With the US Federal Reserve indicating three rate cuts for the next calendar year, the consensus view on Dalal Street is that foreign investors will be back with a bang. Foreign Institutional Investors (FIIs) have so far bought Rs 29,700 crore worth of equities in December, after having sold about Rs 75,000 crore worth of equities in the past three months.

Analysts and fund managers believe that the land is fertile for strong FII inflows on the back of dollar easing, bond yields cooling off and rate cuts on the horizon. Furthermore, political uncertainty in the country has faded after BJP's three-state election win and the latest data showing robust growth for the domestic economy.

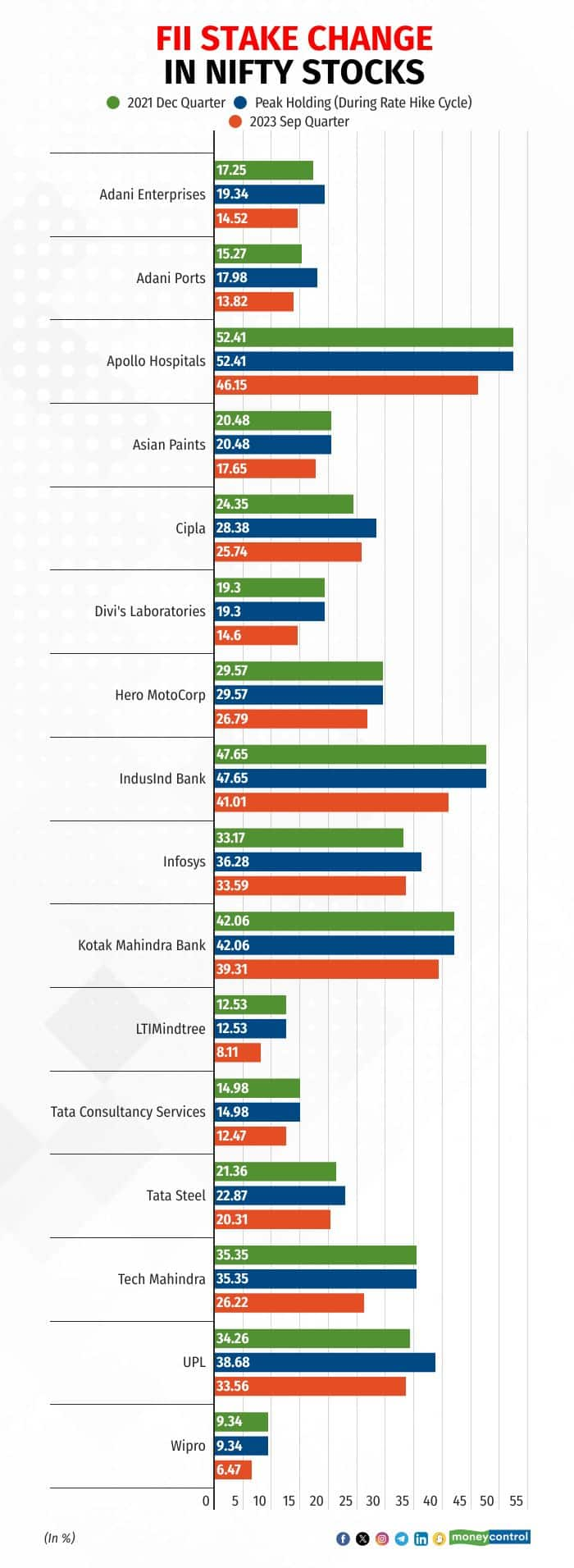

As FIIs flock to India, all eyes are on large-caps, especially Nifty 50 stocks, where liquidity will not be a problem for the big money. According to a Moneycontrol analysis, IT, pharma and certain banks stand to benefit from the gush of flows as they have taken the highest dent in FII stake since the rate hike cycle began in 2022.

In Wipro, TCS, LTIMindtree and Infosys, FII stakes are 2-3 percentage points below the peak holding during the rate hike cycle. For Tech Mahindra, the difference is as wide as 9 percentage points. With the rate cycle turning, the view is big deal wins will soon resume from large clients.

Aishvarya Dadheech, Founder of Fident Asset Management, said, "Largecap IT stocks' valuations are very reasonable at the moment. The growth outlook is a little bleak but that should reverse in the next 2-3 quarters. When that happens, IT stocks will have EPS (earnings per share) tailwinds behind them, too."

Over the past two days, since Fed sounded dovish, large-cap IT stocks have gained 5-7 percent.

The other sector that is likely to be a beneficiary is pharma. Stocks like Cipla, Divi's Laboratories have seen FII stakes fall 3-5 percentage points during the rate hike cycle. On the other hand, Sun Pharma and Dr Reddy's have seen their FII stake increase over the same period.

"Pharma, healthcare stocks are anyway considered defensive stocks. The sector's revenues are now normalising after the COVID-19 bump up. Furthermore, generic pricing decline now is not as steep as last 5 years so profitability from the existing portfolio will go up," said Rajesh Pherwani, founder of Valcreate Investment Managers.

"The sweet spot is stocks that have US as well as India presence, have new products in the pipeline and are not running into problems with US FDA often," Pherwani added.

Also Read: Nifty at 21k: Tata Motors, SBI among 19 stocks trading below long-term valuation

Last but certainly not least - financials. Banking stocks are set to see their FII holding increase, as stake has fallen from peaks. Dadheech believes that overall credit growth will be 15-17 percent over the next two years, as the Reserve Bank of India (RBI) resorts to shallow rate cuts next year.

"Asset quality problems are also not on the horizon, at least for the next two years. Apart from that, a technical reason behind the inflows is that banks have the biggest weightage on Nifty 50," he said.

Going by the numbers, it seems like the trend has already begun. On December 15, FIIs bought equities worth Rs 9,200 crore, the biggest buy figure this month so far, partly fuelled by FTSE rebalance.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!