Online brokerage platform Zerodha will enable direct US stock investing via GIFT City by early 2026. This will aim to simplify cross-border investing. In a YouTube AMA (Ask Me Anything) with Zerodha's leadership, CEO Nithin Kamath addressed social media queries on US stock access. He confirmed that the team is actively developing it, with a launch expected in the next quarter as a new product.

In fact, Indian investors look to invest abroad, especially in US stocks, to access global leaders like Apple and Tesla, diversify their portfolio beyond India, gain exposure to innovative sectors like AI and biotech, and also benefit from currency appreciation as the US dollar strengthens against the rupee.

There are primarily three ways in which Indians can invest in US stocks. The first way is through Indian brokers that partner with US brokers and let Indians invest in US stocks. INDmoney, HDFC Securities offer this option. Vested also helps Indians invest in US stocks through the US brokerage firm Drive Wealth.

The other option is through mutual funds that invest in US stocks. However, such mutual funds are no longer taking in new investments as now the limits set by SEBI and RBI, which are capped at an industry-wide aggregated cap of $7 billion on overseas investments, has been breached.

The third option is investing through Gify City. This started in March 2022, when NSE IFSC received approval to trade receipts of 50 US-based stocks.

How it works

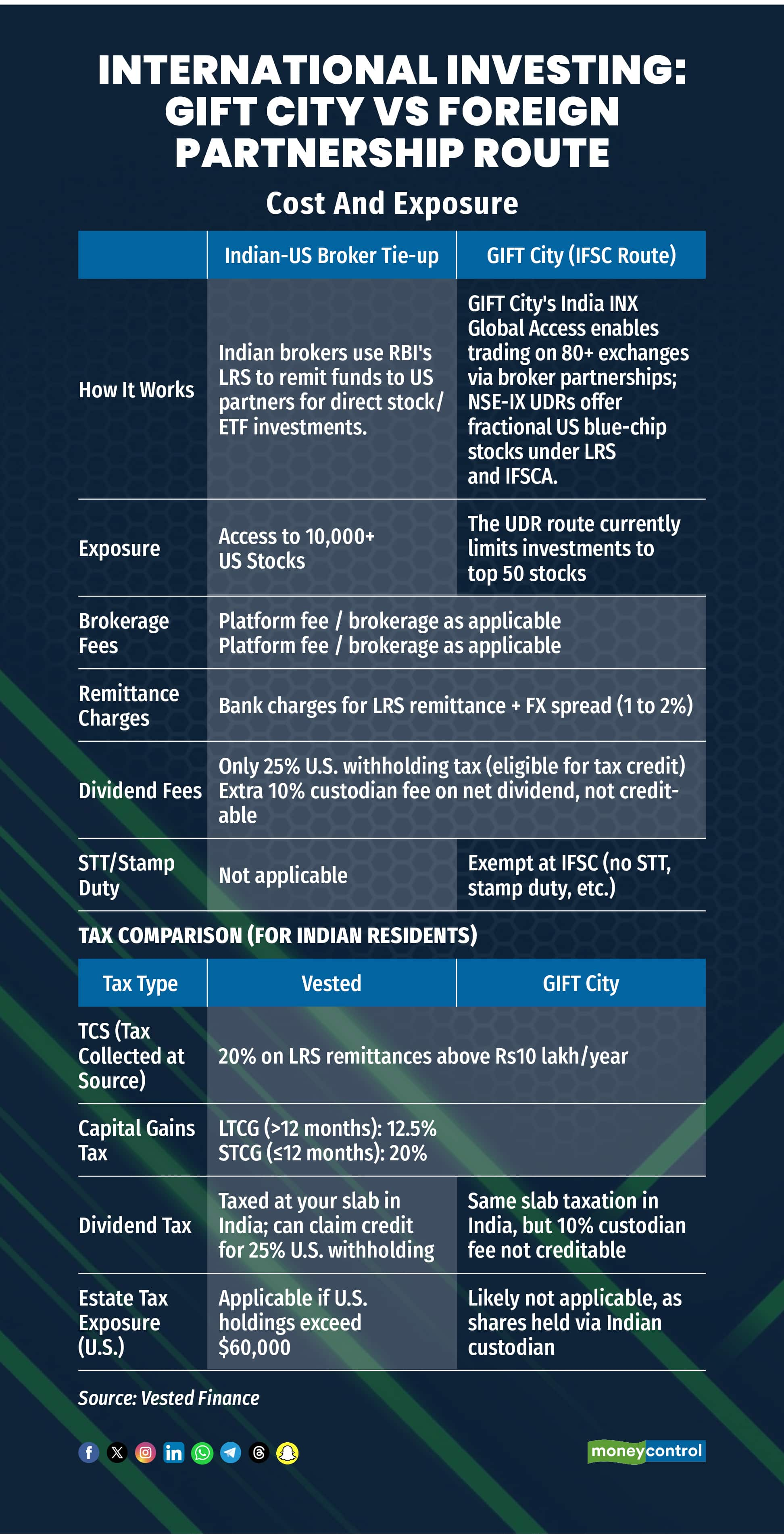

Let us take a look at the two direct ways of investing in US stocks: Through Indian brokers partnering with US brokers and through GIFT City.

“When an Indian broker ties up with a US broker, it uses RBI’s Liberalised Remittance Scheme (LRS) to send money to a US brokerage. The investment is directly made in US stocks and ETFs,” says Viram Shah Co-Founder and CEO of Vested.

There are two primary platforms in GIFT City that facilitate international stock investments -India INX's Global Access and NSE-IX's US stocks Unsponsored Depository Receipts (UDRs).

India INX, a subsidiary of the Bombay Stock Exchange, operates in GIFT City and provides the Global Access platform. This platform lets investors trade on over 80 international exchanges, including the US stock exchange. Trading US stocks through India INX's Global Access works like a partnership where Indian brokers team up with US brokers to open trading accounts for Indian investors, making it easier to buy and sell US stocks. India INX utilizes the IFSC framework to facilitate trades on international exchanges (like NASDAQ/NYSE) so it is different from the pevious model.

Unsponsored Depository Receipts (UDRs)

For the Unsponsored Depository Receipts (UDRs) route, investment is made via Indian brokers registered in GIFT City. You buy NSE IFSC Receipts (Unsponsored Depository Receipts - UDRs) that represent fractional ownership of select US stocks. These are held in a demat account under Indian regulatory oversight. Investing in US stocks via the GIFT City Unsponsored Depository Receipts (UDR) route is also conducted under the RBI's Liberalised Remittance Scheme (LRS).

Unsponsored Depository Receipts (UDRs) are like certificates that represent shares of a US company. However, they are issued and traded on a foreign stock exchange without the company’s involvement. These certificates are stored in electronic form, just like shares of Indian companies.

For example, if you buy Apple UDRs, Apple itself does not issue them. Instead, a custodian in the US owns the real Apple shares for investors. The investors buy and sell UDRs on the Indian exchange NSE-IX. This lets Indian investors trade US company shares easily without dealing directly with a US broker. Here, will focus on the UDR route of investing through GIFT City when comparing it with the LRS route.

Currently many registered brokers, including ICICI, HDFC, INDmoney Global. Geogit and others are offering this option.

To sum up, The UDR route works differently. Investors buy receipts representing US shares, not the shares directly. Payments are made in Indian rupees to an Indian broker, who handles the currency conversion needed to settle trades on the NSE IFSC platform. The UDRs are held safely in your IFSC demat account in India, reducing risk and making the process simpler, more affordable, and fully regulated under Indian law.

Through India INX, Indian investors buy actual US shares through foreign broker tie-ups. This requires opening an overseas trading account and sending money in US dollars under the LRS Scheme.

Accessible Stock Universe

A platform like Vested, for example offers access to 10,000+ US stocks and ETFs. It also allows you to invest in fractional shares. For example, on October 27 a single share of Berkshire Hathaway was selling for $487.95, which is approximately Rs 43,000. With fractional investing you can buy 0.1 shares at one-tenth the price, and that acts in the same way as a full share and earns proportional returns and dividends.

“When you invest through GIFT City UDR route, your investment is limited to 50 US blue-chip stocks (e.g., Apple, Tesla, Amazon). ETFs and smaller-cap US stocks are not available. Fractional investing is possible via pre-split UDR structure (e.g., 1/25th of a share),” says Shah.

One Apple UDR on NSE-IX equals 1/25th of a US Apple share. This fractioning makes a $100 share cost only $4, boosting accessibility for small investors.

Regulation and Custody

In the first case of partnership with foreign broker, the investments are regulated by foreign authorities (e.g., US SEC, FINRA). Securities are held via a foreign brokerage and there is SIPC protection (up to $500,000) in case of broker failure.

For GIFT City, the investments are regulated by IFSCA (the Indian regulator for GIFT IFSC). Securities are held in a demat account with Indian custodians (e.g., HDFC Bank IFSC). There is no SIPC coverage, but custody is transparent and regulated under Indian framework.

User experience

"For platforms like Vested, there is an app-based, modern interface. Quick onboarding with PAN plus Aadhaar makes the process easy. You can invest anytime; trades execute during U.S. market hours, and after-hours trading available too," said Shah.

When investing in US stocks through GIFT City, onboarding can be slower depending on the broker. Also trades during overlapping hours with US markets (7 PM to 1:30 AM IST), added Shah.

What should an investor choose and why?

“Choose the foreign partnership route if you want full access to global stocks and ETFs and if you are comfortable with a foreign broker plus US regulation,” said Shah. Also, here you can invest in ETFs and also get thematic exposure which groups companies around long-term trends like artificial intelligence, electric vehicles, and so on.

Go for the GIFT City Route if are happy with just the top 50 US stocks and prefer the Indian regulatory framework and demat-based holding.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.