Given the illiquid nature of alternative investment fund (AIF) structures, Reserve Bank of India’s (RBI) recent directive on loan evergreening will likely result in higher provisioning and non-performing assets for select NBFCs in the coming quarters, experts said.

The total investment in AIFs by RBI-regulated entities is estimated to be Rs 15,000 crore and some leading players in these instruments are Piramal Enterprises, Edelweiss and Indiabulls, according to industry sources. The exact details of the quantum of AIFs that currently hold ‘doubtful investments’ and the provisioning impact on the said NBFCs on account of these investments, however, could not be ascertained.

On December 19, the RBI issued a notification prohibiting regulated entities (REs) such as banks and NBFCs from making investments in any scheme of AIFs which has downstream investments either directly or indirectly in a debtor company of the RE.

This way the RE would pawn off the loan to an AIF and make its own books look clean. Industry sources also said that RE lenders to infra companies are the ones generally found guilty of this practice.

Now RBI has asked all such positions to be unwound. If an AIF scheme, in which the RE is already an investor, makes a downstream investment in any such debtor company, then the RE shall liquidate its investment in the scheme within 30 days from the date of such downstream investment by the AIF, said the RBI.

Also Read: Explained | Why the RBI barred lenders from investing in AIFs linked to borrower companies

In case REs are not able to liquidate their investments within the above-prescribed time limit, the regulator added that, they shall make 100 percent provision on such investments.

According to experts, the second scenario is a more likely outcome. This is because several AIFs come with a prescribed lock-in period, meaning the capital is committed for a specific duration.

“As liquidating AIF units does not look practically possible in 30 days, I see greater chances of making provisions for such investments,” Mataprasad Pandey, Vice President at ARETE Capital Services said.

To this, an AIF official who did not want to be named added that an AIF generally finds it difficult to liquidate units as the secondary market in this asset class is not yet fully developed.

Which lenders could be hit most?

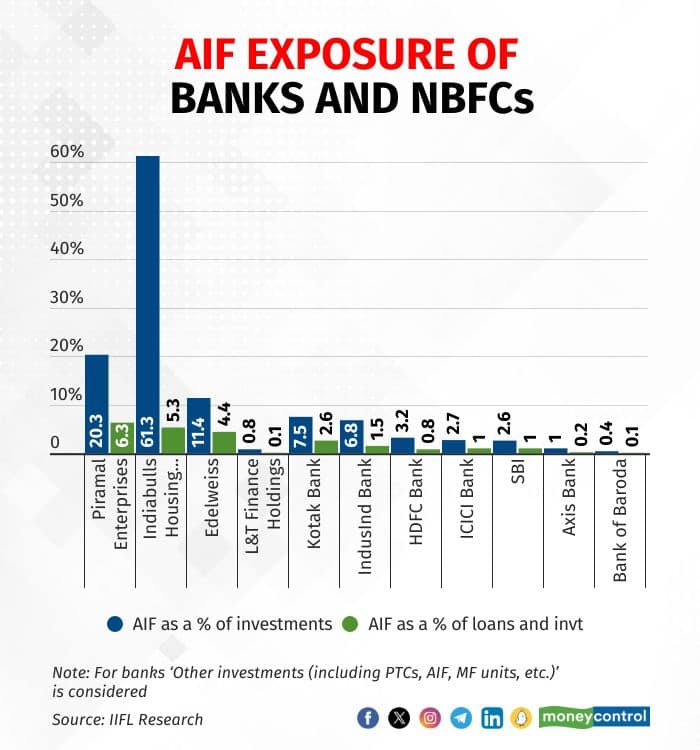

According to a note by IIFL Securities, NBFCs such as Piramal Enterprises, Indiabulls Housing Finance and Edelweiss have a higher share of AIF investments. Piramal has 20.3 percent of its total investments in AIFs, Indiabulls Housing has 67.3 percent and Edelweiss has 11.4 percent.

.

.

In an exchange filing, Piramal Enterprises said that it had invested Rs 3,817 crore in AIFs, of which only Rs 653 crore pertains to funds that have no exposure to any debtor companies. It intends to adjust the rest of the amount. Moneycontrol has reached out to other NBFCs to understand the quantum of such investments.

Meanwhile, the impact will be minimal for banks as the numbers are below 10 percent and several REs make investments in units of AIFs as part of their regular investment operations.

Also Read: Sebi cracks the whip on AIF-structures helping regulated lenders hide stressed assets

“My concern is the concentrated risk of such investments. If they are held by only a few REs then it leads to the concentration risk and thereby causes a cascading effect,” Pandey said.

IIFL itself also has investments in AIFs. According to Jefferies’ calculations, IIFL has Rs 1,100 crore (2 percent of AUM) of investments in AIFs, respectively. Though, the company does not expect any impact.

“Piramal and IIFL AIFs have investments in debtor firms, but the investments are mostly in accounts where PIEL/IIFL have exposure preceding the last 12 months. Thus, the impact could be limited,” it said.

“If PIEL and IIFL have to provide against their entire AIF exposure, the hit to net worth could be -10 percent and -8 percent, we estimate,” added Jefferies.

What happens to AIFs after this notification?

While it could lead to higher provisions for banks and NBFCs, AIFs will also get impacted as their pool of investments will shrink.

“I fully expect RBI to come up with a clarification because their intent will not be to harm regular AIFs in the normal course of business. If no clarity comes out then AIFs will be harmed because banks and NBFCs may be afraid to invest in these structures,” said an AIF official quoted above.

Also Read: SEBI ready to allow contentious tranche investments again, if AIFs self-regulate: Official

Nevertheless, she agrees that the notification was much needed. Shyamal Karmakar of RV Capital also said "It is very important for fund managers and AIFs to avoid any conflicts that may potentially harm the interests of investors and this seems to be a step in the right direction to address this issue."

According to Capitalmind’s Deepak Shenoy, this is a good regulation. He said in a note “We shouldn’t have NBFCs investing in units of AIFs to evergreen loans. You should of course have junk bond AIFs that can take bad assets off NBFCs but buy them at a super low price so that a recovery can be profitable for the AIF.”

“The new rules don’t stop that, just that the investors into that junk bond AIF cannot be NBFCs at all,” he added,

How does the evergreening work?

In a consultation paper issued in May, SEBI had explained how NBFCs in cahoots with AIFs were using the priority distribution method or ‘tranching’ for evergreening of loans.

Essentially, tranches reflect different degrees of credit risk. A senior tranche of investors is prioritised in distribution of proceeds over the junior tranche. Senior tranches get lower yields, reflecting their reduced risk.

Also Read: Why SEBI’s latest proposal for debt securities can be game-changing

Subordinate tranches are those that are junior to the senior tranche and absorb the loss first. Junior tranches get higher yields due to the added credit risk.

If a lender, bank or NBFC, wants to take out loans that are at risk of default from its books, it subscribes to the junior tranche of an AIF scheme set up for this purpose. The size of investment made by the regulated lender was determined by the expected loss on the loan portfolio at the time of structuring (haircut).

Then, the AIF got on board investors who are willing to subscribe to the rest, as the senior class of units. Once funds are collected, the AIF lends the money to the same risky borrower to repay the loans and make the lender's books look clean by avoiding NPA (non-performing asset) recognition. This is how RBI's rules were being circumvented.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.