With the Sensex nearing the 86,000 level and the Nifty50 scaling the 26,000 peak, fresh questions are being raised on the possibility of a correction in the days to come. The focus is once again on the importance of diversification and rebalancing your portfolio.

Diversification or asset allocation is one of the most fundamental principles of smart investing as a well-constructed portfolio not only captures market gains during rallies but also provides protection during downturns.

A key element in building such a portfolio is having representation across asset classes. By spreading your investments in different asset classes and countries, one can reduce the risk of a significant loss from any one investment.

Here’s how you must go about diversifying your investments meaningfully.

Why it matters

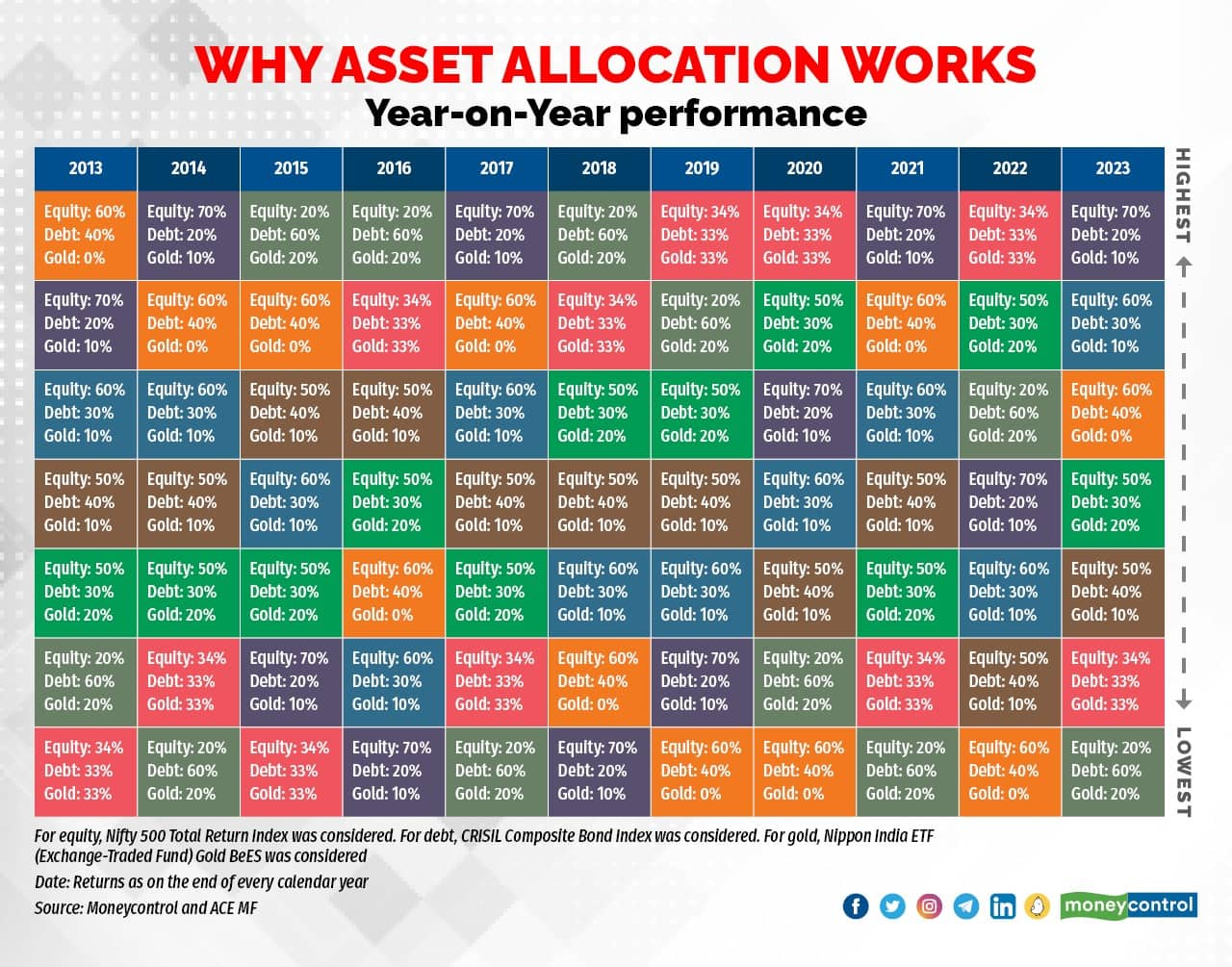

The primary reason is to minimise risk. Different asset classes (stocks, bonds, real estate, etc.) react differently to market conditions. Data shows that all asset classes don't perform in a linear format. During 2015, 2016, 2018 and 2022, when equity returns were tepid, other asset classes such as gold and debt did well.

Also read | Marriage & money: Why coming together is crucial, moneywise

Within the equity bucket as well, large-cap, mid-cap and small-cap segments can differ in performance. By distributing your investments across various asset classes, the poor performance of one investment can be offset by another investment and is less likely to significantly impact your entire portfolio.

Financial markets can be unpredictable, often reacting to economic cycles, political events or market sentiment. Diversification reduces the impact of these fluctuations, enabling your portfolio to grow more consistently.

Although spreading ones money across different investment options doesn't ensure profits or eliminate all losses, it can enhance long-term returns by balancing risk and reward.

How to diversify your portfolio

When determining asset allocation, it's essential to strike a balance between risk and return that matches your financial goals, investment timeline and comfort with risk.

A key to any successful investing strategy is identifying your goals. Are you saving for retirement, to buy a home or for funding your kid’s education? Define your short-term and long-term financial objectives. These goals will then heavily influence how much risk you're willing to take and how you allocate assets across stocks, bonds and other avenues.

Next comes understanding one’s risk tolerance level. Your risk tolerance should guide how much of your portfolio is allocated to high-risk investments (like stocks) versus lower-risk options (like bonds).

The next important thing is the time horizon, or how long you plan to invest before needing to access the money. Shorter-term goals may require a more conservative approach to protect against market volatility.

Next comes diversification across assets. Over the past year, the Nifty Small-cap 250 Total Return Index (TRI) has gained 55 percent, the Nifty Midcap 150 TRI is up 49 percent and the Nifty 50 TRI has rallied 34 percent. Should you invest entirely in small-cap funds now?

Also read | Festive sale frenzy: 5 online shopping traps to avoid this season

Keep in mind that while small-cap stocks can rise rapidly, they can decline just as quickly. However, that doesn't mean you should avoid small-caps. Instead, split your investments across large-, mid- and small-cap funds while considering different strategies for balanced growth.

Diversifying within each asset class—such as investing in both domestic and international markets or different sectors—can further reduce risk and even out performance.

While asset allocation is key, investors cannot take a laidback approach. Keep an eye on market and economic conditions but avoid reacting to short-term trends. While it’s important to stay informed, making drastic changes to your asset allocation based on market fluctuations can undermine long-term returns.

One key aspect of asset diversification is liquidity requirement as one should keep an emergency corpus in a bank for easy access in cases of emergency.

Common mistakes to avoid

Excess of anything is bad. That holds good for asset allocation as well. While investing in the equity market directly or via mutual funds, don’t go overboard in terms of the number of stocks you own or the mutual fund schemes you own.

The thumb rule is to have a portfolio with four to five different types of funds. Aim for a balanced approach where you’re diversified enough to manage risk, but not spread so thin that gains in high-performing investments are minimised.

Also read | Voluntary Provident Fund: How to invest and benefit from high interest rates

Each asset management company and its fund manager may take a different approach to managing the same type of mutual fund. One should also look at periodic rebalancing to maintain the quality of the portfolio. For example, a sharp rally in small-cap stocks over the past two years may have made your portfolio skewed towards this higher-risk segment. Take the time to regularly take another look at your portfolio and adjust your holdings to maintain your original asset allocation.

Diversification is one of the most effective ways to manage risk and enhance long-term returns. By allocating your investments across various asset classes, sectors and geographical regions, you protect your portfolio from the inevitable fluctuations of the market.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.