Indian startups recorded an uptick in private equity and venture capital investments in February over the year-ago period, data from analytics firm Venture Intelligence shows, highlighting a recovery from the prolonged funding lull.

Improving fundamentals and better agreement on valuations among investors and founders helped the funding thaw, industry players said.

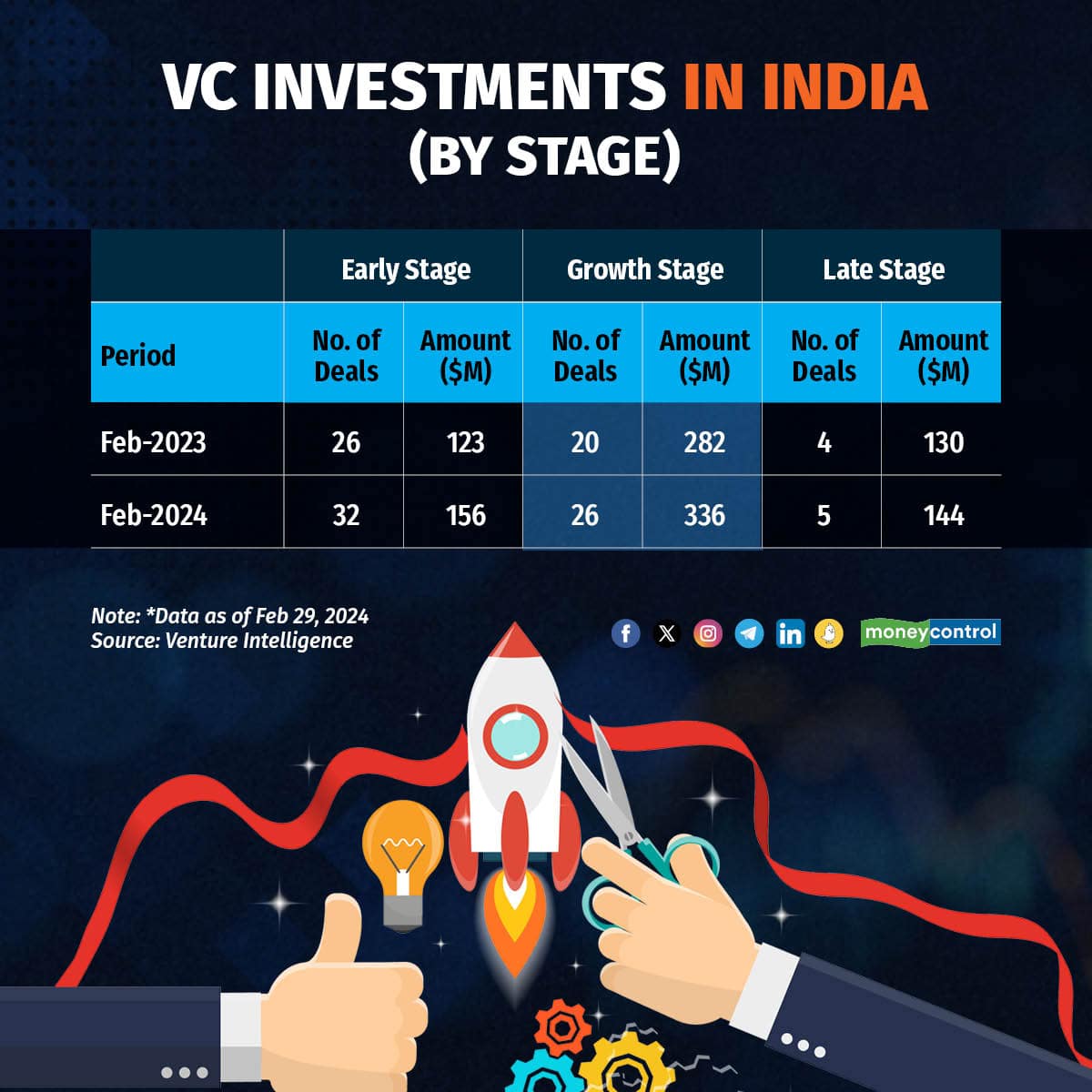

Investments in Indian startups recorded a 27, 19 and 11 percent growth across early, growth and late stages, respectively, in February from the same month in 2023.

VC Investments in India (By Stage)

VC Investments in India (By Stage)Funding to new-age tech companies also saw an overall jump to $636 million in 63 deals during the month, an uptick of about 19 percent from $535 million in 50 deals in February 2023, data shows.

Vikram Chachra, former fintech founder turned VC at 8i Ventures, told Moneycontrol that one reason for improved investments is the syncing of valuation expectations between venture capitalists and founders.

“We have seen compression of valuation in the range of 50-60 percent across stages,” he added.

Shashank Randev, founder VC and co-founder of 100X.VC, said founders are showing maturity in understanding how higher valuations can impact in the short term.

“They are seeing the importance of follow-on funding without down rounds and are more realistic,” he said.

The total size of investment in the early stage increased to $156 million from $123 million in February 2023, the data shows. Early-stage players like Fireside Ventures, Anicut Capital and Matrix Partners continue to dominate the investor charts, closely followed by Peak XV Partners and Trifecta Capital among others.

Most Active Investors (2024 YTD*)

Most Active Investors (2024 YTD*)Similarly, growth-stage deals stood at $336 million during the month against $282 in February 2023.

While the rise was slightly less pronounced, the deal amount for late-stage increase at $130 million. In February 2023, the amount was $144 million. To be sure, late stage deals also saw a massive recovery over January of 2024 when Indian startups could attract only $31 million in funding.

“(There is) more capital to deploy and more opportunities are maturing. A few startups are showing tremendous progress and hence investable opportunities are arising,” said 100X.VC’s Randev.

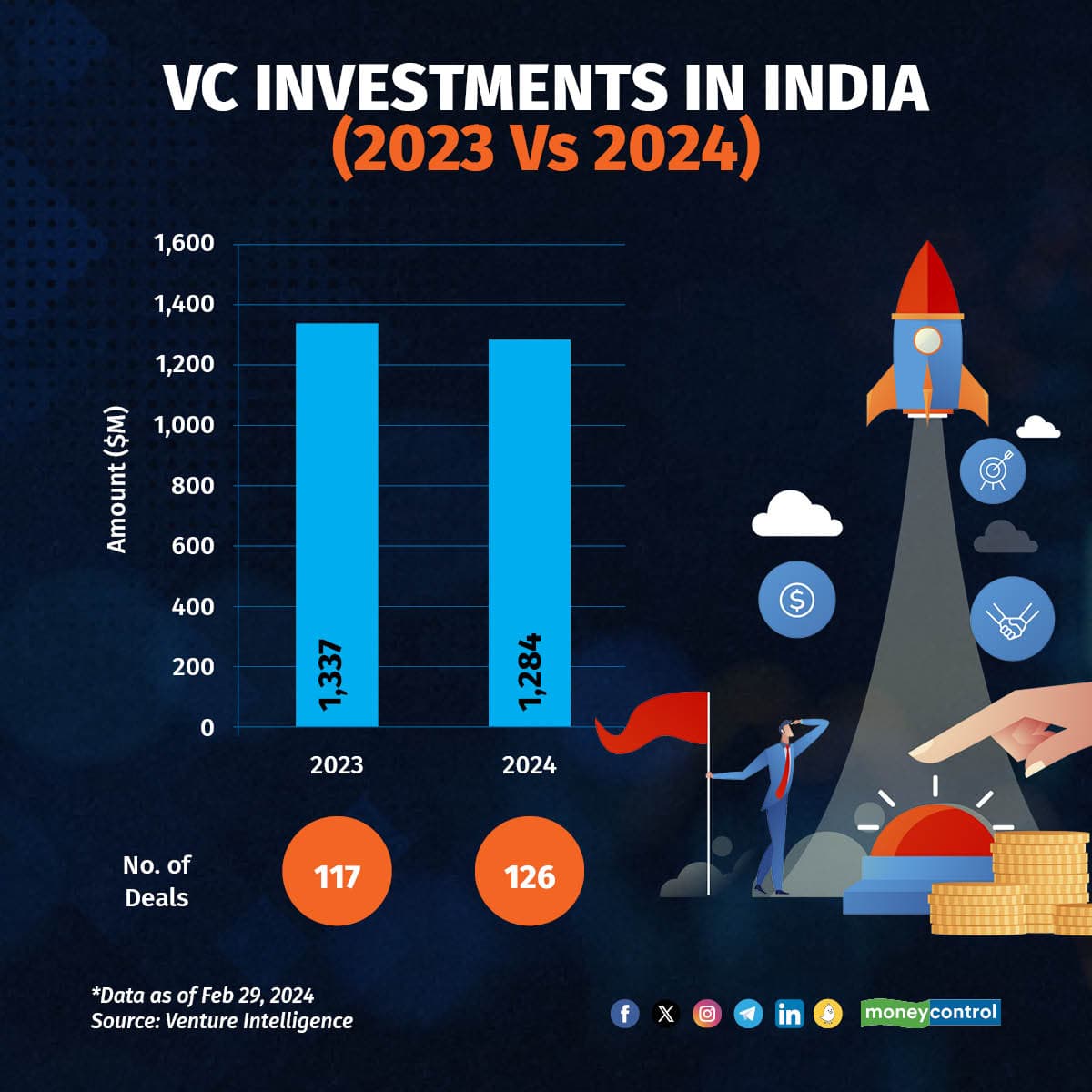

Caution prevailsThe total size of investment, however, fell about 14 percent from $648 million in January, the data shows.

VC Investments in India (February)

VC Investments in India (February) VC Investments in India (2024 v/s 2023)

VC Investments in India (2024 v/s 2023)This comes as investors continue to be cautious while closing deals on the back of muted sentiments on Indian startups with cases of mismanagement and governance stemming within Indian startups.

Anirudh Damani, managing partner, Artha Venture Fund, said while there is a stronger momentum of deal flows, investors are keeping a strong focus on unit economics and due diligence to ensure that “excesses of the past do not get repeated”.

“It's (deal closure timelines) much much longer because now investors, especially institutional, want all internal and external processes completed before putting the money in,” he added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.