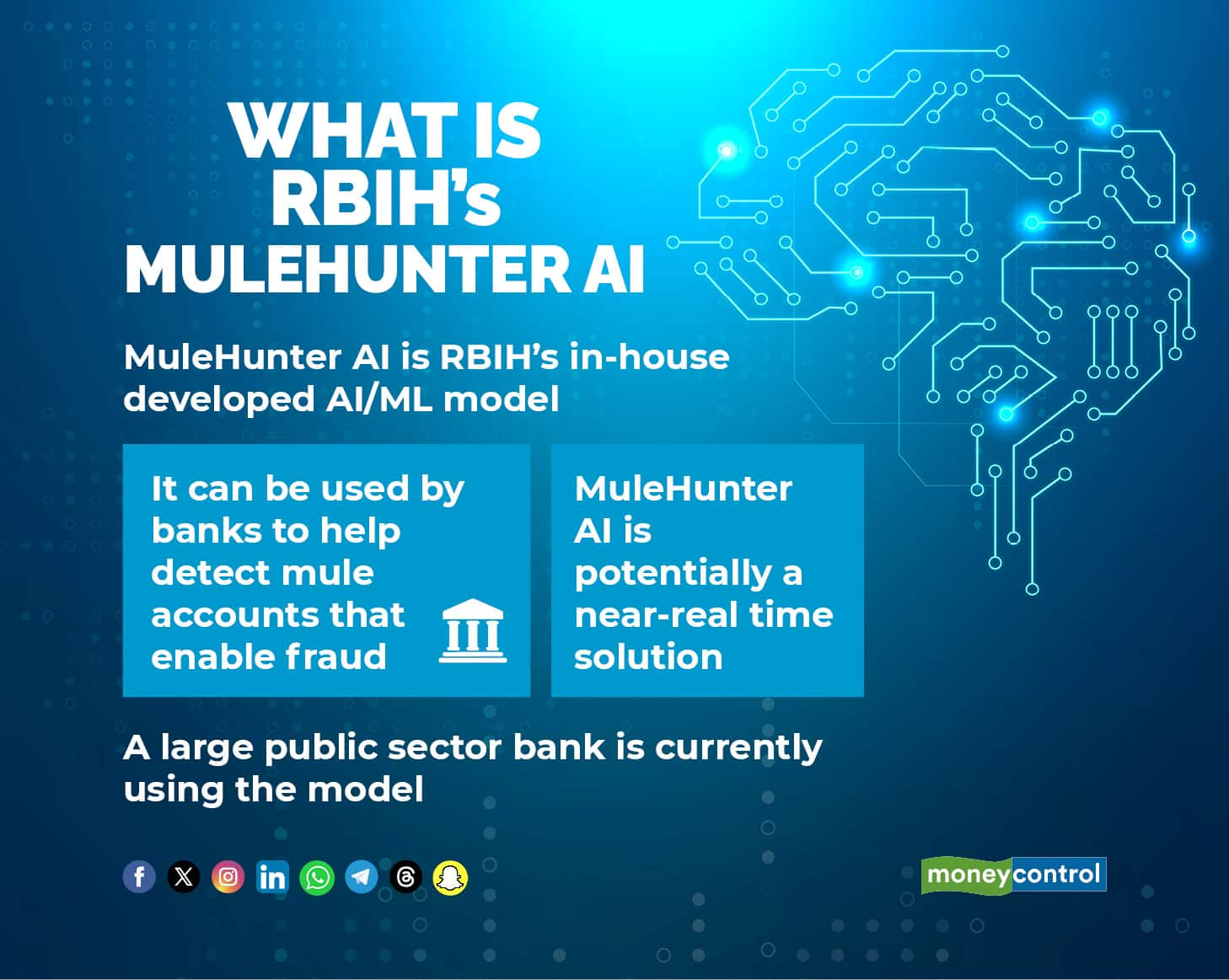

The Reserve Bank of India Innovation Hub (RBIH), a subsidiary of RBI, has developed an artificial intelligence and machine learning (AI/ML) model, MuleHunter AI, which helps banks and financial institutions detect mule accounts amid rising concern in the ecosystem around fraud enabled through these accounts.

RBIH showcased the model and its use-cases at the Global Fintech Fest in August. The Reserve Bank Innovation Hub is a wholly-owned subsidiary of the Reserve Bank of India (RBI) set-up to promote and facilitate an environment that accelerates innovation across the financial sector.

A banking industry source told Moneycontrol that the model has been deployed in one of the large public sector banks and will soon be deployed with other banks as well.

A mule account is an account created by one person but operated by another person. These accounts are often used for money laundering and tax evasion.

Mule accounts are in violation of several rules and can be prosecuted under the Prevention of Money Laundering Act (PMLA). Also, such arrangements are illegal under tax laws. Even Sebi and Reserve Bank of India (RBI) rules say such accounts should not be used.

The timing is crucial as digital transactions surge in India, increasing vulnerability to financial crime.

Data as per the National Crime Records Bureau (NCRB) reveals that online financial frauds constitute a staggering 67.8 percent of all cybercrime complaints received in the second quarter of 2025. Cases of fraud have increased by 31 percent between 2020 and 2022, reaching a worrisome count of 1.5 lakh registered cases in 2022.

In a recent instance, Hyderabad's State Bank of India (SBI) branch manager and his accomplices have been arrested in a Rs 175 crore fraud. The scam involved the use of "mule accounts" to divert substantial funds, according to the Cybersecurity Bureau.

What is MuleHunter AIMuleHunter AI is RBIH’s in-house developed AI/ML model which when deployed in banks, helps detect mule accounts.

RBIH

RBIHLeveraging artificial intelligence and machine learning technologies can significantly enhance mule account detection capabilities as against traditional rule-based systems, said another banking source on the model.

Regulator’s urgeBanking regulator Reserve Bank of India and market regulator, Securities Exchange Board of India, have been urging banks to step up their efforts against mule accounts.

In July, the RBI Governor Shaktikanta Das, held meetings with the MDs and CEOs of public sector banks and select private sector banks in Mumbai and urged them to work on this.

He also asked them to intensify customer awareness and educational initiatives, among other measures, to curb digital frauds. Following this, several banks and financial institutions have taken efforts to identify mule accounts.

For example, IDFC First Bank’s MD and CEO V. Vaidyanathan, said during the Global Fintech Fest that the bank will implement a mechanism to get transaction data of other banks and their new customers from payment aggregators.

Market regulator Securities and Exchange Board of India (Sebi) has also initiated a crackdown against mule accounts.

Also Read: Why is Sebi cracking down on mule accounts?

Sebi’s surveillance found that certain investment bankers were using these mule accounts to inflate subscription numbers both in debt market issuances and IPOs

Organisations like the Indian Cybercrime Coordination Centre (I4C) are also working against curbing a sophisticated web of fintech frauds and mule accounts.

Also Read: A sneak peek into I4C: Tackling India’s rising fintech frauds, one mule account at a time

Initially established under the Ministry of Home Affairs’ Cyber and Information Security division in 2018, I4C recently became a separate entity on the lines of the National Investigation Agency (NIA) or the Intelligence Bureau (IB).

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.