- Home

- Documents Required

- How to file ITR

- Register/Login

- ITR Common Mistakes

- ITR Refund Status

- ITR Glossary

- Income Tax News

- ITR Filing FAQs

ITR e-filing: Essential Documents Required for Online Income Tax Return Filing

Keep these crucial documents handy to ensure a smooth and hassle-free ITR e-filing process:

Personal Information

- PAN: Your Permanent Account Number (PAN) is crucial for all tax-related activities.

- Aadhaar card: Ensure your Aadhaar number is linked to your PAN for seamless processing.

- Bank account details: Provide accurate bank account information, including IFSC code, for direct credit of refunds.

Income Proof

- Form 16: issued by your employer, this form details your salary, TDS and other deductions.

- Salary slips: monthly payslips for detailed income breakup

- Form 16A/16B/16C: for TDS on income other than salary, like interest, rental income or professional fees

Investment and Expense Proofs

- Investment proofs: documents related to investments under Section 80C, such as PPF, NSC, ELSS, and life insurance premiums.

- Housing loan interest certificate: for claiming deduction on home loan interest under Section 24

- Medical insurance receipts: for claiming deductions under Section 80D.

Other Income Proofs

- Interest certificates: from savings accounts, fixed deposits, and other investments.

- Rental income receipts: detailed records of rental income received.

- Capital gains statements: from the sale of property, shares, or mutual funds.

Tax Payment Proofs

- Advance tax receipts: proof of any advance tax payments made.

- Self-assessment tax receipts: proof of any self-assessment tax paid before filing returns

How to e-File Income Tax Returns on the Portal: A Step-by-Step Guide

To calculate your income tax liability, start by summarising your TDS payments for all four quarters of the assessment year using your Form 26AS. This summary will help you understand the total tax deducted at source and any additional tax liability you might have.

Ensure that your Form-16 details and other financial information that you share in ITR forms tally with Form 26AS and Annual Information Statement (AIS) that can be accessed through the e-filing portal (www.incometax.gov.in).

Next, determine the category you fall under by referring to the definitions provided by the Income Tax Department (ITD) for each ITR form. This step is crucial to ensure you select the correct ITR form for your filing.

Once you have your documents ready and have chosen the appropriate ITR form, you can proceed with e-filing your ITR using the Income Tax e-Filing portal.

Here’s a comprehensive guide to help you e-file your ITR 1 (Sahaj) on the official portal:

Step 1

Log in to the Income Tax e-Filing Portal - eportal.incometax.gov.in - using your PAN/Aadhaar/Other User ID

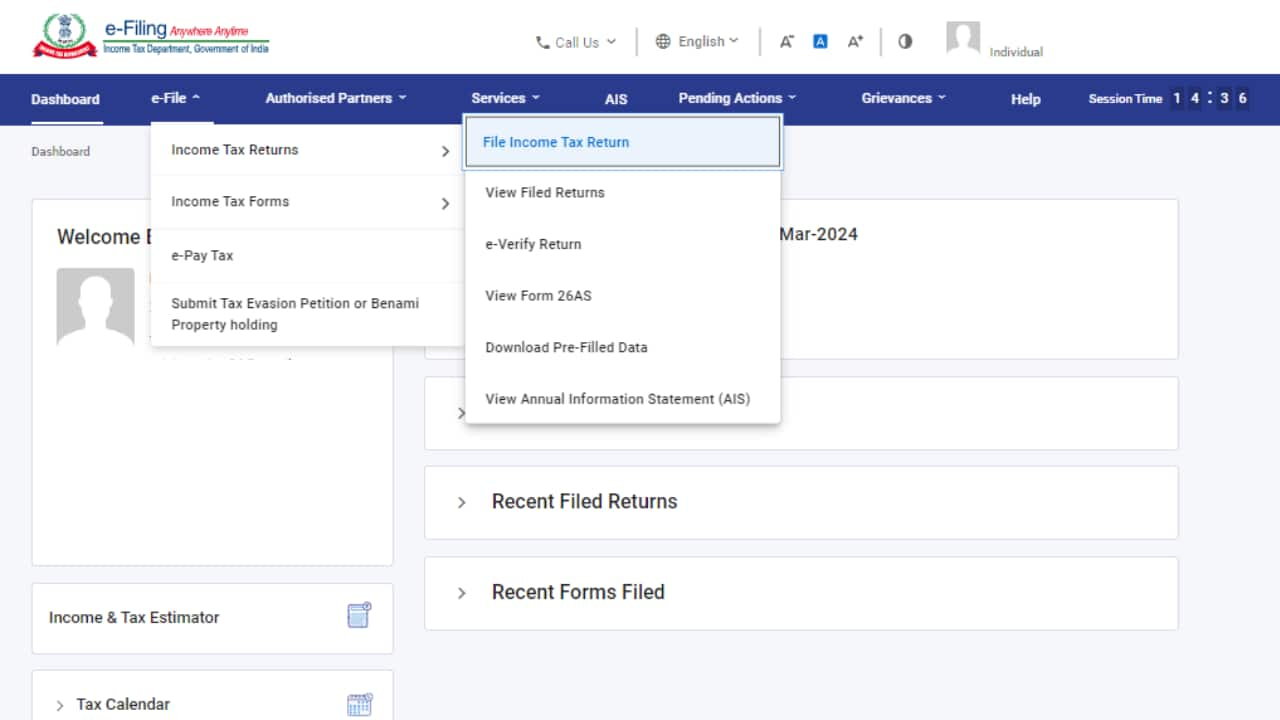

Step 2

Navigate to e-File > Income Tax Returns > File Income Tax Return.

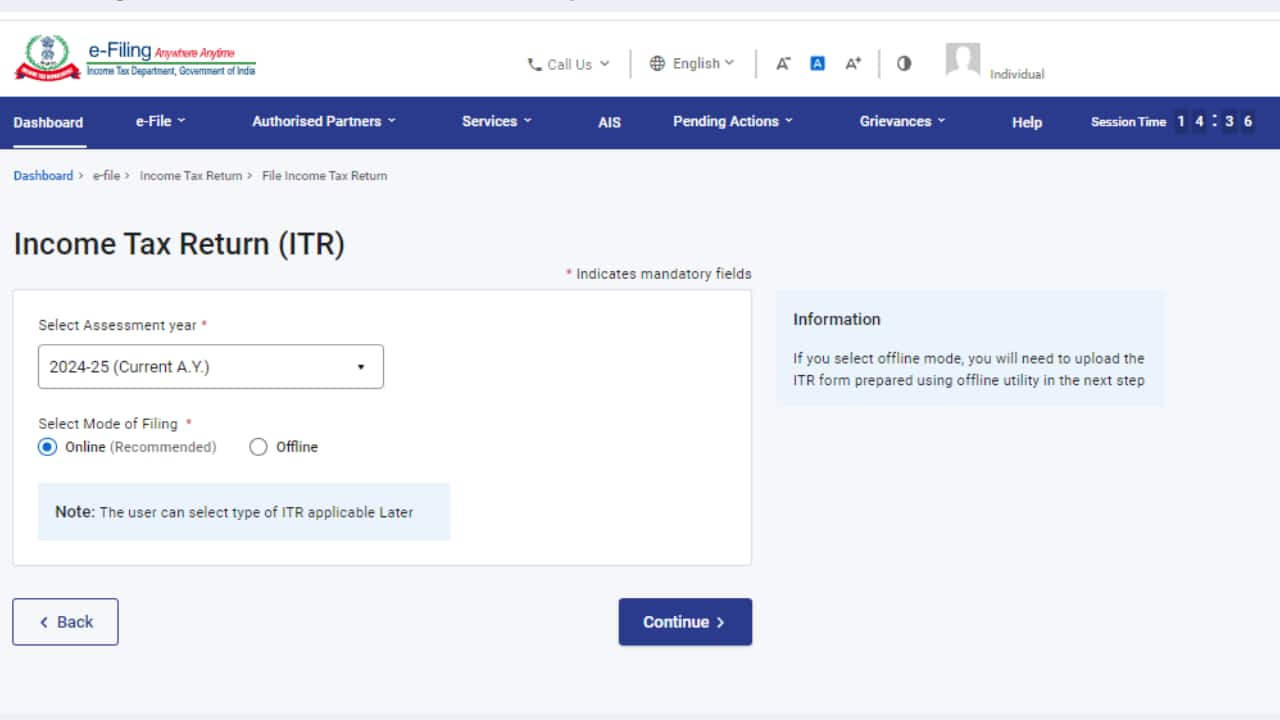

Step 3

Select the Assessment Year as 2025–26 and choose the online mode, then click Continue.

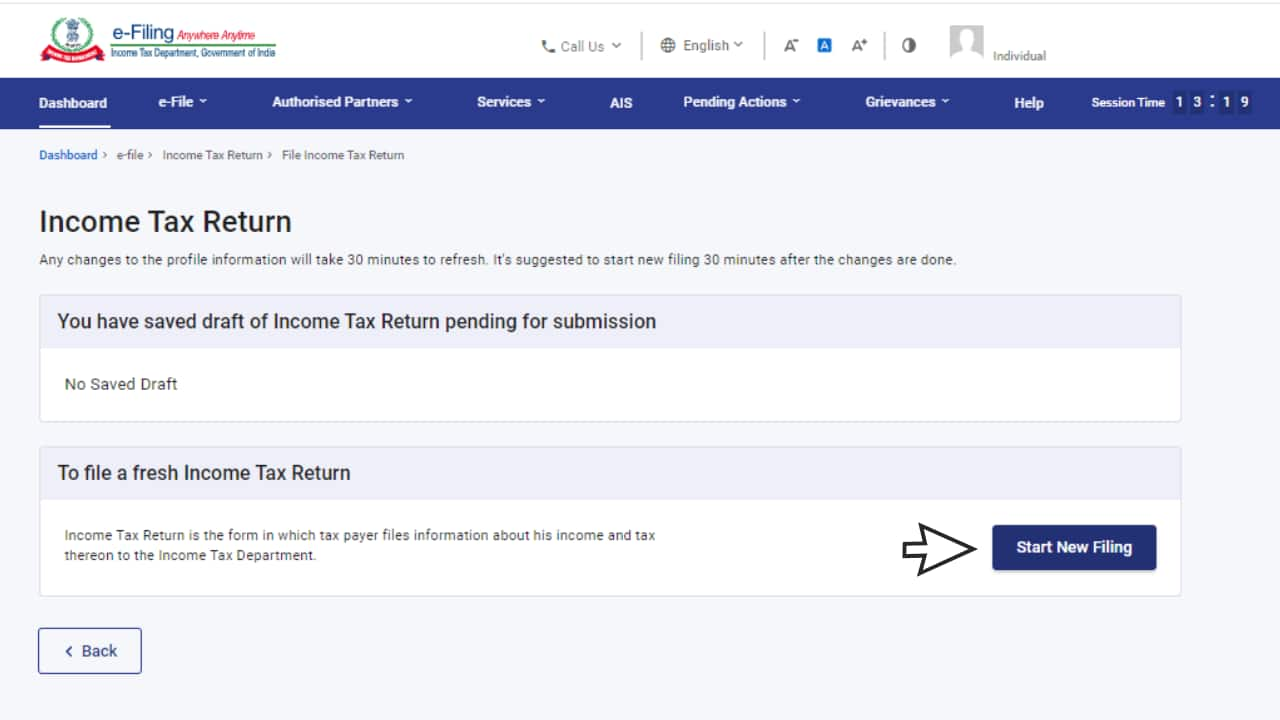

Step 4

If you have a saved return pending submission, click ‘Resume Filing’. Otherwise, click ‘Start New Filing’.

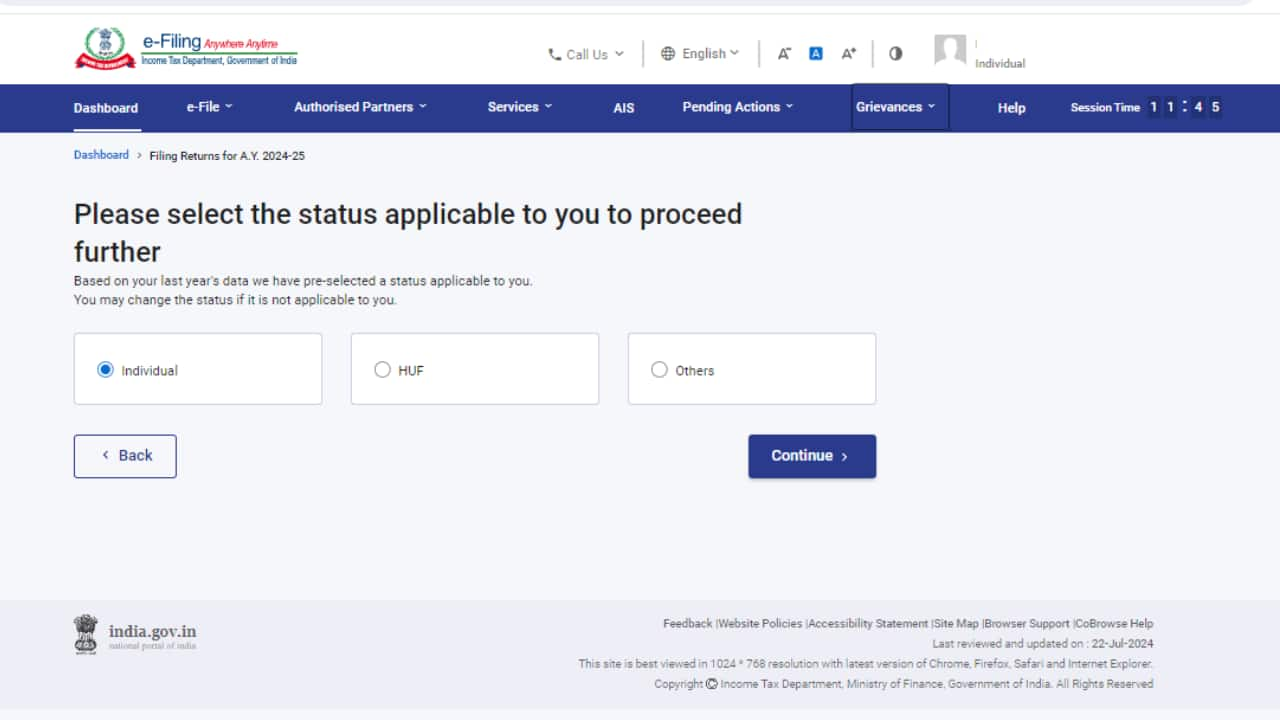

Step 5

Select your applicable status (Individual/HUF/Others) and click ‘Continue’.

Step 6

Choose your ITR form and note the list of required documents and click ‘Let’s Get Started’.

Step 7

Indicate your reason for filing ITR by selecting the applicable checkbox and click ‘Continue’.

Step 8

Review and edit your pre-filled data as necessary. Enter any additional required data and confirm each section.

Step 9

Enter or edit your income and total deductions. After completing all sections, click ‘Proceed’.

If there is a tax liability, you will see a summary of your tax computation. Use the ‘Pay Now’ option to avoid penalties.

If there is no tax liability or you are eligible for a refund, click ‘Preview Return’.

Step 10

If opting to pay immediately, you will be redirected to the e-Pay Tax service. Complete your payment and return to the filing page.

Step 11

After successful payment, click ‘Back to Return Filing’.

Step 12

Re-check your return by clicking ‘Preview Return’.

Step 13

Select the declaration checkbox on the Preview and Submit Your Return page and click ‘Proceed to Preview’.

Step 14

Review your return details and click ‘Proceed to Validation’.

Step 15

After validation, click ‘Proceed to Verification’.

Step 16

On the ‘Complete your Verification’ page, select your preferred e-verification method and click ‘Continue’.

Step 17

Choose your e-Verification option and complete the process. If you are choosing to verify via ITR-V, send a signed physical copy to the Centralised Processing Centre in Bengaluru within 30 days.

How to Create a New Account or Login on ITR e-Filing Portal?

Creating a new account or logging into the Income Tax e-Filing Portal is a simple and straightforward process. Here’s a step-by-step guide to help you get started:

How to Register as a New User on the Income Tax e-Filing Portal?

- Visit the Official e-Filing Portal - eportal.incometax.gov.in.

- On the homepage, locate and click on the ‘Register’ button, at the top-right corner of the page.

- Choose the appropriate user type from the options provided (Taxpayer/Others)

- Enter your PAN (Permanent Account Number) and click ‘Validate’ to confirm your PAN details. Once validated, you will be directed to the next step.

- Enter your basic and contact details such as name, date of birth, primary mobile number, email address, address etc.

- Choose a strong password for your account.

- Create a secure access message, which will be displayed every time you log in to your account.

- Enter the CAPTCHA code as displayed on the screen to verify you are not a robot.

- After filling in all the details, click on the ‘Register’ button to complete the registration process.

- You will receive an OTP (One-Time Password) on your registered mobile number and email address. Enter the OTPs in the respective fields to verify your contact details.

- Upon successful verification, you will receive a confirmation message. You are now registered on the Income Tax e-Filing portal.

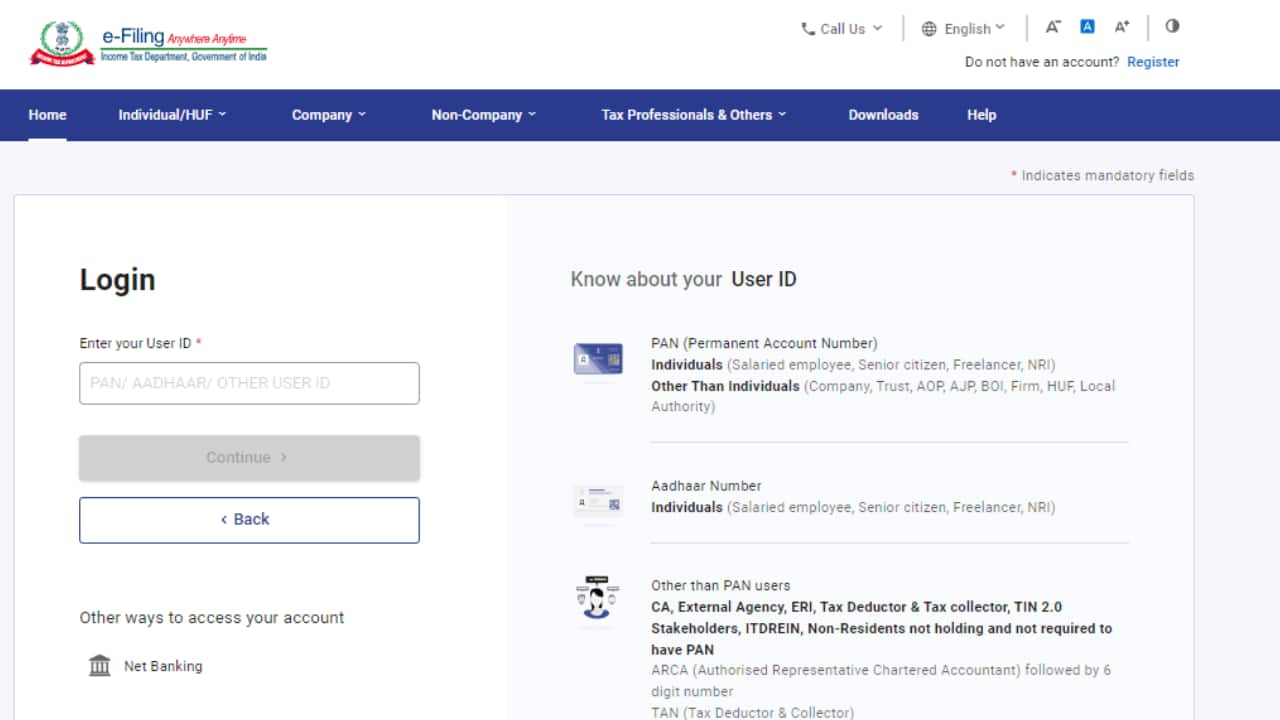

How to Log-In to ITR e-Filing Portal - eportal.incometax.gov.in?

- Visit the Official e-Filing Portal - eportal.incometax.gov.in.

- On the homepage, locate and click on the ‘Login’ button, usually found at the top-right corner of the page.

- In the User ID field, enter your PAN (Permanent Account Number), Aadhaar Number, or any other user ID as applicable.

- After entering your User ID, click the ‘Continue’ button to proceed.

- Click on checkbox to confirm your secure access message displayed on the screen.

- Enter your password and click the ‘Continue’ button to access your account.

Avoid These 10 Common Mistakes While Filing Your ITR

Filing your Income Tax Return (ITR) accurately is crucial to avoid penalties and ensure a smooth tax process. Here are some common mistakes to avoid when filing your ITR:

1. Incorrect Personal Information

Ensure that all personal details such as PAN, name, address, and bank account information are entered correctly. Mistakes in these details can lead to processing delays or rejections.

2. Wrong ITR Form Selection

Choosing the incorrect ITR form is a common mistake. Select the appropriate form based on your income sources. Using the wrong form can lead to the return being treated as defective.

3. Mismatched Income and TDS Details

Verify that the income and TDS details you report match the information available in your Form 26AS and AIS. Discrepancies can lead to notices from the tax department.

4. Failure to Report All Income Sources

All income sources, including interest from savings accounts, fixed deposits, rental income, and capital gains, must be reported. Omitting any source of income can attract penalties.

5. Incorrect Claim of Deductions

Ensure that you claim deductions accurately and provide the necessary proofs. For instance, ensure that you preserve health insurance premium receipt if you are claiming deductions under section 80D. Incorrect claims can lead to scrutiny and disallowance of deductions.

6. Not Verifying the ITR

Filing the ITR is not complete until it is verified. You can verify your ITR electronically using Aadhaar OTP, net banking, or by sending a physical copy of ITR-V to the CPC, Bengaluru.

7. Ignoring Tax Notices

If you receive any tax notice or intimation, respond promptly. Ignoring these communications can lead to further complications and penalties.

8. Delay in Filing

Filing your ITR after the due date can result in penalties and interest on any unpaid tax. Aim to file your return well before the deadline to avoid last-minute hassles.

9. Inconsistent Bank Account Details

Ensure the bank account details provided are correct and updated. This ensures smooth processing of refunds directly into your account.

10. Incorrect Calculation of Tax Liability

Use the correct tax rates and slabs for the assessment year. Miscalculating your tax liability can lead to additional interest and penalties.

How to Check ITR Refund Status?

Checking the status of your Income Tax Return (ITR) refund through the Income Tax e-Filing Portal is a straightforward process.

Here are the steps to check your ITR refund status using the e-Filing Portal:

- Visit the Income Tax e-Filing Portal - eportal.incometax.gov.in

- Enter your User ID (PAN) and password to log in.

- Go to the 'e-File' tab > Select 'Income Tax Returns' >> Click on 'View Filed Returns'

- Now you can check the refund status for the desired assessment year. The details will include the assessment year, mode of payment, and the status of the refund.

Frequently Used ITR Terminologies You Must Know

Understanding key terminologies is essential for accurate and efficient Income Tax Return (ITR) filing. Here are ten frequently used ITR terms you should be familiar with:

Assessment Year (AY)

The period of 12 months following the financial year in which income is assessed. For example, for income earned in FY 2024-25, the AY is 2025-26.

Financial Year (FY)

The year in which you earn income. It starts on April 1 and ends on March 31 of the following year. For example, FY 2024-25 runs from April 1, 2024 to March 31, 2025.

Permanent Account Number (PAN)

A unique ten-digit alphanumeric identifier issued by the Income Tax Department to track financial transactions and ensure compliance with tax regulations.

Form 16

A certificate issued by an employer detailing the salary paid and the TDS deducted during the financial year. It is crucial for salaried individuals while filing ITR.

Annual Information Statement

This document, which can be accessed through the ITR e-filing portal, contains details of your financial transactions during the year. Ensure that you study this statement and flag discrepancies, if any, and provide feedback through the portal to rectify any errors.

Form 26AS

A consolidated tax statement that provides details of tax deducted at source (TDS), tax collected at source (TCS), and advance tax paid during a financial year. It is essential for verifying tax credits.

Tax Deducted at Source (TDS)

A method where tax is deducted directly from your income (such as salary, interest or rent) by the payer and deposited to the government on your behalf.

Tax Collected at Source (TCS)

A method where the seller collects tax from the buyer at the time of sale of specified goods or services and deposits it with the government.

Deductions and exemptions

Reductions in taxable income allowed under various sections of the Income Tax Act (e.g., Section 80C for investments in PPF, NSC, etc., and Section 80D for health insurance premiums).

Exemptions are certain types of income that are not subject to tax, such as agricultural income, specified allowances, and certain investments. These help reduce your taxable income.

Income Tax Return (ITR) Form

A form used to declare your income, claim deductions, and report taxes paid. Various forms (e.g., ITR-1, ITR-2) are available based on the type of income and category of taxpayer.

Income Tax News

ITR Filing FAQs

Even if your income is below the taxable limit, it's advisable to file ITR to maintain a financial record and to claim refunds if TDS has been deducted.

After filing your ITR, you need to e-verify it within 30 days. You can e-verify using EVC, Aadhaar OTP, net banking, or by sending a physically signed copy of the ITR-V to CPC Bangalore.

If you miss the ITR filing deadline, you can still file a belated return by December 31, but you may incur a late filing fee.

The ITR form you should use depends on your income sources and category. For instance, ITR-1 is for individuals with income up to Rs 50 lakh from salary, one house property, and other sources. If you have capital gains or business income, you may need to use ITR-2 or ITR-3.

Yes, you can file ITR even if you don't have taxable income. Filing ITR is beneficial for various reasons such as obtaining loans, visas, and maintaining a record of financial transactions.

You can check your ITR status by logging into the Income Tax e-filing portal, going to 'My Account,' and selecting 'View e-Filed Returns/Forms' to see the status of your ITR.

Key documents include PAN, Aadhaar, Form 16 (for salaried individuals), bank statements, TDS certificates (Form 16A/16B/16C), interest certificates and investment proofs for claiming deductions.

Senior citizens (60-79 years) are required to file ITR if their income exceeds Rs 3 lakh. Super senior citizens (80+ years) need to file if their income exceeds Rs 5 lakh. Those over 75 with only pension and interest income can skip filing returns by submitting Form 12BBA.

Form 26AS is a consolidated tax statement that includes details of tax deducted at source (TDS), tax collected at source (TCS), and advance tax paid, which helps in verifying the tax credits claimed while filing ITR.

Ensure all income and TDS details match the information in Form 26AS. If there are discrepancies, reconcile them by checking with your employer or deductor and make necessary corrections before filing your ITR.