Budget 2023 may have clipped the wings of debt mutual fund (MF) schemes by doing away with their tax benefits but the Rs 55-trillion Indian mutual fund industry is not done yet.

The Association of Mutual Funds of India (AMFI), the industry body, has launched a campaign for fixed-income mutual funds to win back investor trust.

And to drive home the message, it has hitched a ride on cricket. Mutual Funds Mein Fixed-Income Wali Baat catchline can be seen everywhere during the ongoing edition of the Indian Premier League (IPL).

Retail investors have for long ignored debt funds except in some pockets, especially when compared to equity funds, gold, real estate, fixed deposits (FDs), small savings schemes and traditional insurance policies.

A debt-oriented scheme invests in fixed-income instruments such as bonds issued by the government and corporate, debt securities, and money market instruments, etc.

Even today, a large section of investors believe that mutual funds invest only in equities.

That’s the perception AMFI wants to change. It wants people to know that debt funds are worth investing in. Will investors buy this pitch?

What is the campaign?

In its debt MF campaign, AMFI is looking to replicate the success it tasted the first time around.

The Mutual Funds Sahi Hai campaign has single-handedly taken mutual funds to every nook of the country. The investor education and awareness initiative was started in March 2017.

“While investors have been using conventional fixed-income instruments for their debt investments, mutual funds offer an edge in terms of diversification across issuers, rating classes and sectors through a single fund with a flexibility of partial redemption, etc,” said Navneet Munot, managing director (MD) and chief executive officer (CEO) of HDFC Asset Management. Munot is also the chairman of AMFI.

In the past, AMFI promotions did talk about debt funds, but for the first time, the industry is highlighting the benefits and the features of fixed-income mutual funds.

The pitch is that just like FDs, debt funds, too, can be used to plan retirement and regular earnings by low-risk investors.

Further, via systematic withdrawal plans (SWPs), individuals can withdraw small amounts to meet their needs.

“We have done ads on the equity front, and it's a natural process that as a part of our investor awareness and education programme, we should also educate them on the fixed-income part. While the equity inflows have been good, people should also be made aware of the fixed-income asset class,” AMFI CEO Venkat Chalasani said.

Why now?

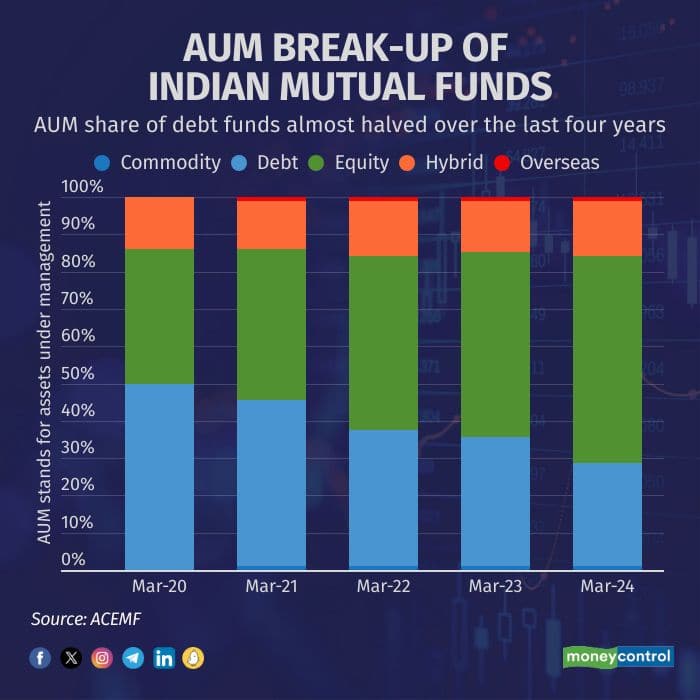

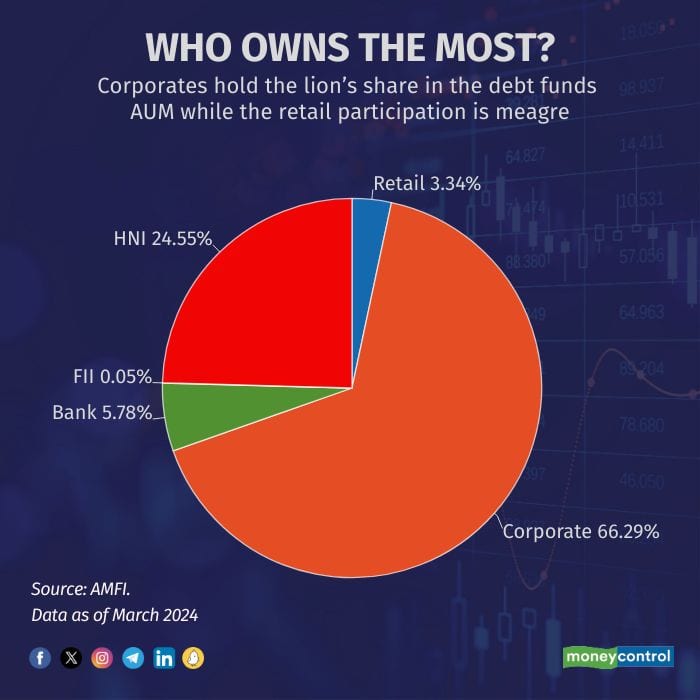

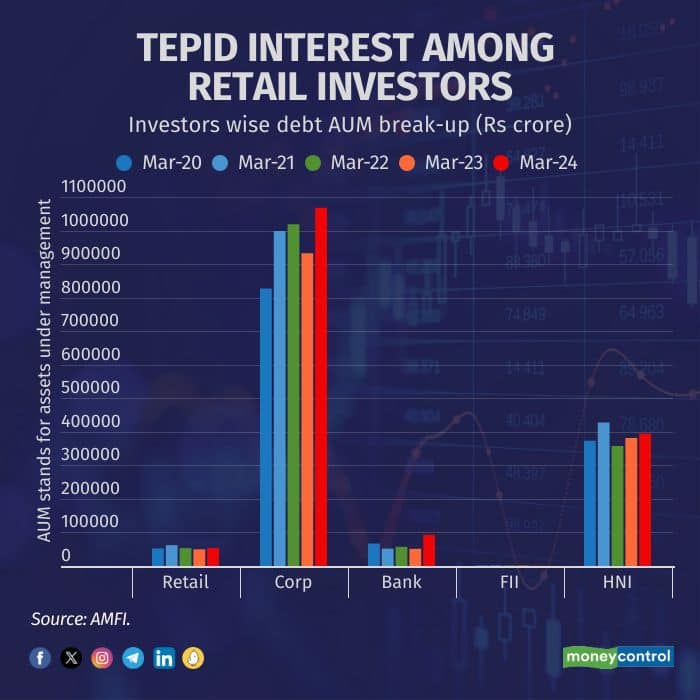

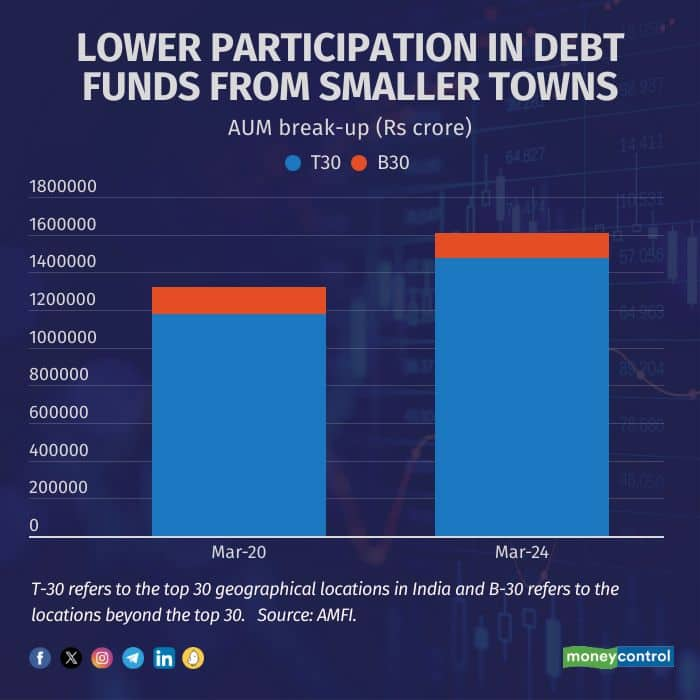

While individual participation — retail and high net worth individuals (HNIs) — stands at 88 percent in equity-oriented schemes, the exposure for the same group in debt-oriented plans is just 40 percent. The retail participation in the debt fund category stood at a mere 3 percent at the end of March.

To be fair, the penetration of mutual funds in general had been low in India for a long time and it was necessary to make people aware of investing in equities and equity funds for the long term to create wealth.

Aditya Birla Sun Life Asset Management CEO A Balasubramanian said 2024 is a good time to launch a campaign for debt funds because interest rates, equity market and valuations are high.

“In the current market conditions, while we continue to hold the view that equity markets remain bullish from the long-term perspective, but if there is market volatility in the short term, fixed-income funds can play a role in protecting investors’ interest,” Balasubramanian said.

He led the AMFI before Munot and was also involved in the planning of the promotional campaign.

Has the industry recovered from the debt crisis?

Retail investors’ fixed-income funds’ experience has not been consistent or positive.

“In 2018, there was a spate of downgrades followed by IL&FS and DHFL defaults. During covid, certain funds had to suspend redemptions because of the lack of liquidity in the underlying markets. Also, it's a time-taking task that people have to understand that fixed-income funds should be part of your allocation,” Trust Asset Management CEO Sandeep Bagla said.

According to experts, these two episodes shook investor confidence in debt markets.

In 2018, AMFI was ready to launch a similar campaign about debt MFs but the Infrastructure Leasing & Financial Services’ (IL&FS’) debt credit crisis broke out. The contagion eventually peaked when covid-19 set in and Franklin Templeton wound up six of its debt schemes suddenly.

A lot has changed since then. Debt funds have recovered, Franklin Templeton paid off its investors and regulations have been put in place to ensure that debt funds don’t take unnecessary risks.

“As we speak now, the risk management framework has been improved and has been put in place at all the mutual funds. The liquidity risks have also been properly identified and SEBI and the mutual fund industry have put in place necessary risk mitigations,” Chalasani said.

Balasubramanian also said that after the credit-market crisis, the industry got streamlined in terms of portfolio construction and uniform practices were brought in for the same. “The risk-o-meter was also introduced for fixed-income debt funds,” he said.

The risk-o-meter assesses the risk level of mutual funds by looking at historical volatility, asset allocation and underlying securities. Designed in keeping with AMFI guidelines, it resembles the speedometer of a vehicle and shows five levels of risk with a different colour. It categorises funds from low to high risk, helping investors make a decision.

Is the industry taking the battle to FDs?

In India, around 65 percent of investors put money in non-financial assets such as realty, while the rest into financial assets such as equities and gold.

In the financial assets segment, just 6 percent of it comes into mutual funds, with the bulk going into bank deposits.

Chalasani said debt mutual funds are not competing with bank FDs but are trying to convince savers in non-financial assets or those keeping idle cash to come to the mutual fund industry.

Balasubramanian said fixed-income mutual funds are market-linked instruments where returns can fluctuate, which is not the case with FDs.

“In the market-linked instrument category, today everybody is looking at equity but they can also consider debt funds, as, during times of equity volatility, fixed-income mutual funds can offer investors a hedge,” Balasubramanian said.

Simple message

Manish Kothari, co-founder and CEO of Zfunds, a mutual fund distributor, said retail investors largely don't understand debt funds. The inverse correlation between interest rates and bond prices and terms such as duration, etc are not easily understood.

“When retail investors come for investing, they see returns chart, where debt funds, by the nature of the instrument, are generally absent. Debt is actually out of the consideration set. There are a few people who come in for a six-month to one-year period and that too in funds such as arbitrage. There is no inherent demand for debt,” he said.

Kothari said investors are also not aware of the risks in debt funds. “They think that debt funds can never go negative.”

“The push (for debt funds) needs to be consistent, just like the Mutual Fund Sahi Hai campaign. Even if the campaign doesn't increase awareness, it will create curiosity, which will compel people to ask questions, which, in turn, will increase awareness. The message should be very simple and linked to a purpose,” Kothari said.

Bagla of Trust Asset Management, which was a debt-only fund house for a long time, said the mutual fund industry needs to communicate that fixed-income funds have an upside potential, which is not the case with FDs.

“People understand the movement of equity shares, people intuitively don't understand the movement and correlation between interest rate and bond prices. Once that understanding is there, then people will start using fixed-income funds in a proper way,” he said.

The Mutual Fund Sahi Hai campaign, though not an equity-specific campaign, did a good job of creating awareness about equity schemes as can be seen in the rising penetration of these funds.

Through the Mutual Fund Me Fixed-Income Wali Baat campaign, the industry aims to replicate the success of the Mutual Fund Sahi Hai to create awareness about fixed-income mutual funds.

(Dhuraivel Gunasekaran contributed to this story)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.