The market sentiment is expected to remain positive, though the benchmark indices saw profit booking after hitting a new high on February 23. Intermittent consolidation and correction is always a part of any consistent rally. Hence, the Nifty 50 may face immediate resistance at 22,300 in the coming session, followed by 22,500 mark, with immediate support at 22,000 level and then 21,900, experts said.

On February 23, the BSE Sensex was down 15 points at 73,143, while the Nifty 50 shed 85 points from its record high of 22,297.50 and closed with 5 points loss at 22,213. The index has formed bearish candlestick pattern on the daily charts, but continued formation of higher highs for eighth straight session.

"Nifty closed at the day's low due to profit booking. However, the sentiment remained positive for the short term as the index closed above the crucial resistance level of 22,200, with the next resistance is seen at 22,400," Rupak De, senior technical analyst at LKP Securities said.

He feels short-term support is positioned at 21,900. As long as Nifty maintains levels above 21,900, the index may continue to be considered a buy on dips, he advised.

Santosh Meena, head of research at Swastika Investmart said the Nifty has broken out of a 45-day consolidation period, indicating potential upside towards 22,500 level. "Immediate support lies at the 20-day moving average (DMA) around 21,900, while the 50-DMA at 21,700 serves as a key support level."

The pivot point calculator indicates that the Nifty is likely to take immediate support at 22,190 followed by 22,163 and 22,121 levels, while on the higher side, it may see immediate resistance at 22,223 followed by 22,301 and 22,344 levels.

Bank NiftyOn February 23, the Bank Nifty fell 108 points to 46,812, continuing downtrend for third consecutive session and formed bearish candlestick pattern on the daily charts, while earlier downward sloping resistance trendline now acted as a support level for the index.

"Bank Nifty has been consolidating in the range of 46,400 – 47,400 since the last three trading sessions," Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas said.

He expects the Bank Nifty to continue the consolidation before the next upmove resumes and expects the index to rise towards 48,000 – 48,300 from short term perspective.

As per the pivot point calculator, the Bank Nifty is expected to take support at 46,727 followed by 46,604 and 46,405 levels, while on the higher side, the index may see resistance at 46,860 followed by 47,250 and 47,449 levels.

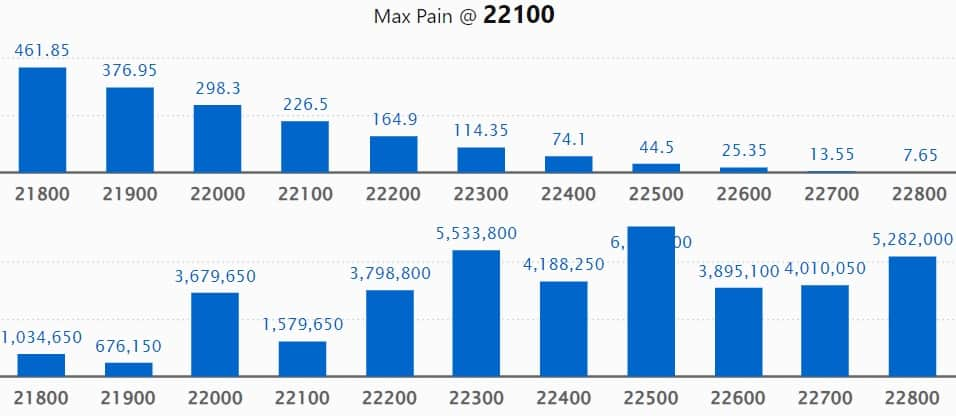

On the weekly options data front, 23,000 strike owned the maximum Call open interest with 1.26 crore contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 22,500 strike, which had 65.80 lakh contracts, while the 22,300 strike had 55.33 lakh contracts.

Meaningful Call writing was seen at the 23,100 strike, which added 31.95 lakh contracts followed by 22,300 and 22,500 strikes adding 29.1 lakh and 27.35 lakh contracts, respectively.

The maximum Call unwinding was at the 22,100 strike, which shed 4.67 lakh contracts followed by the 22,000 strike, which shed 4.02 lakh contracts, and 21,900 strike 64,500 contracts.

On the Put side, the 21,000 strike owned the maximum open interest, which can act as a key support level for Nifty, with 76.06 lakh contracts. It was followed by the 22,000 strike comprising 74.16 lakh contracts and then 21,500 strike with 53.04 lakh contracts.

Meaningful Put writing was at 21,200 strike, which added 15.09 lakh contracts followed by the 22,200 strike and 22,300 strike, which added 14.86 lakh contracts and 12.79 lakh contracts.

Put unwinding was seen at 21,900 strike, which shed 1.69 lakh contracts followed by the 21,100 strike, which shed 1.55 lakh contracts, and 23,000 strike, which shed 16,500 contracts.

A high delivery percentage suggests that investors are showing interest in the stock. Crompton Greaves Consumer Electricals, ICICI Prudential Life Insurance Company, Marico, Aditya Birla Capital, and Shriram Finance saw the highest delivery among the F&O stocks.

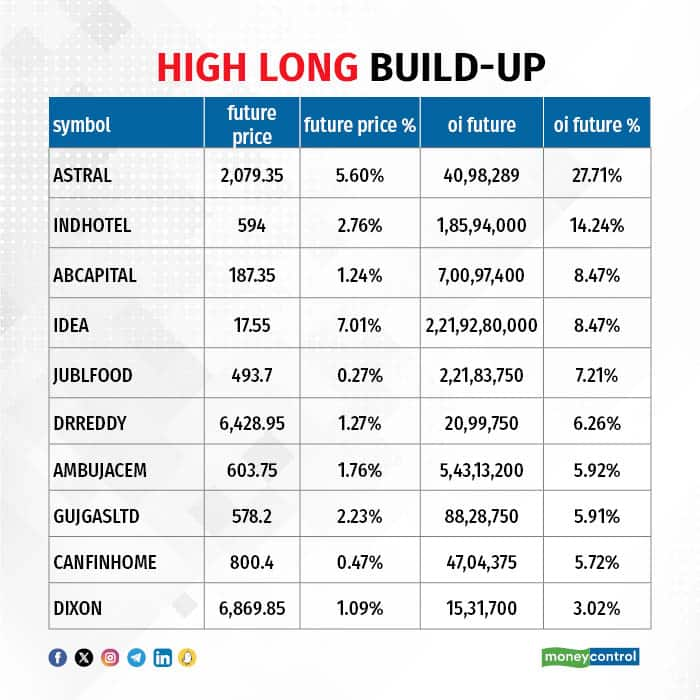

A long build-up was seen in 40 stocks, which included Astral, Indian Hotels, Aditya Birla Capital, Vodafone Idea, and Jubilant Foodworks. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, 37 stocks saw long unwinding including ABB India, Siemens, Coal India, Piramal Enterprises, and Balrampur Chini Mills. A decline in OI and price indicates long unwinding.

A short build-up was seen in 67 stocks including Canara Bank, Oracle Financial Services Software, India Cements, Metropolis Healthcare, and IndiaMART InterMESH. An increase in OI along with a fall in price points to a build-up of short positions.

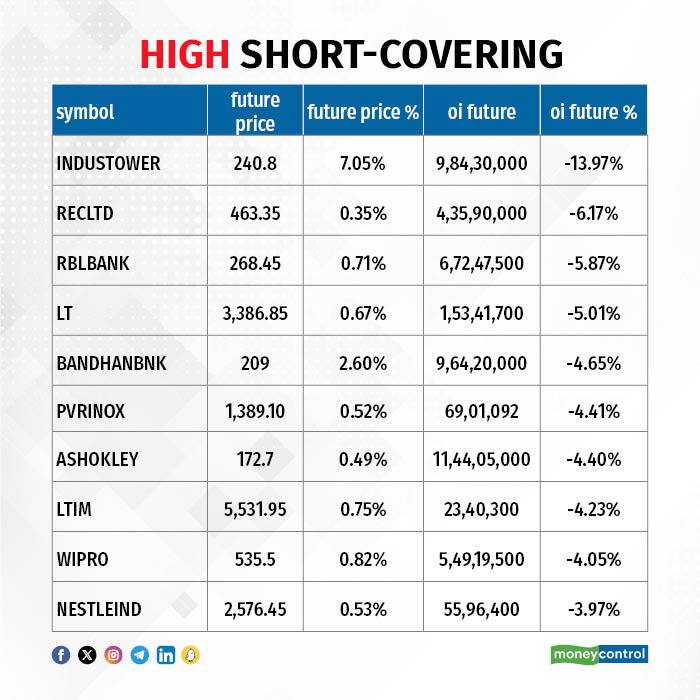

Based on the OI percentage, 42 stocks were on the short-covering list. This included Indus Towers, REC, RBL Bank, Larsen & Toubro, and Bandhan Bank. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, fell to 1.02 on February 23 against 1.19 levels in the previous session. The PCR above 1 indicates that the trading volume of Put options is higher than the Call options, which generally indicates increasing bearish sentiment.

Bulk deals

Rain Industries: The calcined petroleum coke producer has posted consolidated net loss at Rs 107.9 crore for quarter ended December 2023 (Q4CY23), against profit of Rs 12.6 crore in year-ago period, impacted by lower topline, impairment loss and higher finance cost. Consolidated revenue from operations fell by 25 percent year-on-year to Rs 410 crore for the quarter.

Biocon: The biopharmaceutical company has given a corporate guarantee of $20 million in favour of Mizuho Bank to secure term loan facility of $20 million extended to company's step-down subsidiary Biocon Generics Inc by the bank. The corporate guarantee is valid for 5 years.

JSW Infrastructure: The JSW Group company has received Letter of Award from V O Chidambaranar Port Authority for mechanization of North Cargo Berth-III (NCB-III) for handling dry bulk cargo at the port on design, build, finance, operate and transfer (DBFOT) basis through PPP basis.

Foseco India: The foundry consumables and solutions company has registered a 33 percent on-year growth in net profit at Rs 16.3 crore for quarter ended December CY23 (Q4CY23), partly supported by topline and other income. Revenue from operations for the quarter grew by 15.7 percent to Rs 122.3 crore compared to year-ago period.

Kotak Mahindra Bank: The bank, Zurich and Kotak Mahindra General Insurance Company have mutually agreed that Zurich will acquire 70 percent stake in Kotak General through a combination of primary and secondary acquisitions in a single tranche, for Rs 5,560 crore.

Funds Flow (Rs crore)

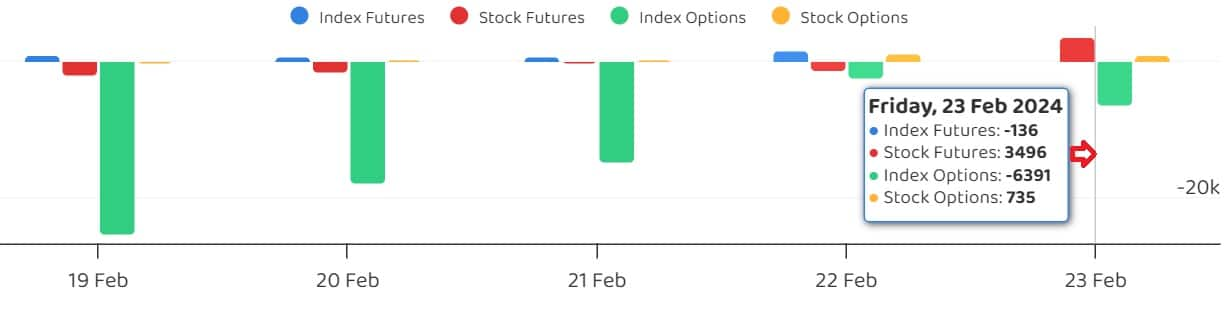

Foreign institutional investors (FIIs) net bought shares worth Rs 1,276.09 crore, while domestic institutional investors (DIIs) purchased Rs 176.68 crore worth of stocks on February 23, provisional data from the NSE showed.

Stocks under F&O ban on NSEThe NSE has added Canara Bank to the F&O ban list for February 26, while retaining Aditya Birla Fashion & Retail, Ashok Leyland, Balrampur Chini Mills, Biocon, GMR Airports Infrastructure, GNFC, Hindustan Copper, Piramal Enterprises, PVR INOX, RBL Bank, SAIL, and Zee Entertainment Enterprises to the said list. Bandhan Bank, Indus Towers, and National Aluminium Company were removed from the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.