Closing Bell: Sensex gains, Nifty above 20,100 on expiry day; pharma, realty shine

-330

November 30, 2023· 16:46 IST

Indian benchmark indices ended higher in the volatile expiry session on November 30 with Nifty above 20,100. At close, the Sensex was up 86.53 points or 0.13 percent at 66,988.44, and the Nifty was up 36.60 points or 0.18 percent at 20,133.20.

We wrap up today's edition of the Moneycontrol live market blog, and will be back tomorrow morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices/ for all the global market action.

-330

November 30, 2023· 16:38 IST

-330

November 30, 2023· 16:37 IST

Prashanth Tapse, Senior VP (Research), Mehta Equities:

Markets were volatile on the expiry day, but Dow Jones Futures indicating positive start for US markets and gains in other Asian indices helped local markets clock modest gains at close. However, caution prevailed amongst the investors ahead of the exit poll results of five states later today, and the market could see a knee-jerk reaction in the next trading session.

-330

November 30, 2023· 16:32 IST

Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities:

The Bank Nifty index experienced heightened volatility on the last day of the monthly expiry, navigating a broad trading range. Facing immediate resistance at 44700, a level associated with a previous correction, a breakout above this point is anticipated to trigger additional short-covering moves towards 45000. The lower end support is situated at the 44300-44200 zone, acting as a supportive cushion for the bulls.

-330

November 30, 2023· 16:30 IST

Ajit Mishra, SVP - Technical Research, Religare Broking:

Market traded volatile on the monthly expiry day and ended marginally in the green. After the flat start, Nifty oscillated in a narrow range for most of the session and finally settled around the upper band of the same. Meanwhile, a mixed trend on the sectoral front and rollover of derivatives positions kept the traders busy wherein realty and pharma pack put up a good show. Besides, the market breadth was also inclined on the advancing side, thanks to outperformance by the midcap and smallcap counters.

We have almost reached the record high now after three days of advance and may take a breather now. However, rotational buying across sectors would keep the tone positive. We thus suggest utilizing an intermediate pause or a dip to add quality names.

-330

November 30, 2023· 16:19 IST

Vinod Nair, Head of Research at Geojit Financial Services:

India’s GDP growth upgrade to 6.4% from 6.0% for FY24 by S&P Global Rating has bought optimism to the broad market. The Nifty50 could cross the psychological level of 20,000 and be able to sustain the gains providing long-term support. Bold performance of the global markets and IPOs listing are adding glitters to mid & small caps. State exit poll and the final result slated to be announced on Sunday may bring some cautiousness.

-330

November 30, 2023· 16:15 IST

Rupak De, Senior Technical Analyst at LKP Securities:

Nifty ended close to the day's high on a choppy expiry day. The sentiment remains strong as long as it stays above 20000 since the Put writers at the 20000 strike will defend this level moving forward.

The sentiment might weaken only if there's a drop below 20000; until then, the buy-on-dips strategy is likely to stay prevalent. On the higher side, 20200-20230 acts as a resistance zone. If breached, the index could potentially move towards 20450-20500.

-330

November 30, 2023· 16:09 IST

Stock Market LIVE Updates | Biocon announces completion of integration of the Viatris’ biosimilars business in 31 European countries

-330

November 30, 2023· 15:57 IST

Deven Mehata, Research Analyst at Choice Broking:

After a flat opening Nifty traded volatile on the monthly expiry day but managed to close near day’s high at 20133. On Bank Nifty the pressure was seen today where the index closed negative but has managed to close near 44500 levels.

The Sensex gaining 0.13 percent and closed at 66988.44 and Nifty was up by 0.18 percent intraday and closed at 20133.15 levels whereas Bank Nifty was down by 0.19 percent and settled at 44481.75.

Among sectors Nifty Auto, Nifty Pharma and Nifty FMCG ended in green while Nifty PSU Bank, Nifty IT and Nifty PVT Bank ended on the lower side. In Nifty stocks, UltraTech Cement, Bharti Airtel and HDFC Life were the top gainers while Adani Enterprise, Adani Ports and IndusInd Bank were the prime laggards.

INDIA VIX was negative by 0.16 percent intraday and settled at 12.69.

Index has a support around 20050-20100 zone.

Coming to the OI (Open Interest) Data, on the call side, the highest OI observed at 20400 followed by 20300 strike prices while on the put side, the highest OI is at 20000 strike price. On the other hand, Bank nifty has support at 44100-43900 while resistance is placed at 44900-45000 levels.

-330

November 30, 2023· 15:46 IST

Aditya Gaggar Director of Progressive Shares

With an extreme swing on both sides, Nifty50 settled the monthly expiry day higher at 20,133.15 with gains of 36.55 points. Sector-wise, Realty and Pharma were the outperformers; and on the flip side, PSU Banking sector was the major laggard.

The interest of the market participants was more towards the broader markets as Mid and Smallcap ended the session with gains of 0.68% & 1.14% respectively and outperformed the Frontline Index. In the higher top higher bottom formation, the index has made a bullish candle which suggests that a fresh could be seen in the coming days.

-330

November 30, 2023· 15:33 IST

Rupee Close:

Indian rupee ended marginally lower at 83.39 per dollar on Thursday against Wednesday's close of 83.32.

-330

November 30, 2023· 15:30 IST

Market Close:

Benchmark indices ended higher in the volatile session on November 30 with Nifty above 20,100.

At close, the Sensex was up 86.53 points or 0.13 percent at 66,988.44, and the Nifty was up 36.60 points or 0.18 percent at 20,133.20. About 1838 shares advanced, 1752 shares declined, and 130 shares unchanged.

UltraTech Cement, HDFC Life, Sun Pharma, Apollo Hospitals and Eicher Motors were among top gainers on the Nifty while losers were IndusInd Bank, Adani Enterprises, Adani Ports, Reliance Industries and Power Grid Corporation.

On the sectoral front PSU Bank index down 1.5 percent, while pharma, capital goods, realty and oil & gas indices added 1-1.5 percent each.

BSE Midcap index gained 0.8 percent and smallcap index rose 1 percent.

-330

November 30, 2023· 15:27 IST

Stock Market LIVE Updates | Jefferies View On Global Health

-Buy call, target Rs 1,000 per share

-Investors acknowledged the strong performance from Medanta post listing

-Strong performance led by IPD volume growth

-Investors acknowledged sustainability of performance at new hospitals

-Got an update on ongoing expansion plans

-Key concern was threat from competition in Delhi/NCR region

-Key concern was sustainability of high ARPOBs

-330

November 30, 2023· 15:23 IST

Sensex Today | Anuj Choudhary - Research Analyst at Sharekhan by BNP Paribas:

Indian Rupee depreciated by 7 paise on Thursday on weak domestic markets and a strong US Dollar. Surge in crude oil prices also weighed on Rupee. However, FII inflows over the past few sessions cushioned the downside. US Dollar gained on better than expected US GDP data and weak Euro. Unfavorable PMI data from China also supported the greenback. US economy expanded by 5.2% in Q3 2023 v/s 4.9% in initial estimates and forecast of 5%. However, dovish fedspeak capped sharp gains.

We expect Rupee to trade with a slight negative bias on month-end Dollar demand from importers and volatility in crude oil prices ahead of the OPEC meeting. However, fresh foreign inflows may support Dollar at lower levels. Traders may take cues from India’s GDP and fiscal deficit data. Traders may also take cues from core PCE price index, weekly unemployment claims, personal income and pending home sales data from US. USDINR spot price is expected to trade in a range of Rs 83.10 to Rs 83.70.

-330

November 30, 2023· 15:21 IST

Stock Market LIVE Updates | General Insurance jumps 7% to extend rally, stock up 70% this year

Shares of General Insurance Corporation of India (GIC Re) continued their stellar run on November 30, rising around 7.5 percent. The stock has rallied over 35 percent in seven days and over 50 percent in just 15 days. The company's market capitalisation has soared to Rs 55,834 crore.

The surge can be attributed to the company's impressive financial performance, credit rating upgrade and strong outlook.

The reinsurer’s management recently conducted non-deal road shows following which the investors have started understanding the company’s operations and business. With a strong FY23 financial performance, GIC Re has received a credit rating upgrade which is helping the company bag large international orders.

On the financial strength scale, AM Best assigned a B++ (good) rating to GIC Re, and revised the outlook to “positive” from “stable”. It also assigned a bbb+ (good) rating to long-term issuer credit, accompanied by an upgraded outlook to “positive”. GIC Re also received an aaa.IN (exceptional) NSR rating with a stable outlook.

-330

November 30, 2023· 15:19 IST

Stock Market LIVE Updates | Nitin Spinners commences production in Ring Spinning unit

Nitin Spinners has informed that commercial production in Ring Spinning Unit of 32640 Compact Spindles at Begun Unit has started today i.e.30.11.2023. With this the expansion project of Spinning, Knitted Fabrics and Woven Fabrics announced on 30.12.2021 has been completed.

-330

November 30, 2023· 15:14 IST

Sensex Today | BSE Auto index up 0.5 percent supported by Eicher Motors, Hero MotoCorp, M&M:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Eicher Motors | 3,907.95 | 2.5 | 35.75k |

| Hero Motocorp | 3,821.90 | 2.03 | 96.78k |

| M&M | 1,648.50 | 1.83 | 62.78k |

| Cummins | 1,906.00 | 1.75 | 5.04k |

| Ashok Leyland | 182.80 | 0.88 | 324.70k |

| Bajaj Auto | 6,087.15 | 0.36 | 6.13k |

| Maruti Suzuki | 10,617.25 | 0.26 | 2.53k |

| Apollo Tyres | 426.50 | 0.14 | 35.57k |

| UNO Minda | 675.55 | 0.13 | 20.63k |

| TVS Motor | 1,863.70 | 0.09 | 17.55k |

-330

November 30, 2023· 15:08 IST

Stock Market LIVE Updates | L&T Technology Services gets NCLT nod for amalgamation of Esencia Tech, Graphene Semicon & Seastar with the company

The Hon'ble National Company Law Tribunal (NCLT), Mumbai at the hearing held on November 29, 2023 has approved the Scheme of Amalgamation between Esencia Technologies India Private Limited, Graphene Semiconductor Services Private Limited and Seastar Labs Private Limited with L&T Technology Services Limited and their respective shareholders.

-330

November 30, 2023· 15:06 IST

Stock Market LIVE Updates | Vascon Engineers board approves fund raising of up to Rs 125 crore via QIP

The board of directors of Vascon Engineers at its meeting held on November 30, 2023 approved raising of funds by way of issuance of such number of equity shares having face value of Rs 10 each of the company and / or other eligible securities or any combination thereof, for an aggregate amount not exceeding Rs 125 crore or an equivalent amount thereof by way of qualified institutions placement (QIP) or other permissible mode in accordance with the applicable laws, subject to the receipt of necessary regulatory / statutory approvals, as may be required.

-330

November 30, 2023· 15:04 IST

Stock Market LIVE Updates | M&M to extend timeline for completion of balance investment by subsidiary in Whizzard

Mahindra Logistics (MLL) entered into agreements to acquire, up to 60% of the share capital of ZipZap Logistics Private Limited (Whizzard), on a fully diluted basis, in tranches by 30th November, 2023.

MLL has informed that certain conditions precedents for completion of the balance investment by MLL in Whizzard (resulting in aggregate shareholding of up to 60% on fully diluted basis) are underway. Accordingly, the parties have mutually agreed to extend the timeline for completion of the transaction to 31st December, 2023.

-330

November 30, 2023· 14:59 IST

| Company | Price at 14:00 | Price at 14:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| NDL Ventures | 161.95 | 150.65 | -11.30 6.20k |

| Pansari Develop | 81.00 | 77.00 | -4.00 10 |

| Prestige Estate | 1,046.75 | 1,002.75 | -44.00 359.31k |

| Lloyds Luxuries | 121.10 | 116.10 | -5.00 1.25k |

| Nandani Creatio | 76.35 | 73.20 | -3.15 27.67k |

| Urban Enviro Wa | 445.00 | 430.00 | -15.00 18.54k |

| Pentagon Rubber | 130.00 | 126.00 | -4.00 1.50k |

| Tourism Finance | 114.10 | 110.80 | -3.30 47.22k |

| Mangalam Organ | 370.60 | 360.00 | -10.60 256 |

| MCON Rasayan | 144.00 | 140.10 | -3.90 1.13k |

-330

November 30, 2023· 14:58 IST

| Company | Price at 14:00 | Price at 14:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| Vilin Bio Med | 20.65 | 21.95 | 1.30 4.00k |

| Hinduja Global | 958.45 | 1,017.20 | 58.75 1.54k |

| Jet Airways | 54.00 | 57.15 | 3.15 742 |

| Ameya Precision | 52.00 | 55.00 | 3.00 0 |

| Tridhya Tech | 35.05 | 37.00 | 1.95 48.38k |

| Indiabulls Hsg | 195.75 | 206.50 | 10.75 2.27m |

| SHUBHLAXMI | 82.00 | 86.10 | 4.10 0 |

| Orissa Bengal C | 57.65 | 60.45 | 2.80 3.07k |

| Emkay Taps | 602.00 | 629.95 | 27.95 330 |

| HP Adhesives | 98.40 | 102.80 | 4.40 42.46k |

-330

November 30, 2023· 14:56 IST

Sensex Today | Colin Shah, MD, Kama Jewelry

For the 8-year tenure, Sovereign Gold Bonds delivered a splendid CAGR of around 10.8% with an annual interest rate of 2.5%. This is a testimony to the fact that SGBs are here to stay and deliver stellar returns in the future. With a plethora of benefits like hassle-free storage compared to physical gold, the annual fixed interest of 2.50% payable semi-annually, and scheme value being linked to market price.

Being a government-backed investment, it promises security along with other advantages like the flexibility of being tradable in stock exchanges and exemption from capital gains tax, making it a well-preferred investment choice, especially for risk-averse investors who look out for investments that carry minimum risk and give stable returns. Having raised Rs 245 crore from the investors during the tenure of the first tranche, we anticipate that sovereign gold bonds are here to stay and will keep garnering interest from investors.

-330

November 30, 2023· 14:55 IST

Stock Market LIVE Updates | Delta Expands into the Real Estate sector

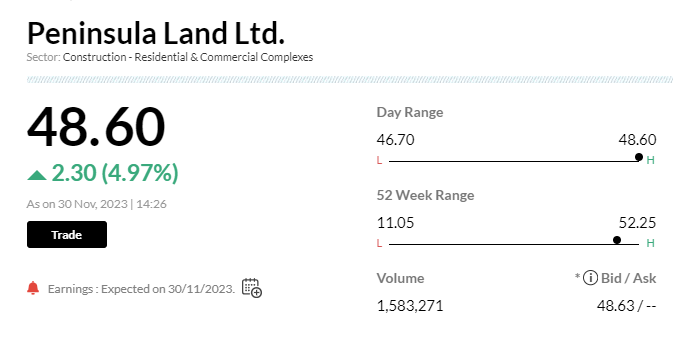

Delta Corp has decided to make a strategic investment of Rs 99,99,88,000in Peninsula Land Ltd. (PLL) which will issue 1,50,00,000 equity shares and 77,27,000 CCDs at Rs 44.

Furthermore, a joint venture is envisaged to be established between Delta & PLL with a capital outlay of Rs 250 crores where Delta will be a majority stakeholder. This JV will help Delta expand into the sector.

-330

November 30, 2023· 14:45 IST

-330

November 30, 2023· 14:40 IST

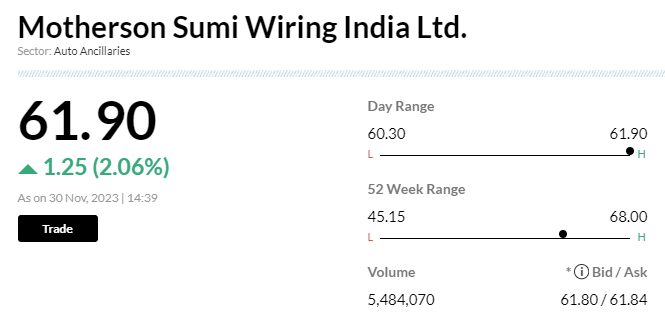

Stock Market LIVE Updates | Motherson Sumi gains 1.8% after huge block deal

Motherson Sumi Wiring India jumped 1.8 percent after a huge block deal. Around 1.19 million shares changed hands in a bunch of trades, according to Bloomberg. However, details of the buyers and sellers were not known.

-330

November 30, 2023· 14:34 IST

-330

November 30, 2023· 14:28 IST

Stock Market LIVE Updates | Peninsula Land surges 5% post approval of Rs 100 cr issue to Delta Corp

Shares of Peninsula Land Ltd jumped 5 percent after its board approved Rs 66 crore preferential issue and Rs 34 crore debenture issue of share to Delta Corp.

-330

November 30, 2023· 14:21 IST

-330

November 30, 2023· 14:15 IST

Sensex Today | Nifty Pharma index up 1 percent led by Alkem Laboratories, Divis Laboratories, Lupin:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Alkem Lab | 4,675.75 | 2.38 | 177.62k |

| Divis Labs | 3,796.05 | 1.78 | 375.62k |

| Lupin | 1,271.35 | 1.74 | 1.26m |

| Aurobindo Pharm | 1,037.60 | 1.58 | 1.59m |

| Zydus Life | 638.55 | 1.39 | 696.02k |

| Torrent Pharma | 2,119.55 | 1.32 | 154.66k |

| Sun Pharma | 1,217.30 | 1.26 | 2.09m |

| Cipla | 1,201.50 | 0.77 | 1.30m |

| Dr Reddys Labs | 5,749.10 | 0.59 | 473.49k |

| Biocon | 238.10 | 0.57 | 2.33m |

-330

November 30, 2023· 14:08 IST

-330

November 30, 2023· 14:02 IST

Sensex Today | Market at 2 PM

The Sensex was down 78.51 points or 0.12 percent at 66,823.40, and the Nifty was down 13.80 points or 0.07 percent at 20,082.80. About 1591 shares advanced, 1562 shares declined, and 119 shares unchanged.

-330

November 30, 2023· 13:56 IST

| Company | Price at 13:00 | Price at 13:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| Savera Ind | 108.00 | 117.00 | 9.00 391 |

| Simplex Papers | 970.20 | 1,047.95 | 77.75 3.58k |

| KZ Leasing | 23.28 | 24.99 | 1.71 207 |

| Anjani Portland | 206.10 | 220.30 | 14.20 2 |

| Medinova Diag | 29.02 | 30.96 | 1.94 186 |

| Visco Trade Ass | 133.25 | 142.00 | 8.75 109 |

| Guj Terce Labs | 26.90 | 28.50 | 1.60 102 |

| Amco India | 60.95 | 64.50 | 3.55 467 |

| Sri Nachammai | 32.00 | 33.86 | 1.86 501 |

| Classic Filamen | 36.00 | 38.00 | 2.00 310 |

-330

November 30, 2023· 13:50 IST

Stock Market LIVE Updates | Jefferies On Eicher Motors

-Buy call, target Rs 4,650 per share

-RE’s annual biking festival in Goa increases confidence on RE's brand appeal

-See limited impact on RE from the recent competitive launches

-See potential for re-rating

-Confidence on long-term market share sustainability amid tailwinds

-330

November 30, 2023· 13:41 IST

| Company | CMP | High Low | Gain from Day's Low |

|---|---|---|---|

| New India Assur | 251.40 | 253.85 227.30 | 10.6% |

| India Cements | 253.25 | 253.70 233.55 | 8.44% |

| GAIL | 133.60 | 134.20 125.25 | 6.67% |

| Intellect Desig | 740.65 | 745.85 695.00 | 6.57% |

| GE Shipping | 869.80 | 874.85 817.00 | 6.46% |

| BHEL | 170.95 | 176.50 160.80 | 6.31% |

| Housing & Urban | 86.67 | 86.99 81.71 | 6.07% |

| General Insuran | 319.10 | 327.25 301.95 | 5.68% |

| NBCC(India) | 73.97 | 74.00 70.15 | 5.45% |

| Aegis Logistics | 365.60 | 371.00 346.75 | 5.44% |

-330

November 30, 2023· 13:39 IST

Stock Market LIVE Updates | Tata Coffee board approves setting up of additional 5500 MT Freeze-Dried Coffee facility in Vietnam

The board of directors of Tata Coffee at its meeting held on November 30, 2023, has approved the setting up of an additional 5500 Metric Tonnes (MT) Freeze-Dried Coffee facility in Vietnam. This facility is being undertaken by Tata Coffee Vietnam Company Ltd, a wholly-owned subsidiary of the Company.

-330

November 30, 2023· 13:37 IST

Sensex Today | Yogesh Kansal, Co-founder & CMO, Appreciate:

The US experienced GDP growth that surpassed initial expectations. This is causing a notable divergence in the performance of various sectors. Higher GDP growth is making technology sector investors uneasy, who fear that the Federal Reserve may delay potential rate decreases. Consequently, the prices of tech stocks have witnessed a decline.

Conversely, this surge in GDP growth has elicited satisfaction among investors in the consumer and automotive sectors. They anticipate increased revenues for companies within these industries due to the favorable economic conditions.

US GDP data also directly impacts the global markets. Emerging country stock markets, in particular, are likely to be adversely affected because an accelerated US GDP growth suggests an increased likelihood of the Federal Reserve maintaining a high funds rate. This, in turn, diminishes the Equity Risk Premium, contributing to the potential downturn in emerging market equities.

-330

November 30, 2023· 13:31 IST

Sensex Today | BSE Capital Goods index up 0.6 percent led by BHEL, Thermax, Praj Industries:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| BHEL | 170.80 | 3.42 | 5.72m |

| Thermax | 2,605.00 | 3.34 | 9.59k |

| Praj Industries | 646.60 | 1.97 | 102.72k |

| Elgi Equipments | 527.90 | 1.84 | 2.52k |

| ABB India | 4,320.85 | 1.8 | 5.80k |

| Bharat Elec | 143.50 | 1.77 | 1.02m |

| Polycab | 5,246.30 | 1.63 | 10.00k |

| SKF India | 4,585.00 | 0.99 | 536 |

| Hindustan Aeron | 2,357.20 | 0.58 | 106.93k |

| Suzlon Energy | 39.90 | 0.55 | 6.27m |

-330

November 30, 2023· 13:27 IST

-330

November 30, 2023· 13:22 IST

ALERT | Enforcement Directorate

(ED) carries out raids at J&K Bank premises in connection with Rs 250 crore money laundering case

-330

November 30, 2023· 13:17 IST

Stock Market LIVE Updates | Dalmia Bharat Sugar gains on NCLT nod to Baghauli Sugar resolution plan

Dalmia Bharat Sugar (DBSIL) shares gained 2.3 percent on November 30 after the company's resolution plan for the Baghauli Sugar and Distillery was approved by the NCLT.

Dalmia Bharat Sugar submitted a resolution plan for the revival of Baghauli Sugar and Distillery under the Corporate Insolvency Resolution Process (CIRP) under the Insolvency and Bankruptcy Code (IBC). This was approved by the Allahabad Bench of the NCLT. The approval of the plan, now, is solely subject to clarification from the Supreme Court based on past orders. Read More

-330

November 30, 2023· 13:14 IST

Stock Market LIVE Updates | Elara Securities View on Bharat Dynamics

Elara Securities retain its EPS during FY24-26E and keep target price unchanged at Rs 1,360 based on 23x September FY25E P/E.

It reiterate Buy on a strong inflow trajectory over FY25-27, robust orderbook of Rs 208bn, and rising visibility in the exports business. Key monitorable would be QRSAM order in CY24.

Expect an earnings CAGR of 86% during FY23-26E and a ROE of 24% & ROCE of 12% during FY24-26E.

Broking house remain optimistic on the defence indigenization story, supported by the unexplored exports market in the missiles segment. Key risks include lower spend in the defence capital budget, less allocation toward procurement, increased competition from the private sector, and a significant rise in commodity prices.

-330

November 30, 2023· 13:09 IST

-330

November 30, 2023· 12:58 IST

| Company | Price at 12:00 | Price at 12:54 | Chg(%) Hourly Vol |

|---|---|---|---|

| CLOUDPP | 68.65 | 63.70 | -4.95 1.20k |

| Pentagon Rubber | 136.00 | 130.00 | -6.00 1.38k |

| TARACHAND | 187.95 | 180.00 | -7.95 0 |

| Ind Motor Parts | 1,038.95 | 999.65 | -39.30 637 |

| Drone | 165.95 | 160.00 | -5.95 6.87k |

| Osia Hyper Reta | 55.70 | 53.80 | -1.90 321.75k |

| Jainam Ferro | 124.90 | 121.10 | -3.80 0 |

| Newjaisa Tech | 169.80 | 165.00 | -4.80 - |

| Indian Bank | 418.45 | 406.80 | -11.65 192.46k |

| Beardsell | 48.10 | 46.95 | -1.15 7.79k |

-330

November 30, 2023· 12:56 IST

| Company | Price at 12:00 | Price at 12:54 | Chg(%) Hourly Vol |

|---|---|---|---|

| Le Merite | 44.25 | 48.85 | 4.60 0 |

| Dollex Agrotech | 50.80 | 56.00 | 5.20 36.41k |

| Pearl Polymers | 28.85 | 31.00 | 2.15 5.81k |

| Loyal Textiles | 612.30 | 640.00 | 27.70 5 |

| Gateway Distri | 105.50 | 109.85 | 4.35 98.64k |

| PDS | 587.40 | 611.60 | 24.20 18.35k |

| Network People | 2,106.00 | 2,192.00 | 86.00 198 |

| SGBMAY26 | 6,050.00 | 6,287.90 | 237.90 1 |

| Indian Renew | 65.25 | 67.70 | 2.45 21.98m |

| Suryalakshmi Co | 72.50 | 75.20 | 2.70 6.91k |

-330

November 30, 2023· 12:54 IST

-330

November 30, 2023· 12:52 IST

Stock Market LIVE Updates | Citi View On Tata Power

-Sell call, target Rs 179 per share

-Plans to undertake Rs 60,000 crore capex over FY24-27, of which 45 percent will be on renewables

-Final resolution for Mundra appears to have been pushed out again

-Company does not intend to add any new thermal capacity

-Company sees incremental opportunities across EV charging and T&D

-Aims to nearly double its revenue/EBITDA/PAT by FY27 versus FY23

-Expects share of non-core to reduce to 10 percent by FY27 (60 percent in FY23)

-330

November 30, 2023· 12:50 IST

| Company | CMP Chg(%) | Today Vol 5D Avg Vol | Vol Chg(%) |

|---|---|---|---|

| Timken | 2,922.55 -0.36% | 2.31m 1,921.80 | 120,157.00 |

| ICICIBANKN | 44.77 -0.36% | 1.20m 10,421.00 | 11,423.00 |

| Raj Rayon Ind | 27.98 -2% | 449.65k 8,819.20 | 4,999.00 |

| Radico Khaitan | 1,500.80 -1.07% | 617.15k 13,642.80 | 4,424.00 |

| ICICINV20 | 118.46 0.19% | 89.43k 2,827.80 | 3,063.00 |

| Alembic Pharma | 766.20 6.51% | 135.39k 6,439.00 | 2,003.00 |

| Kesar Ent | 112.50 14.75% | 47.84k 2,860.20 | 1,573.00 |

| LGB Forge | 13.01 7.52% | 1.20m 76,756.00 | 1,467.00 |

| Reliance | 2,386.00 -0.6% | 4.34m 310,506.20 | 1,298.00 |

| KDDL | 2,954.90 -0.98% | 23.79k 1,782.60 | 1,235.00 |

-330

November 30, 2023· 12:46 IST

SMCP in pact with Reliance Brands to enter Indian market, reported CNBC-TV18.

-330

November 30, 2023· 12:44 IST

-330

November 30, 2023· 12:32 IST

Stock Market LIVE Updates | Nirmal Bank View on Solar Industries India (SOIL):

Nirmal Bang believes that the outlook for SOIL remains strong on account of higher off-take by CIL and robust demand from miners amid the ongoing Housing & Infra push.

Ramping up of exports and Defence operations is likely to be the key growth lever going ahead.

Continue to maintain BUY on SOIL with a revised target price (TP) of Rs 7,665 (versus Rs 6,450 earlier), valuing it at 45x Dec’25E EPS (versus 40x Sept’25E EPS earlier).

-330

November 30, 2023· 12:29 IST

Stock Market LIVE Updates | Thomas Cook India falls 5% after Prem Watsa's Fairbridge Capital announces stake sale

Thomas Cook India shares fell 5 percent in the early trade on November 30 on the NSE after the company announced that promoter Fairbridge Capital (Mauritius) would sell over 6 percent in the company through an offer for sale (OFS).

Owned by Indian-origin Canadian Billionaire Prem Watsa, Fairbridge Capital has over the years invested in public and private equity securities and debt instruments in India and Indian businesses.

The investment in Thomas Cook (India) in May 2012 was Watsa's first Indian investment under Fairbridge Capital. Other major investments include Quess Corp, IIFL and Bangalore International Airport. Read More

-330

November 30, 2023· 12:23 IST

-330

November 30, 2023· 12:16 IST

Sensex Today | Nifty Bank index down 0.5 percent dragged by Federal Bank, PNB, HDFC Bank:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Federal Bank | 148.35 | -1.26 | 6.87m |

| PNB | 78.25 | -1.14 | 29.03m |

| HDFC Bank | 1,545.05 | -0.9 | 8.81m |

| ICICI Bank | 932.05 | -0.8 | 7.72m |

| IndusInd Bank | 1,474.00 | -0.64 | 3.26m |

| AU Small Financ | 745.05 | -0.43 | 998.50k |

| SBI | 566.60 | -0.35 | 7.01m |

| Kotak Mahindra | 1,751.40 | -0.12 | 1.99m |

| IDFC First Bank | 84.85 | -0.06 | 13.36m |

-330

November 30, 2023· 12:14 IST

Stock Market LIVE Updates | Aurobindo Pharma's arm gets USFDA nod for Budesonide Inhalation Suspension

Aurobindo Pharma announced that its wholly owned subsidiary company, Eugia Pharma Specialities Limited, has received final approval from the US Food & Drug Administration (USFDA) to manufacture and market Budesonide Inhalation Suspension, 0.5 mg/2 mL Single-Dose Ampule, which is bioequivalent and therapeutically equivalent to the reference listed drug (RLD), PULMICORT RESPULES (budesonide) Inhalation Suspension by Astrazeneca Pharmaceuticals LP.

-330

November 30, 2023· 12:11 IST

Stock Market LIVE Updates | Prateek Pareek resigns as CFO of Raghuvir Synthetics

Prateek Pareek has resigned as Chief Financial Officer (CFO) and Swati Jain as the Company Secretary & Compliance Officer (CS) of Raghuvir Synthetics, due to their personal commitments, with effect from November 30.

-330

November 30, 2023· 12:05 IST

Stock Market LIVE Updates | Citi View On Zomato:

-Buy call, target Rs 145 per share

-Stock has corrected approximately 7 percent since conclusion of the cricket world cup

-Media reports suggesting a new GST penalty hereon on customer delivery charges

-Media reports on GST penalty may have contributed to correction

-New GST would add Rs 5/order charge to non-gold orders

-GST on delivery charges may further support adoption of gold loyalty programme

-Overall growth impact may be modest

-330

November 30, 2023· 12:01 IST

Sensex Today | Market at 12 PM

The Sensex was down 154.42 points or 0.23 percent at 66,747.49, and the Nifty was down 28.70 points or 0.14 percent at 20,067.90. About 1556 shares advanced, 1551 shares declined, and 110 shares unchanged.

-330

November 30, 2023· 11:57 IST

-330

November 30, 2023· 11:55 IST

| Company | Price at 11:00 | Price at 11:54 | Chg(%) Hourly Vol |

|---|---|---|---|

| Jai Hind Synth | 28.08 | 25.42 | -2.66 586 |

| Poddar Housing | 142.35 | 131.35 | -11.00 30 |

| V R Films | 39.00 | 36.00 | -3.00 54.00k |

| Nimbus Projects | 31.50 | 29.20 | -2.30 42 |

| Scan Steels | 55.00 | 51.95 | -3.05 2.42k |

| CCL Internation | 24.96 | 23.58 | -1.38 491 |

| Sumuka Agro Ind | 152.00 | 143.80 | -8.20 869 |

| SKP Securities | 75.47 | 71.70 | -3.77 181 |

| Power & Instrum | 42.49 | 40.40 | -2.09 16 |

| Venkatesh Ref | 120.00 | 114.25 | -5.75 1.82k |

-330

November 30, 2023· 11:54 IST

| Company | Price at 11:00 | Price at 11:54 | Chg(%) Hourly Vol |

|---|---|---|---|

| Photoquip India | 21.15 | 23.80 | 2.65 1 |

| Shree Kr Paper | 28.00 | 30.92 | 2.92 3 |

| HCP Plastene | 190.00 | 207.90 | 17.90 116 |

| Trans Freight | 27.51 | 30.00 | 2.49 3.28k |

| Jindal Leasefin | 30.44 | 33.00 | 2.56 101 |

| Modern Home | 26.30 | 28.35 | 2.05 4 |

| Sir Shadi Lal | 139.50 | 149.80 | 10.30 62 |

| Envair Electro | 186.60 | 200.00 | 13.40 311 |

| Guj Credit | 19.60 | 21.00 | 1.40 107 |

| CIL Securities | 34.80 | 37.25 | 2.45 4.62k |

-330

November 30, 2023· 11:52 IST

Sensex Today | Equirus Long Horizon Offshore Investments secures approval for Gift City operations

Equirus Long Horizon Offshore Investments announced the successful approval for its operations in Gift City, marking a significant achievement in its growth trajectory.

Equirus Wealth Private Limited (IFSC Branch) registered as Fund Management Entity with IFSCA and is Investment Manager of Equirus Long Horizon Offshore Investments.

-330

November 30, 2023· 11:50 IST

-330

November 30, 2023· 11:47 IST

Stock Market LIVE Updates | Max Estates enters into a binding arrangement with Antara Senior Living for advisory services

Max Estates' subsidiary Max Estates Gurgaon (MEGL) and the real estate arm of Max Group proposed to develop a group housing project in Harsaru, Gurugram. It also proposed 33% of the available FAR (floor area ratio) for the said project, translating to approximately 6.07 lakh square feet to be allocated for development of senior living units and associated facilities/amenities including any club for the said senior living development, for which Antara Senior Living (ASLL) has been engaged by MEGL. ASLL will provide its expertise and advisory services for design, conceptualization, training and development of project personnel, and expert advice on marketing and sales for the senior living project.

-330

November 30, 2023· 11:44 IST

Stock Market LIVE Updates | Insolation Energy appoints Madhuri Maheshwari as Chief Financial Officer

Insolation Energy has received board approval for the appointment of Madhuri Maheshwari as Chief Financial Officer and Key Managerial Personnel, with effect from November 29. Sneha Goenka is appointed as the Company Secretary & Compliance Officer of the company.

-330

November 30, 2023· 11:40 IST

| Company | CMP Chg(%) | Today Vol 5D Avg Vol | Vol Chg(%) |

|---|---|---|---|

| Timken | 2,930.00 -0.1% | 2.31m 1,921.80 | 120,055.00 |

| ICICIBANKN | 44.78 -0.33% | 1.20m 10,421.00 | 11,396.00 |

| Radico Khaitan | 1,495.80 -1.4% | 615.99k 13,642.80 | 4,415.00 |

| ICICINV20 | 118.46 0.19% | 89.01k 2,827.80 | 3,048.00 |

| Alembic Pharma | 783.65 8.93% | 116.02k 6,439.00 | 1,702.00 |

| LGB Forge | 12.68 4.79% | 1.11m 76,756.00 | 1,348.00 |

| Reliance | 2,383.65 -0.7% | 4.34m 310,506.20 | 1,297.00 |

| Raj Rayon Ind | 28.00 -1.93% | 101.51k 8,819.20 | 1,051.00 |

| IGL | 387.25 -0.78% | 502.15k 49,390.40 | 917.00 |

| Gufic Bio | 334.20 11.2% | 110.35k 12,246.00 | 801.00 |

-330

November 30, 2023· 11:37 IST

Sensex Today | Morgan Stanley View On Tata Power Company:

-Underweight call, target Rs 213 per share

-FY27 revenue & PAT guidance lowered by 13 percent & 17 percent, respectively, more feasible

-Capex guidance was also reduced by approximately 20 percent

-Capex guidance appears conservative when viewed in context of net debt/ EBITDA

-Management is bullish on transmission & pump storage

-330

November 30, 2023· 11:30 IST

Stock Market LIVE Update | Grasim shows bullish setup as consolidation breakout accompanies long build-up

As per analyst the stock is expected to continue its upward movement and test levels of Rs 2100 followed by Rs 2140 in the short-medium term. A stop-loss can be maintained at Rs 1940 on a closing basis. READ MORE

-330

November 30, 2023· 11:25 IST

Stock Market LIVE Update | IDBI Bank gains as govt invites fresh bids from asset valuers for divestment

Shares of IDBI Bank gained 2.5 percent to Rs 63 on November 30 as the government has once again sent invitation for the appointment of an asset valuer. This is the second time the government has attempted to appoint a valuer after the previous one received a poor response. So far this year, the stock of this state-owned lender has surged over 15 percent as against a 9 percent rise in the benchmark Sensex. READ MORE

-330

November 30, 2023· 11:22 IST

Stock Market LIVE Update | Tata Motors slip nearly 2% post bumper debut of subsidiary Tata Tech

-330

November 30, 2023· 11:16 IST

Stock Market LIVE Update | CRISIL Ratings reaffirms Dabur India's short and long-term bank facilities as stable

-330

November 30, 2023· 11:13 IST

Stock Market LIVE Update | Aurobindo Pharma's wholly-owned subsidiary gets USFDA nod to manufacture and market asthma drug

-330

November 30, 2023· 11:03 IST

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| Hero Motocorp | 3884.50 | 3884.50 | 3,852.60 |

| SBI Life Insura | 1441.15 | 1441.15 | 1,441.00 |

| UltraTechCement | 8960.00 | 8960.00 | 8,860.80 |

| BPCL | 437.50 | 437.50 | 434.05 |

| TATA Cons. Prod | 948.20 | 948.20 | 938.80 |

| Axis Bank | 1080.90 | 1080.90 | 1,066.55 |

| Grasim | 2031.00 | 2031.00 | 2,013.95 |

| HCL Tech | 1341.00 | 1341.00 | 1,338.50 |

| Bajaj Auto | 6100.00 | 6100.00 | 6,067.65 |

| Tata Motors | 717.25 | 717.25 | 700.10 |

-330

November 30, 2023· 11:01 IST

Sensex Today | Market at 11 AM

The Sensex was down 141.24 points or 0.21 percent at 66,760.67, and the Nifty was down 20.80 points or 0.10 percent at 20,075.80. About 1487 shares advanced, 1558 shares declined, and 119 shares unchanged.

-330

November 30, 2023· 10:59 IST

| Company | Price at 10:00 | Price at 10:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| Spectrum Electr | 1,174.00 | 1,090.00 | -84.00 625 |

| Globesecure | 73.50 | 69.50 | -4.00 12.00k |

| RBM Infracon | 284.45 | 269.55 | -14.90 2.00k |

| Pritika Auto | 28.25 | 27.10 | -1.15 99.42k |

| Agri-Tech | 234.75 | 225.90 | -8.85 2.25k |

| Tasty Bite | 15,750.90 | 15,170.00 | -580.90 385 |

| Agarwal Float | 56.00 | 54.00 | -2.00 3.00k |

| Aatmaj Health | 41.90 | 40.45 | -1.45 10.00k |

| Dhunseri Invest | 1,227.05 | 1,185.70 | -41.35 1.17k |

| EQUIPPP | 27.00 | 26.10 | -0.90 33.45k |

-330

November 30, 2023· 10:57 IST

| Company | Price at 10:00 | Price at 10:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| Maitreya Medica | 129.20 | 144.00 | 14.80 9.60k |

| Apollo Micro Sy | 113.00 | 123.70 | 10.70 43.50k |

| Tata Tech | 1,200.00 | 1,313.40 | 113.40 - |

| Bhageria Indu | 157.35 | 170.10 | 12.75 4.10k |

| Chavda Infra | 85.95 | 91.45 | 5.50 - |

| BHEL | 162.20 | 172.05 | 9.85 12.08m |

| Clean Science | 1,339.30 | 1,419.45 | 80.15 5.50k |

| Premier Polyfil | 141.80 | 150.00 | 8.20 5.06k |

| ROX Hi-Tech | 163.00 | 172.10 | 9.10 113.60k |

| The Investment | 106.95 | 112.65 | 5.70 10.94k |

-330

November 30, 2023· 10:54 IST

Sensex Today | Rockingdeals Circular SME IPO surges 125% on debut

Shares of Rockingdeals Circular Economy Ltd opened 125 percent higher on debut on November 30 after its initial public offering of the SME was subscribed over 213 times last week.

The stock opened at Rs 300 on the NSE SME platform from its issue price of Rs 140 a share. At 10am, the stock was trading at Rs 315, up 125 percent from its issue price.

The SME IPO, which was open to bids from November 22 to 24, saw overwhelming subscription levels with 201.42 times buying in the retail category, 47.4 times in QIPs, and 459 times in NIIs.

The Rs 21-crore IPO was an entire fresh issue of 15 lakh shares. The company plans to use the net proceeds for working capital needs and brand positioning, marketing, and advertising.

-330

November 30, 2023· 10:53 IST

Sensex Today | Shivani Nyati, Head of Wealth at Swastika Investmart:

Gandhar Oil Refinery India Limited made its stock market debut, by listing on the BSE and NSE at Rs 298 per share, 76% higher than its IPO price of Rs 169.

The IPO was subscribed 64.05 times, which is significantly higher than the expected. This strong response from investors could be due to a number of factors, including the company's strong track record of growth and profitability, its diversified customer portfolio, and its strong distribution network.

Overall, the listing of Gandhar Oil Refinery India Limited was a success. The company's strong fundamentals, robust demand for the IPO, and strong listing price suggest that the company is well-positioned for growth in the future. However, investors may consider to book profit in it once.

-330

November 30, 2023· 10:50 IST

Stock Market LIVE Updates | PK Vaidyanathan joins Repco Home Finance as Chief Development Officer for 3 years

P K Vaidyanathan has joined Repco Home Finance as the Chief Development Officer for 3 years with effect from November 29. Vaidyanathan is the General Manager, Repatriates Co-operative Finance and Development Bank (Promoter).

-330

November 30, 2023· 10:46 IST

Stock Market LIVE Updates | GNFC to open its share buyback issue on December 1, close on December 7

Gujarat Narmada Valley Fertilizers & Chemicals' buyback offer will be opening on December 1 and closing on December 7. The company is going to buy back 84,78,100 equity shares at a price of Rs 770 per share.

-330

November 30, 2023· 10:41 IST

Sensex Today | Prashanth Tapse, Senior VP (Research), Mehta Equities

As expected, a solid listing gains above our expectation for a leading manufacturer of white oils, Gandhar Oil mainly on the back of reasonable IPO valuation when compared to its peers which were trading high.

Post listing, we believe the valuation gap has narrowed to Gandhar peers and hence expecting limited upside from the current levels, hence we had recommended allotted investors to book listing day profits which is over and above our expectations.

-330

November 30, 2023· 10:38 IST

Stock Market LIVE Updates | Shareholders approve appointment of Amit Jhingran as MD & CEO of SBI Life

SBI Life Insurance Company's shareholders have given approval for appointment of Amit Jhingran as Managing Director & Chief Executive Officer of the company.

-330

November 30, 2023· 10:34 IST

Sensex Today | ICICI Securities falls after BSE, NSE approval to delist shares

Shares of ICICI Securities extended a downturn to the fifth day in a row at Rs 657 on November 30 after the NSE and BSE approved the draft scheme of arrangement to delist its equity shares. In the past five days, the stock has lost 3 percent as against a 1 percent rise in the benchmark Sensex.

The stock of ICICI Securities has soared over 35 percent so far this year.

In an exchange filing on November 30, the company notified that the NSE has conveyed its 'no objection' to ICICI Securities to file the draft scheme of arrangement with National Company Law Tribunal. Read More

-330

November 30, 2023· 10:30 IST

Sensex Today | Nifty PSU Bank index down 0.3 percent dragged by Central Bank of India, PNB, Union Bank of India:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Central Bank | 44.05 | -1.56 | 2.21m |

| PNB | 78.00 | -1.45 | 20.22m |

| Union Bank | 108.90 | -1.27 | 5.24m |

| Bank of India | 104.60 | -1.18 | 1.60m |

| JK Bank | 109.05 | -1.04 | 914.92k |

| Bank of Mah | 43.95 | -0.79 | 4.03m |

| UCO Bank | 37.80 | -0.79 | 2.54m |

| IOB | 39.20 | -0.63 | 4.26m |

| Punjab & Sind | 40.80 | -0.61 | 367.97k |

| Indian Bank | 416.45 | -0.56 | 333.24k |

-330

November 30, 2023· 10:28 IST

Sensex Today | V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services:

The market construct has turned clearly bullish aided by favourable global and domestic clues. A significant trend in the market is the comeback of Bank Nifty. FIIs turning buyers for 5days in a row and DIIs buying aggressively is a strong trend that can take the Nifty past the record Nifty high of 20222 soon. The leader of the rally is likely to be banking assisted by IT.

Global cues are supportive with positive news from the mother market US where growth is strong and inflation is trending down. India’s Q2 GDP numbers expected today will be better than expected. If these good macros are supported by today's exit poll results coming in tune with market expectations, a rally to record highs can happen soon.

With India’s market cap touching $4 trillion and the market cap GDP ratio climbing to 1.2 valuations are getting stretched. But in the short run the market is likely to move ahead of fundamentals.

-330

November 30, 2023· 10:23 IST

-330

November 30, 2023· 10:21 IST

Sensex Today | Apar Industries closes QIP issue, raises Rs 1,000 crore

Apar Industries closed its qualified institutions placement (QIP) issue and raised Rs 1,000 crore as it allocated 18,99,696 equity shares to qualified institutional buyers at an issue price of Rs 5,264 per share.

-330

November 30, 2023· 10:19 IST

Sensex Today | Shivani Nyati, Head of Wealth, Swastika Investmart:

Tata Technologies, a global leader in engineering services, made its much-anticipated stock market debut today, listing at an impressive blockbuster premium of 173% over its IPO price of Rs 500 per share.

The overwhelming response to the IPO was evident in its staggering oversubscription of 69.43 times. This robust investor interest reflects the company's strong fundamentals and promising growth prospects and of course the legacy of the Tata group.

The listing of Tata Technologies is a positive development for the company and the engineering services sector. Investors who participated in the IPO should consider holding on to their shares for the long term, as the company is well-positioned for sustained growth.

-330

November 30, 2023· 10:13 IST

Stock Market LIVE Updates | Morgan Stanley Asia picks half a percent stake in Zomato. Alipay Singapore Holding exits

Alipay Singapore Holding Pte Ltd exited Zomato by selling entire shareholding of 3.44% or 29,60,73,993 equity shares via open market transactions at an average price of Rs 112.70 per share, amounting to Rs 3,336.75 crore. However, Morgan Stanley Asia (Singapore) Pte bought 4,39,73,993 equity shares or 0.51% stake in Zomato at same average price.

-330

November 30, 2023· 10:11 IST

Sensex Today | BSE Power index down 1 percent dragged by Adani Power, Adani Energy, Adani Green Energy:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Adani Power | 418.70 | -3.43 | 731.96k |

| Adani Energy | 851.85 | -2.79 | 227.40k |

| Adani Green Ene | 1,012.25 | -2.74 | 64.26k |

| Tata Power | 266.10 | -2.63 | 377.58k |

| BHEL | 162.05 | -1.88 | 1.39m |

| NHPC | 54.27 | -1.06 | 193.06k |

| JSW Energy | 410.40 | -1.04 | 13.02k |

| NTPC | 256.20 | -0.85 | 67.57k |

| Siemens | 3,618.65 | -0.33 | 2.49k |

| Power Grid Corp | 210.95 | -0.07 | 86.28k |

-330

November 30, 2023· 10:05 IST

Sesnex Today | Fedbank Financial Services stock lists at 1.6% discount to IPO price

Fedbank Financial Services stock made a subdued debut, listing at a 1.61 percent discount to the IPO price on November 30. The shares opened at Rs 137.75 on NSE and Rs 138 on BSE against the issue price of Rs 140.

Ahead of the listing, the grey market premium (GMP) of Fedbank Financial Services was totally wiped out after a dull interest from investors. However, it was trading at a premium of Rs 5-10 per share, when the price band for the issue was announced.

-330

November 30, 2023· 10:03 IST

Sensex Today | Tata Tech doubles investors' wealth, lists at 140% premium over IPO price

The lucky ones who got allotment in the Tata Tech IPO are laughing all the way to the bank. Tata Technologies made an impressive debut on the bourses on November 30, listing at 140 percent premium to the IPO price. The stock started trading at Rs 1,200 on the NSE and at Rs 1,199.95 on the BSE, while its issue price was Rs 500.

The IPO had garnered heavy interest from all categories of investors, with over 73.38 lakh total applications. The public offer was subscribed 69.43 times, with the quota reserved for qualified institutional buyers (QIBs) getting booked a record 203.41 times.

The portion set aside for non-institutional investors (NIIs) and retail investors was booked 62.11 times and 16.50 times, respectively.

-330

November 30, 2023· 10:03 IST

Bumper debut | Gandhar Oil Refinery lists at 75% premium to IPO price

White oil manufacturer Gandhar Oil Refinery (India) surpassed analysts' expectations and listed at a premium of 75 percent on exchanges on November 30. The stock started trading at Rs 295.40 on the BSE and Rs 298 on the NSE, against issue price of Rs 169 per share. Analysts had expected the stock to list at Rs 245.

The IPO was subscribed 64.07 times on November 24, the final day of bidding, with bids coming in for 136.1 crore shares against 2.12 crore shares on the block. Qualified institutional buyers booked 129 times their quota of shares, retail investors booked 28.95 times, and high net-worth individuals 62.2. times.

-330

November 30, 2023· 10:00 IST

-330

November 30, 2023· 09:57 IST

Stock Market LIVE Updates | Fedbank Financial Services to debut on bourses on November 30

Fedbank Financial Services is set to start trading on the BSE and NSE with effect from November 30. The issue price has been fixed at Rs 140 per share. The grey market suggests the stock is not attracting any premium, analysts on anonymity said.

-330

November 30, 2023· 09:55 IST

Stock Market LIVE Updates | Gandhar Oil Refinery India to list shares on the BSE & NSE on November 30

Gandhar Oil Refinery India will debut on the bourses on November 30. The final issue price has been set at Rs 169 per share. According to the grey market, the opening price premium could be around 35-40 percent over the issue price.

-330

November 30, 2023· 09:52 IST

Stock Market LIVE Updates | Tata Technologies set to debut on the bourses on November 30

The subsidiary of Tata Motors and the global engineering services company will be available for trading on the BSE and NSE with effect from November 30. The issue price has been fixed at Rs 500 per share. The grey market indicates the listing premium may be around 75 percent over the offer price, analysts on anonymity said.

-330

November 30, 2023· 09:51 IST

Stock Market LIVE Updates | Tata Tele Business Services collaborates with Truecaller:

Tata Tele Business Services has collaborated with Truecaller, the leading global communications platform. This collaboration introduces the innovative ‘Verified Business Caller Id Solution’ to TTBS enterprise customers making a significant advancement in secure and efficient communication by providing an additional layer of identity, credibility, and spam prevention.

-330

November 30, 2023· 09:47 IST

Deepak Jasani, HDFC Securities View on 2-Wheelers Stock:

-Demand for premium products including 2-wheelers is going up

-Overall market pie will increase in the premium bike space

-We could expect some changes in market share

-Fear of competition denting sales may be unfounded

-330

November 30, 2023· 09:44 IST

Sensex Today | Jonathan Garner, Morgan Stanley told CNBC-TV18:

There are two secular bull markets in Asia; Japan & India. Indian currency is far more stable as compared to its peers, while market volatility may pick-up ahead of elections.