notes were issued. Now, he only allows digital payments when customers don’t have cash.

While grocery stores still accept some form of mobile wallet payment, most say the usage has gone down.

A 50-year old kirana store ran by Navin Bheda in Mumbai’s Worli area has almost all the popular mode of cashless transactions — debit cards, mobile wallets, PoS and BHIM. He is comfortable with mobile wallets, but said fewer people transact using the mode.

“We never crossed the Rs 10,000 limit for [non-KYC] Paytm accounts even though a lot of people used it last year. Now, the total transaction amount hardly goes up to Rs 3,000 to Rs 4,000 a month,” Bheda said.

Bheda added that he hasn’t been able to utilise BHIM-Aadhaar Pay. He complained that the distributor is yet to install a biometric scanner, even 45 days after he made a requisition. He observed that during demonetisation, customers didn’t use BHIM and opted for mobile wallet payments instead.

While some stayed afloat with the means of mobile wallets or PoS machines, some traders failed to adapt to the new-age digital transaction.

Arif Agwah who runs a small kirana store near Bheda’s, did not use digital payments. Depending on cash hurt his business twice as much. Agwah said his profits became one fourth of what it was before demonetisation.

“The business has not recovered for most of us after the note ban. It is slowly becoming better. Even during Diwali festivities, sales remained stagnant,” Agwah said.

Agwah’s woes were echoed by another kirana store owner Ishaqul Usman who did not resort to mobile wallets and still remains unmoved about his alliance to cash. “All these Paytm like things are too complicated for me. It also charges you when you try to transfer your money to your bank account,” Usman said.

Usman accepted demonetised notes for a whole month after the November 8 announcement. But as the deadline for submitting old notes neared, he stopped doing so. “My business has become half of what it was then,” he said while reminiscing the better days he witnessed before demonetisation.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.