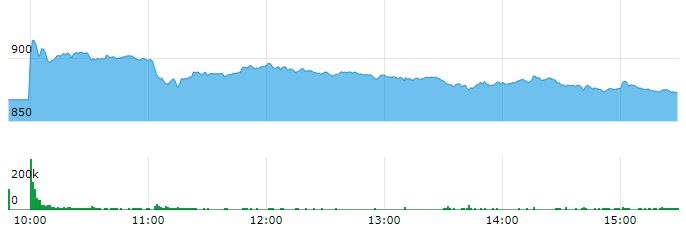

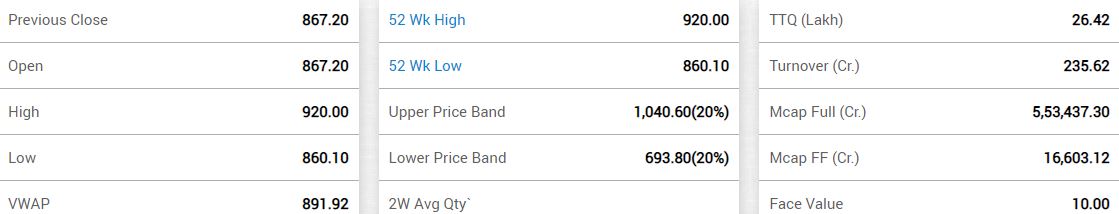

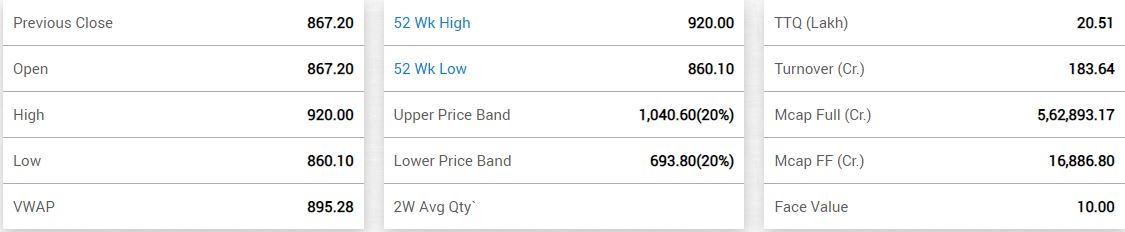

Despite the reduction in the pre-IPO valuation of LIC, the scrip has still listed at a discount on the bourses which is in tandem with the diminution in insurance companies’ valuation and softness in the markets due to macro-economic constraints. However, given the attractive fundamentals, stability in operating metrics and expected recovery in the markets, we can potentially see some buying interest from investors'