Tax-Saving FDs: These largest banks offer up to 7% interest rate

Tax-saving FDs are one of the least risky investment options in the crowded 80C benefit. They have a lock-in period of five years and premature withdrawals are not allowed. The interest in this investment is taxable

1/11

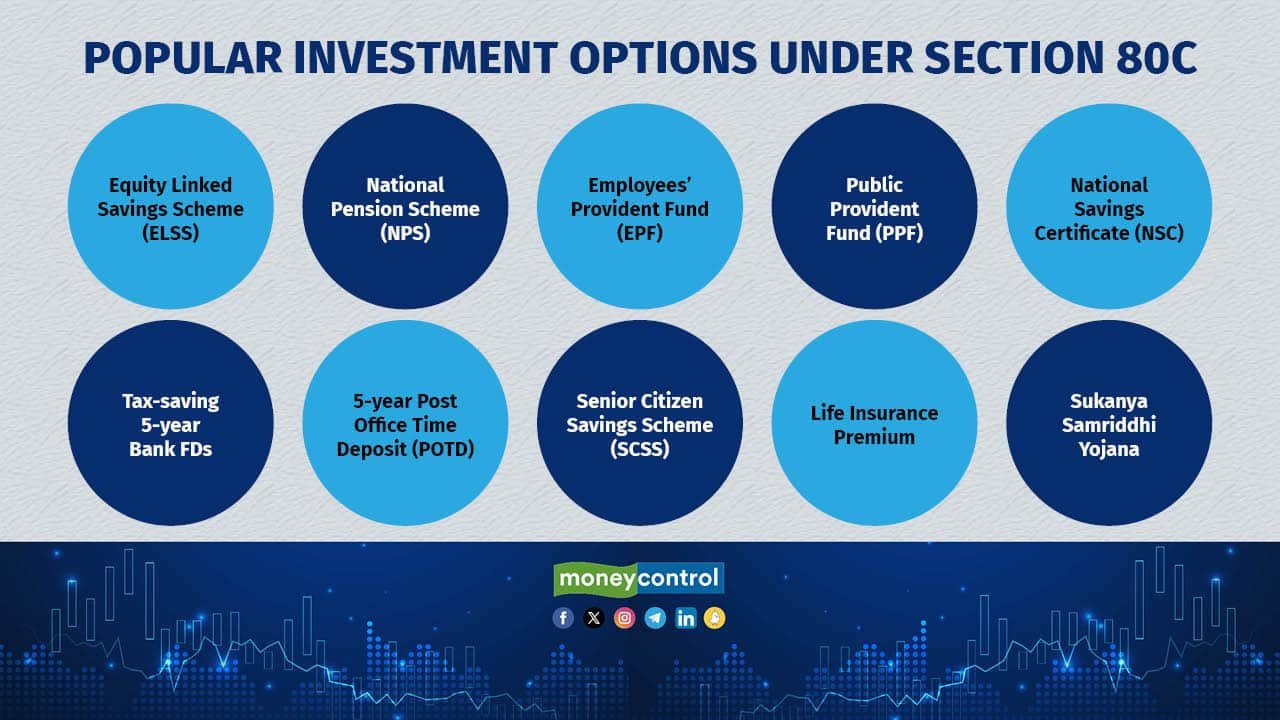

It’s time to submit investment proofs to your employer to save on taxes. And the tax-saving 5-year Bank Fixed Deposits (FDs) is a good option for those in lower to medium tax bracket. It offers Section 80C tax deduction benefit, up to an investment of Rs. 1.5 lakh.

• Among the least risky options

• Tenure: 5 years

• Premature withdrawals are not allowed.

• Interest in this investment is taxable.

Below are the best interest rates offered by India’s largest banks by deposits. Source: BankBazaar.com. Data as of December 22, 2023.

• Among the least risky options

• Tenure: 5 years

• Premature withdrawals are not allowed.

• Interest in this investment is taxable.

Below are the best interest rates offered by India’s largest banks by deposits. Source: BankBazaar.com. Data as of December 22, 2023.

2/11

HDFC Bank

Interest rate on the 5-year tax-saving FDs: 7%

Interest rate on the 5-year tax-saving FDs: 7%

3/11

ICICI Bank

Interest rate on the 5-year tax-saving FDs: 7%

Interest rate on the 5-year tax-saving FDs: 7%

4/11

Axis Bank

Interest rate on the 5-year tax-saving FDs: 7%

Interest rate on the 5-year tax-saving FDs: 7%

5/11

Canara Bank

Interest rate on the 5-year tax-saving FDs: 6.7%

Interest rate on the 5-year tax-saving FDs: 6.7%

6/11

Union Bank Of India

Interest rate on the 5-year tax-saving FDs: 6.7%

Interest rate on the 5-year tax-saving FDs: 6.7%

7/11

State Bank Of India

Interest rate on the 5-year tax-saving FDs: 6.5%

Interest rate on the 5-year tax-saving FDs: 6.5%

8/11

Punjab National Bank

Interest rate on the 5-year tax-saving FDs: 6.5%

Interest rate on the 5-year tax-saving FDs: 6.5%

9/11

Bank Of Baroda

Interest rate on the 5-year tax-saving FDs: 6.5%

Interest rate on the 5-year tax-saving FDs: 6.5%

10/11

Indian Bank

Interest rate on the 5-year tax-saving FDs: 6.25%

Interest rate on the 5-year tax-saving FDs: 6.25%

11/11

Bank Of India

Interest rate on the 5-year tax-saving FDs: 6%

Interest rate on the 5-year tax-saving FDs: 6%

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!