Closing Bell: Sensex down 523 pts, Nifty around 21,600; PSU Banks worst hit, IT, pharma gain

-330

February 12, 2024· 16:10 IST

-330

February 12, 2024· 16:09 IST

Ajit Mishra, SVP- Technical Research Religare Broking

Markets started the week with a cut amid mixed cues and lost over half a percent. After the flat start, Nifty slipped gradually lower and finally settled around the day’s low at 21,616.05 level. Most sectors felt the heat wherein realty, metal, energy and banking were among the top losers. The sharp decline in the broader indices, midcap (-2.57%) and smallcap (-4.04%), further dented the sentiment.

The banking index has retested its long term moving average i.e. 200 DEMA and others are also witnessing profit taking now. It would be difficult for Nifty to hold 21,600 in the prevailing scenario. We thus recommend maintaining shorts as well and using any pause or rebound to reduce longs

-330

February 12, 2024· 16:08 IST

Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities

The Bank Nifty index experienced continued dominance by bears, with clear rejection observed at higher levels. Closing below the near-term support zone of 45000 signaled bearish sentiment.

The index faces immediate resistance at 45100, and a breakthrough could trigger short-covering moves towards 45500 levels. Conversely, the immediate support is at 44800, and breaching this level may intensify selling pressure towards the 44000 mark.

-330

February 12, 2024· 16:05 IST

Mandar Bhojane, Research Analyst at Choice Broking

Indian equity indices concluded lower on February 12, with the Nifty hovering around 21,600, as selling pressure affected various sectors except for IT and pharmaceutical companies.

On the daily chart, Nifty experienced a breakdown of the daily trendline and formed a bearish engulfing pattern with significant volume, indicating weakness in the index. The Relative Strength Index (RSI) exhibited a downward slope at 50.7, suggesting the persistence of bearish momentum. Immediate support levels are identified at 21,500-21,400, while hurdles are anticipated at 21,800 and 21,950.

Among the top losers on the Nifty were Coal India, Hero MotoCorp, BPCL, ONGC, and IndusInd Bank, while gainers included Dr. Reddy's Laboratories, Apollo Hospitals, Wipro, Divis Labs, and HCL Technologies.

The India VIX (Volatility Index) saw an intraday increase of 3.98 percent, settling at 16.06, indicating heightened market volatility.

Upon examining the Open Interest (OI) data, the call side revealed the highest OI at 21,800, followed by 22,000 strike prices. On the put side, the maximum OI was observed at the 21,500 strike price.

-330

February 12, 2024· 16:01 IST

Rupak De, Senior Technical Analyst, LKP Securities

Nifty declined further after a consolidation breakdown on the hourly chart, indicating an increase in pessimism. The daily chart shows the index forming a lower top, signaling diminishing bullish sentiment.

The momentum indicator aligns with this bearish outlook, displaying a crossover. The Nifty might remain sell on rise as long as it remains below 21850. On the downside, support is situated at 21500.

-330

February 12, 2024· 15:56 IST

Vinod Nair, Head of Research, Geojit Financial Services

An uptick in exchange margin requirements caused a decrease in positions, primarily in mid and small caps. Aside from the pharma and IT sectors, selling was widespread, with notable struggles seen in PSU banks. The premium valuation gap between mid to large caps has notched to its all-time high. Despite a robust economic forecast, corporate earnings are expected to slow due to moderated operating margins. It is going to be a challenge for the broad market to sustain the premium valuation. Large caps are predicted to excel amid consolidation.

-330

February 12, 2024· 15:33 IST

Rupee Close:

Indian rupee ended at 83 per dollar on Monday versus Friday's close of 83.04.

-330

February 12, 2024· 15:31 IST

Market Close:

Indian equity indices ended lower on February 12 with Nifty around 21,600, amid selling across the sectors barring IT and pharma names.

At close, the Sensex was down 523 points or 0.73 percent at 71,072.49, and the Nifty was down 166.50 points or 0.76 percent at 21,616. About 791 shares advanced, 2618 shares declined, and 66 shares unchanged.

Top losers on the Nifty included Coal India, Hero MotoCorp, BPCL, ONGC and NTPC, while gainers were Dr Reddy's Laboratories, Apollo Hospitals, Wipro, Divis Labs and HCL Technologies.

On the sectoral front, FMCG, PSU Bank, capital goods, metal, oil & gas, power and realty down 1-4 percent each, while healthcare and IT indices ended in the green.

BSE midcap index fell 2.6 percent and smallcap index shed 3 percent.

-330

February 12, 2024· 15:29 IST

Mazagon Dock Q3

Net profit up 77% at Rs 626.8 crore against Rs 354.2 crore and revenue up 30.1% at Rs 2,362.5 crore versus Rs 1,815.9 crore, YoY.

-330

February 12, 2024· 15:24 IST

Stock Market LIVE Updates | Macquarie View On Bandhan Bank

-Neutral call, target Rs 225 per share

-Asset quality continues to disappoint

-PAT miss due to lower other income & higher credit costs

-Opex/average assets stood at 3.7 percent

-Even post system migration management expects opex ratios to remain range bound 3.5-3.7 percent levels

-RoA flat QoQ at 1.9 percent

-Management remains confident of recovering 2nd tranche of CGMFU claim

-Confidence of recovering 2nd tranche of CGMFU claim is encouraging

-330

February 12, 2024· 15:21 IST

Sensex Today | Samvardhana Motherson Q3 Results:

Cons profit rose 26.5 percent at Rs 633.3 crore versus Rs 500.7 crore and consolidated revenue up 26.8 percent at Rs 25,697.6 crore versus Rs 20,267.2 crore, YoY.

-330

February 12, 2024· 15:20 IST

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| SJVN | 112.50 | -19.99 | 15.37m |

| Bharat Dynamics | 1,621.10 | -11.61 | 50.50k |

| NMDC Steel | 58.77 | -11.61 | 1.48m |

| New India Assur | 257.40 | -11.53 | 529.96k |

| Mishra Dhatu | 409.00 | -11.26 | 326.15k |

| NHPC | 86.62 | -10.01 | 25.64m |

| HUDCO | 180.25 | -9.99 | 2.34m |

| IOB | 64.01 | -9.98 | 6.43m |

| NBCC (India) | 133.15 | -9.97 | 1.97m |

| General Insuran | 366.60 | -9.67 | 258.92k |

-330

February 12, 2024· 15:17 IST

Sensex Today | Trust Fintech files DRHP with NSE Emerge

Trust Fintech Limited, a leading provider of SaaS product focused fintech software solutions, announced the filing of its Draft Red Herring Prospectus (DRHP) with NSE Emerge

-330

February 12, 2024· 15:16 IST

For the quarter that ended on December 31, 2023, BLS E-Services consolidated revenue stood at Rs 71.65 crore, compared to Rs 69.07 crore in the corresponding previous quarter. Operating EBITDA witnessed a growth of 15.7% to Rs 10.31 crore.

-330

February 12, 2024· 15:11 IST

Stock Market LIVE Updates | BoFA Securities View On Zydus Lifesciences

-Neutral call, target raised to Rs 840 per share

-Q3 was a good quarter with India & emerging markets surprise positively

-Company’s commentary on continued momentum in India/EM provide confidence to maintain margins

-Impending risk of competition for gasacol HD & likely impact on margin

-330

February 12, 2024· 15:09 IST

On the inspection conducted by the United States Food & Drug Administration (USFDA) at Dr Reddy's Laboratories' R&D centre (Integrated Product Development Organisation or IPDO) in Bachupally, Hyderabad, the USFDA has classified the inspection as Voluntary Action Indicated (VAI).

-330

February 12, 2024· 15:07 IST

Stock Market LIVE Updates | Morgan Stanley View On Hero MotoCorp

-Underweight call, target Rs 3,638 per share

-Q3 was in-line with estimates

-Management appears to be executing well on its strategy

-Market share gains in premium segment will be key to track

-Disruption risk in the core segment & elevated valuations keep us underweight

-330

February 12, 2024· 15:04 IST

Sensex Today | Dollar steady, US inflation data tops this week's bill

The dollar was steady on Monday as a holiday in most major Asian markets subdued the start of what could turn into a busy week, with all eyes on U.S. inflation data for clues on when the Federal Reserve may start to cut rates.

The euro was down a whisker at $1.0778, edging off a 10-day high touched in early trading after the past week saw a small bounce back after steady declines in 2024. A reading of the euro zone's economic growth in the fourth quarter on Wednesday could offer fresh direction.

The pound was flat at $1.2632, though the Japanese yen strengthened a fraction to 149.04 per dollar as the approaching release of U.S. CPI data for January on Tuesday capped moves.

-330

February 12, 2024· 15:03 IST

Stock Market LIVE Updates | TCI Express Q3 Results:

Net profit down 9.5 percent at Rs 32.2 crore versus Rs 35.6 crore and revenue down 2.5 percent at Rs 314 crore versus Rs 322 crore, QoQ.

-330

February 12, 2024· 15:01 IST

Sensex Today | Market at 3 PM

The Sensex was down 466.66 points or 0.65 percent at 71,128.83, and the Nifty was down 147.80 points or 0.68 percent at 21,634.70. About 809 shares advanced, 2596 shares declined, and 67 shares unchanged.

-330

February 12, 2024· 15:01 IST

Sensex Today | Colin Shah, MD, Kama Jewelry

With an issue price of Rs 6,263 per gram, the subscription of the 4th tranche of Sovereign Gold Bond launched today is expected to garner major traction. Both household as well as institutional investors are increasingly getting attracted towards this asset class owing to the plethora of benefits that come along with lucrative returns. As the Indian economy resiliently navigate through choppy waters, investments in SGB tranche is one of the safest harbors for the investors which they can hedge against the headwinds.

With India traditionally inclined towards gold for domestic investments, we foresee the behavioral shift in buyers towards SGBs for investment-driven purpose, thus positioning physical gold as lifestyle statement for adornment purpose.

-330

February 12, 2024· 14:59 IST

| Company | Price at 14:00 | Price at 14:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Supreme Power | 173.00 | 152.05 | -20.95 13.52k |

| Kirl Electric | 126.80 | 115.70 | -11.10 306.13k |

| Bharat Forge | 1,280.85 | 1,182.65 | -98.20 494.93k |

| Modison | 141.65 | 131.00 | -10.65 7.27k |

| Basilic Fly | 409.95 | 382.85 | -27.10 - |

| Khadim India | 377.90 | 354.05 | -23.85 5.23k |

| Welspun Invest | 760.25 | 714.30 | -45.95 144 |

| NHPC | 86.60 | 81.45 | -5.15 15.81m |

| Thyrocare Techn | 607.95 | 573.00 | -34.95 1.86k |

| Bohra Industrie | 24.95 | 23.60 | -1.35 509 |

-330

February 12, 2024· 14:59 IST

| Company | Price at 14:00 | Price at 14:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Shanti Overseas | 24.15 | 30.10 | 5.95 2.95k |

| Savita Oil Tech | 385.00 | 433.00 | 48.00 19.92k |

| Wonder Elect. | 311.10 | 349.00 | 37.90 14 |

| Gandhi Spl Tube | 782.40 | 875.00 | 92.60 302 |

| Uma Exports | 71.10 | 78.50 | 7.40 4.67k |

| Radhika Jewel | 60.35 | 65.90 | 5.55 61.24k |

| Touchwood Enter | 151.00 | 159.95 | 8.95 57 |

| Jubilant Pharmo | 554.85 | 586.70 | 31.85 16.49k |

| Party | 118.00 | 123.75 | 5.75 1.80k |

| Vinsys IT | 248.00 | 259.00 | 11.00 0 |

-330

February 12, 2024· 14:59 IST

Stock Market LIVE Updates | Morgan Stanley View On Tata Power

-Underweight call, target Rs 213 per share

-Q3 earnings miss was driven by slower growth in regulated business, lower margins in utility scale renewable

-Commissioning of RE remains sluggish

-Key positives were solar EPC business execution & improved profitability of coal JV in Q3

-Adjusted PAT (ex of one other income) was -39 percent YoY

-Receivables increased QoQ to Rs 8,300 crore

-330

February 12, 2024· 14:54 IST

Stock Market LIVE Updates | CLSA View On Bandhan Bank

-Outperform call, target cut to Rs 250 per share

-Gross NPAs of MFI business up 70 bps QoQ, a third consecutive quarterly increase

-AUM growth of 19 percent YoY and healthy expansion in margin

-Trim EPS estimate 3 percent-9 percent over CL24-26C

-330

February 12, 2024· 14:52 IST

Stock Market LIVE Updates | Aurobindo Pharma received USFDA approval for Deflazacort Tablets, which are indicated for the treatment of Duchenne Muscular Dystrophy

-330

February 12, 2024· 14:51 IST

Sensex Today | Nifty FMCG index down 1 percent dragged by United Breweries, ITC, HUL

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| United Brewerie | 1,735.00 | -2.35 | 248.06k |

| ITC | 407.80 | -1.85 | 9.14m |

| HUL | 2,386.05 | -1.57 | 1.09m |

| Godrej Consumer | 1,202.75 | -1.3 | 594.04k |

| Jubilant Food | 476.50 | -1.15 | 1.51m |

| United Spirits | 1,100.35 | -1 | 615.56k |

| P and G | 16,399.00 | -0.93 | 2.32k |

| Colgate | 2,517.85 | -0.64 | 65.52k |

| Emami | 482.85 | -0.35 | 354.33k |

| Dabur India | 537.90 | -0.24 | 1.28m |

-330

February 12, 2024· 14:49 IST

Sensex Today | Anuj Choudhary Research Analyst, Sharekhan by BNP Paribas:

Indian Rupee traded on a flat note with minor gains on softness in the US Dollar and easing crude oil prices. However, weak domestic markets and FII outflows capped sharp gains. US Dollar softened on consolidation ahead of US inflation report.

We expect Rupee to trade with a slight positive bias on positive global equities and a slight correction in the greenback. However, any bounce back in crude oil prices amid ongoing geopolitical tensions in the Middle East and selling pressure from foreign investors may weigh on Rupee at higher levels.

Traders may take cues from India’s CPI and IIP data. Headline inflation is expected to ease to 5.09% from 5.69%. Investors may remain vigilant ahead of US inflation data on Tuesday. USDINR spot price is expected to trade in a range of Rs 82.80 to Rs 83.20.

-330

February 12, 2024· 14:46 IST

Sensex Today | BSE Metal index down 2 percent dragged by SAIL India, Coal India, NMDC:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| SAIL | 125.70 | -5.95 | 4.38m |

| Coal India | 435.00 | -4.54 | 500.70k |

| NMDC | 231.25 | -4.22 | 771.72k |

| Jindal Stainles | 584.25 | -3.81 | 124.25k |

| Tata Steel | 138.10 | -2.26 | 2.34m |

| Vedanta | 270.50 | -1.4 | 599.91k |

| Jindal Steel | 750.75 | -1.39 | 48.61k |

| Hindalco | 585.40 | -1.05 | 175.22k |

-330

February 12, 2024· 14:44 IST

Stock Market LIVE Updates | Nomura View On Hero MotoCorp

-Neutral call, target Rs 5,356 per share

-Right strategy to lift growth & market share

-Q3 margins in-line

-Execution of 125cc, EVs and Harley key monitorable for re-rating

-Management expect FY25 industry revenue growth of 10 percent+ & company to grow faster

-Margins were supported by commodities, leap savings and price hikes

-330

February 12, 2024· 14:40 IST

Sensex Today | NHPC Q3 Results:

Net profit down 30.1 percent at Rs 546.1 crore versus Rs 781.6 crore and revenue down 25.3 percent at Rs 1,697 crore versus Rs 2,272.2 crore, YoY.

-330

February 12, 2024· 14:40 IST

-330

February 12, 2024· 14:34 IST

Stock Market LIVE Updates | DCM Shriram reports net profit of Rs 29 crore in Q3

DCM Shriram posted a net profit of Rs 29 crore in Q3, up from Rs 11.30 crore in the same quarter last fiscal. Revenue fell 18.5 percent on year to Rs 468.30 crore, as against Rs 574.3 crore in the year ago period.

-330

February 12, 2024· 14:30 IST

Stock Market LIVE Updates | Surya Roshni bags order worth Rs 119.70 cr for supply of coated pipes

-330

February 12, 2024· 14:25 IST

Stock Market LIVE Updates | Force Motors reports Q3 net profit of Rs 85.40 crore

Force Motors posted a net profit of Rs 85.40 crore in the December quarter as against a loss of Rs 15.60 crore in the year ago period. Its revenue jumped 30 percent on year to Rs 1,691.7 crore in Q3.

-330

February 12, 2024· 14:20 IST

Stock Market LIVE Updates | Hindustan Aeronautics Q3 net profit rises 9%, revenue up 7%

Defence equipment manufacturer Hindustan Aeronautics reported a near 9 percent on year rise in its net profit to Rs 1,253.30 crore in the December quarter. Its revenue rose 7 percent on year to Rs 6,061 crore as against Rs 5,666 in the year-ago period.

-330

February 12, 2024· 14:14 IST

Stock Market LIVE Updates | PB Fintech gains 2% after Jefferies initiates coverage with 'buy' tag

Shares of PB Fintech Limited traded 2 percent higher to Rs 950 in afternoon trade on February 12 after global brokerage firm Jefferies initiated coverage with a 'buy' rating on the counter citing multiple levers for growth.

The firm has also assigned a target price of Rs 1,150, implying an upside growth potential of 23 percent on the exchanges.

"Large digital intermediaries offer superior play on Indian insurance and Policybazaar could gain market share from other channels," Jefferies stated in the report. It added that Paisabazaar's growth will moderate after the Reserve Bank of India's (RBI) measures.

-330

February 12, 2024· 14:09 IST

Stock Market LIVE Updates | Zomato surges 6% to new 52-week high; brokerages upbeat on Q3 result

Shares of Zomato soared 6 percent in the morning trade on February 12 to hit a new 52-week high of Rs 158.80 on the National Stock Exchange (NSE). The surge pushed the scrip closer to its all-time high of Rs 169, which it hit on November 16, 2021.

The rally comes after the Gurugram-based food aggregator consolidated net profit of Rs 138 crore for Q3FY24, as against a net loss of Rs 347 crore in the year-ago fiscal. Zomato's contribution margin — a key profit metric — expanded to 7.1 percent in the December quarter after it introduced of a platform fee for food deliveries.

-330

February 12, 2024· 14:04 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| BSE Auto | 44866.94 0.23 | 6.25 0.12 | 5.42 47.66 |

| BSE CAP GOODS | 54676.07 -1.4 | -1.74 -1.65 | -3.08 58.23 |

| BSE FMCG | 19278.37 -0.88 | -5.81 -2.33 | -5.37 17.48 |

| BSE Metal | 27316.76 -1.57 | 1.21 -1.02 | 3.30 36.13 |

| BSE Oil & Gas | 27618.90 -1.47 | 19.97 0.31 | 14.01 57.23 |

| BSE REALTY | 6767.19 -2.21 | 9.38 -0.75 | -2.86 103.43 |

| BSE IT | 38693.00 0.61 | 7.45 2.05 | 4.24 25.90 |

| BSE HEALTHCARE | 35127.77 0.56 | 11.34 2.72 | 7.63 56.53 |

| BSE POWER | 6386.67 -1.54 | 9.76 -1.74 | 4.99 82.44 |

| BSE Cons Durables | 49540.95 -0.31 | -0.92 0.34 | -3.46 28.21 |

-330

February 12, 2024· 14:04 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| SENSEX | 71158.37 -0.61 | -1.50 -0.80 | -1.94 17.26 |

| BSE 200 | 9779.19 -0.79 | 1.45 -0.12 | 0.08 28.56 |

| BSE MIDCAP | 38903.26 -1.68 | 5.60 -0.09 | 2.71 56.30 |

| BSE SMALLCAP | 44654.20 -2.18 | 4.64 -2.38 | 0.34 57.99 |

| BSE BANKEX | 50809.88 -1.78 | -6.56 -1.89 | -5.55 8.10 |

-330

February 12, 2024· 13:59 IST

-330

February 12, 2024· 13:59 IST

| Company | Price at 13:00 | Price at 13:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Kirl Electric | 135.70 | 126.75 | -8.95 82.34k |

| JHS Svendgaard | 30.00 | 28.30 | -1.70 44.95k |

| Uniinfo Telecom | 38.70 | 36.65 | -2.05 2.19k |

| S J Logistics | 260.00 | 248.55 | -11.45 - |

| Crop Life Sci. | 46.00 | 44.00 | -2.00 571 |

| Ramky Infra | 606.95 | 582.60 | -24.35 197.31k |

| Shemaroo Ent | 163.20 | 156.80 | -6.40 36.25k |

| BARTRONICS IND | 27.60 | 26.65 | -0.95 22.14k |

| Loyal Textiles | 674.80 | 652.15 | -22.65 10 |

| Windsor | 79.75 | 77.10 | -2.65 48.08k |

-330

February 12, 2024· 13:58 IST

| Company | Price at 13:00 | Price at 13:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| DUGLOBAL | 59.00 | 66.05 | 7.05 8.83k |

| Lagnam Spintex | 115.10 | 127.55 | 12.45 3.16k |

| Patel Eng | 66.65 | 71.65 | 5.00 621.97k |

| Arihant Academy | 149.90 | 159.00 | 9.10 23.11k |

| IFGL Refractory | 542.30 | 570.20 | 27.90 32.87k |

| Nandan Denim | 33.45 | 35.10 | 1.65 34.68k |

| Apeejay Surrend | 196.15 | 205.70 | 9.55 1.99m |

| Saakshi Medtech | 210.00 | 218.85 | 8.85 4.55k |

| Tilaknagar Ind | 243.10 | 253.15 | 10.05 42.97k |

| MEP Infra | 20.55 | 21.35 | 0.80 131.21k |

-330

February 12, 2024· 13:56 IST

Sensex Today | BCL Industries Q3 Results:

Revenue up 16.5 percent at Rs 622.2 crore versus Rs 534 crore and profit up 31 percent at Rs 30.6 crore versus Rs 23.4 crore, YoY.

-330

February 12, 2024· 13:54 IST

Sensex Today | Nifty Pharma index up 0.5 percent supported by Zydus Life, Dr Reddy's Laboratories, Divis Laboratories

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Zydus Life | 859.80 | 6.8 | 5.77m |

| Dr Reddys Labs | 6,378.00 | 3.61 | 578.53k |

| Divis Labs | 3,754.20 | 2.79 | 1.11m |

| Aurobindo Pharm | 1,011.80 | 0.86 | 5.74m |

| Sun Pharma | 1,534.95 | 0.01 | 3.22m |

-330

February 12, 2024· 13:52 IST

Stock Market LIVE Updates | CLSA View On Tata Power Company

-Sell call, target Rs 249 per share

-Weak Q3 due to net long coal position & weak RE IPP profitability

-Key message from Q3 was that Indonesian coal saw a big PAT decline

-Indonesian coal was a key driver of profit for past two years

-PAT (Ex-Treasury) also fell for renewable independent power producers

-Renewables IPP hit by lower PLF but EPC did well

-Stock remains expensive at a 36x CL25CL PE

-330

February 12, 2024· 13:50 IST

Sensex Today | BSE Bank index down 1.7 percent dragged by IDFC First Bank, Kotak Mahindra Bank, IndusInd Bank

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| IDFC First Bank | 79.11 | -2.67 | 3.05m |

| IndusInd Bank | 1,447.50 | -2.56 | 101.10k |

| Kotak Mahindra | 1,700.55 | -2.39 | 107.47k |

| AU Small Financ | 589.60 | -2.32 | 30.84k |

| ICICI Bank | 989.85 | -2.07 | 448.89k |

| SBI | 711.00 | -1.83 | 713.88k |

| Bank of Baroda | 258.30 | -1.66 | 919.85k |

| Axis Bank | 1,039.60 | -1.09 | 120.85k |

| HDFC Bank | 1,387.95 | -1.09 | 578.50k |

| Federal Bank | 146.60 | -0.51 | 844.86k |

-330

February 12, 2024· 13:48 IST

Sensex Today | Rupak De, Senior technical analyst at LKP Securities

Nifty declined after a consolidation breakdown on the hourly chart, indicating an increase in pessimism. The daily chart shows the index forming a lower top, signaling diminishing bullish sentiment.

The momentum indicator aligns with this bearish outlook. Sentiment is expected to stay weak as long as Nifty remains below 21850. On the downside, support is situated at 21500.

-330

February 12, 2024· 13:45 IST

Stock Market LIVE Updates | Bharat Forge Q3 earnings:

Net profit rose 30.7 percent at Rs 377.8 crore versus Rs 289.1 crore and revenue up 16 percent at Rs 2,263.3 crore versus Rs 1,952.1 crore, YoY.

The company board accorded in-principal approval for raising funds not exceeding Rs 5,000,000,000 through term loan, non-convertible debentures or any other debt instruments and delegated authority to Investment Committee – Strategic Business of the company in this regard.

-330

February 12, 2024· 13:44 IST

Stock Market LIVE Updates | Patel Engineering Q3 Results:

Net profit at Rs 68.2 crore versus Rs 17.2 crore and revenue up 11.1 percent at Rs 1,061 crore versus Rs 954.6 crore, YoY.

-330

February 12, 2024· 13:39 IST

Stock Market LIVE Updates | Goldman Sachs View On Divis Laboratories

-Neutral call, target Rs 3,670 per share

-Growth improves but margins under pressure

-Margins (ex-other income) came in weaker at 26.4 percent

-Margin came weaker due to pricing pressure on generics & higher logistics, insurance costs

-Company reiterated its long-term double digit growth outlook predicated on its key growth drivers

-Commercialisation of Kakinada phase 1 from Q2FY25, freeing up capacity at unit 1&2

-Scope for market share gains in molecules where global share is 25 percent to 30 percent

-Ramp-up following ongoing investments in Peptides, Sartans & Contrast media

-Investments in customs synthesis biz backed by strong order visibility, remains firmly intact

-330

February 12, 2024· 13:30 IST

Stock Market LIVE Updates | Sakhti Sugars Q3 Results:

Net loss at Rs 42.7 crore versus profit of Rs 19.5 crore and revenue down 18.8 percent at Rs 151 crore versus Rs 186 crore, YoY.

-330

February 12, 2024· 13:29 IST

Stock Market LIVE Updates | HSBC View On Interglobe Aviation

-Buy call, target raised to Rs 3,770 per share

-Q3FY24 net profit significantly above consensus

-Q3FY24 above estimate partly due to potential compensation from OEMs, costs in-line

-Q4 capacity to grow 12 percent YoY, implying a sequential decline of 7 percent

-No concrete guidance on yield

-For FY24 & FY25, now forecast net profit of Rs 7,000 crore & Rs 6,900 crore respectively

-330

February 12, 2024· 13:26 IST

-330

February 12, 2024· 13:20 IST

| Company | 52-Week Low | Day’s Low | CMP |

|---|---|---|---|

| Orient Electric | 212.00 | 212.00 | 202.80 |

| GMM Pfaudler | 1407.15 | 1407.15 | 1,349.10 |

| Vinati Organics | 1654.20 | 1654.20 | 1,609.35 |

| Deepak Fert | 517.45 | 517.45 | 504.70 |

| Vedant Fashions | 980.55 | 980.55 | 963.50 |

-330

February 12, 2024· 13:20 IST

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| Global Health | 1446.75 | 1446.75 | 1,373.75 |

| Star Cement | 219.45 | 219.45 | 210.50 |

| Zydus Life | 862.85 | 862.85 | 860.60 |

| JBM Auto | 2207.95 | 2207.95 | 2,079.65 |

| Zomato | 158.70 | 158.70 | 154.60 |

| HCL Tech | 1685.00 | 1685.00 | 1,676.45 |

| Aarti Ind | 701.90 | 701.90 | 682.00 |

| Apollo Hospital | 6675.05 | 6675.05 | 6,572.85 |

| Dr Reddys Labs | 6332.15 | 6332.15 | 6,319.75 |

| JSW Energy | 521.40 | 521.40 | 508.00 |

-330

February 12, 2024· 13:18 IST

Stock Market LIVE Updates | Goldman Sachs View On Hero MotoCorp

-Sell call, target Rs 3,730 per share

-Q3 in-line, seeking market share pickup in ICE + EV

-Company expects FY25 industry revenue growth to be in the double-digit range

-ICE 2W portfolio is presently at 16 percent EBITDA margin

-ICE 2W portfolio is enabling 125 to 150 bps of annualised EV business investment

-330

February 12, 2024· 13:15 IST

Stock Market LIVE Updates | Kiri Industries Q3 results:

Net profit at Rs 126.4 versus Rs 54 crore and revenue up 7.3 percent at Rs 218.7 crore versus Rs 203.8 crore, YoY.

-330

February 12, 2024· 13:13 IST

-330

February 12, 2024· 13:07 IST

Sensex Today | BSE Information Technology index up 0.5 percent in the week market led by Control Print, Coforge, HCL Technologies:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Control Print | 882.55 | 4.34 | 2.37k |

| COFORGE LTD. | 6,677.10 | 2.72 | 5.74k |

| HCL Tech | 1,675.80 | 2.68 | 126.93k |

| Wipro | 503.30 | 2.65 | 690.47k |

| MphasiS | 2,635.05 | 1.85 | 6.04k |

| LTIMindtree | 5,525.00 | 1.34 | 6.82k |

| Infosys | 1,685.65 | 0.96 | 208.00k |

| Cigniti Tech | 1,032.05 | 0.56 | 8.10k |

| Latent View | 510.20 | 0.45 | 126.65k |

| Tech Mahindra | 1,315.85 | 0.31 | 46.75k |

-330

February 12, 2024· 13:06 IST

Stock Market LIVE Updates | HSBC View On Escorts Kubota:

-Reduce call, target Rs 2,400 per share

-Management lowers domestic tractor industry growth guidance from flat to negative 6-7 percent for FY24

-Construction equipment growth to slow in Q1FY25 due to elections

-Railways retains momentum on strong order book

-330

February 12, 2024· 13:04 IST

Stock Market LIVE Updates | JP Morgan View On Bandhan Bank

-Overweight call, target cut to Rs 270 per share from Rs 320 per share

-Q3 PAT at Rs 730 crore, RoE at 14 percent was below estimate driven by lower other income & higher provisions

-Gross slippage at 5.2 percent was similar to last quarter, partly driven by CBS upgrade in Oct’23

-Cut F24/25 EPS by 12/10 percent

-Expect high teen RoEs of 17 percent in F25/26 with 25 percent/18 percent EPS growth in F25/26

-Key catalysts over next 6 months will be news around release of claims under government guarantees

-Release of claims under government guarantees is a key for driving net NPL to under 1 percent

-News around extension of current CEO Mr Ghosh in Q1FYF25 will also be key catalysts

-330

February 12, 2024· 13:00 IST

Sensex Today | Market at 1 PM

The Sensex was down 493.67 points or 0.69 percent at 71,101.82, and the Nifty was down 154.50 points or 0.71 percent at 21,628. About 817 shares advanced, 2545 shares declined, and 65 shares unchanged.

-330

February 12, 2024· 12:59 IST

Sensex Today | Nifty Bank index down 2 percent dragged by Bandhan Bank, PNB, Kotak Mahindra Bank

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bandhan Bank | 201.40 | -6.85 | 35.34m |

| PNB | 119.70 | -3.39 | 44.99m |

| Kotak Mahindra | 1,695.70 | -2.68 | 2.18m |

| IDFC First Bank | 79.25 | -2.46 | 21.04m |

| IndusInd Bank | 1,451.20 | -2.36 | 1.13m |

| ICICI Bank | 989.10 | -2.14 | 4.01m |

| SBI | 712.25 | -1.79 | 14.47m |

| AU Small Financ | 594.00 | -1.64 | 2.55m |

| Bank of Baroda | 259.40 | -1.56 | 17.98m |

| HDFC Bank | 1,386.15 | -1.24 | 8.60m |

-330

February 12, 2024· 12:59 IST

| Company | Price at 12:00 | Price at 12:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Arihant Academy | 170.20 | 150.05 | -20.15 124 |

| Rachana Infra | 82.75 | 78.10 | -4.65 4.69k |

| Oneclick Logi. | 92.50 | 88.00 | -4.50 - |

| Cera Sanitary | 8,028.90 | 7,653.80 | -375.10 360 |

| On Door Concept | 336.20 | 321.00 | -15.20 - |

| Nitiraj Enginee | 168.85 | 161.60 | -7.25 370 |

| AKI India | 29.10 | 28.00 | -1.10 2.29k |

| Shah Alloys | 71.00 | 68.50 | -2.50 482 |

| Ameya Precision | 58.00 | 56.00 | -2.00 3.02k |

| Ganges Securiti | 133.75 | 129.15 | -4.60 346 |

-330

February 12, 2024· 12:58 IST

| Company | Price at 12:00 | Price at 12:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Urban Enviro Wa | 303.00 | 320.00 | 17.00 7.65k |

| Ramky Infra | 577.15 | 608.30 | 31.15 328.21k |

| Network People | 1,300.00 | 1,350.95 | 50.95 2.70k |

| Kandarp Digi | 28.50 | 29.50 | 1.00 7.20k |

| BLB | 35.05 | 36.25 | 1.20 30.53k |

| Nakoda Group | 56.55 | 58.45 | 1.90 8.73k |

| Magnum Ventures | 61.25 | 63.25 | 2.00 23.68k |

| Apeejay Surrend | 185.00 | 191.00 | 6.00 7.10m |

| Mitcon Cons | 143.30 | 147.85 | 4.55 3.77k |

| JSW Holdings | 6,476.05 | 6,678.10 | 202.05 12.85k |

-330

February 12, 2024· 12:57 IST

-330

February 12, 2024· 12:55 IST

Sensex Today | Nifty PSU Bank index down 3 percent dragged by IOB, Central Bank of India, Punjab and Sind Bank

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| IOB | 64.45 | -9.35 | 37.19m |

| Central Bank | 62.15 | -8.6 | 32.80m |

| Punjab & Sind | 61.75 | -7.28 | 4.54m |

| Bank of Mah | 57.15 | -7.15 | 40.07m |

| UCO Bank | 56.55 | -6.61 | 28.01m |

| Bank of India | 130.65 | -4.81 | 11.75m |

| Indian Bank | 506.50 | -4.73 | 1.31m |

| Union Bank | 142.55 | -4.23 | 14.27m |

| JK Bank | 139.05 | -3.44 | 3.23m |

| PNB | 119.90 | -3.23 | 44.35m |

-330

February 12, 2024· 12:54 IST

Stock Market LIVE Updates | EMS Q3 Results:

Net profit up 26.4 percent at Rs 37.3 crore versus Rs 29.5 crore and revenue up 32 percent at Rs 200 crore versus Rs 151.4 crore, YoY.

-330

February 12, 2024· 12:52 IST

Stock Market LIVE Updates | Bajaj Healthcare posts Q3 net loss at Rs 2.2 crore

Bajaj Healthcare has posted net loss at Rs 2.2 crore for third quarter of FY24, against profit of Rs 11.05 crore in same period last year. Revenue from operations fell by 18.1% YoY to Rs 108.6 crore for the quarter. Meanwhile, Rupesh Nikam has resigned as Chief Financial Officer (CFO), and Whole Time Director of the company.

-330

February 12, 2024· 12:48 IST

-330

February 12, 2024· 12:46 IST

Sensex Today | BSE Capital Goods index down 1 percent dragged by Rail Vikas Nigam, Finolex Cables, Suzlon Energy

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Rail Vikas | 237.75 | -8.28 | 1.62m |

| Suzlon Energy | 45.02 | -4.98 | 11.75m |

| Finolex Cables | 1,005.25 | -4.97 | 13.69k |

| BHEL | 219.20 | -3.67 | 2.09m |

| GMR Airports | 85.74 | -3.52 | 1.71m |

| Praj Industries | 485.00 | -2.87 | 30.06k |

| Bharat Elec | 176.30 | -2.38 | 491.28k |

| Hindustan Aeron | 2,901.40 | -2.17 | 154.20k |

| KPIL | 861.10 | -1.98 | 10.02k |

| Sona BLW | 606.50 | -1.89 | 21.54k |

-330

February 12, 2024· 12:44 IST

Stock Market LIVE Updates | Cera Sanitary Q3 Earnings:

Net profit down 9.6% at Rs 51 crore versus Rs 56.4 crore and revenue down 4.1% at Rs 439 crore versus Rs 458 crore, YoY.

-330

February 12, 2024· 12:42 IST

Stock Market LIVE Updates | CLSA View On Lupin

-Sell call, target raised to Rs 1,420 per share

-Growth from new launches likely to be offset by erosion in key assets

-Q3FY24 beat on revenue and margin

-US business growth dependent on new launch pipeline

-India business showed chronic portfolio continues to drive double-digit growth

-330

February 12, 2024· 12:40 IST

Stock Market LIVE Updates | EaseMyTrip to set up a 5-star hotel in Ayodhya; shares fall 7% from day’s high

Shares of online travel aggregator EaseMyTrip fell seven percent from its intraday high on February 12. The firm will establish a new 5-star hotel in Ayodhya, near the Ram Mandir temple.

In early trade, shares surged 5 percent but pared their gains to fall 2 percent in the red.

EaseMyTrip received an in-principle approval from its board for a joint-venture. The firm will commit Rs 100 crore as one of the joint venture partners, in Jeewani Hospitality, the entity super heading the project under incorporation.

In a filing with the exchanges, the firm said, “This investment will represent 50 percent of the total paid-up share capital of the JV Company on a fully diluted basis through equity swap, once finalized.”

-330

February 12, 2024· 12:38 IST

-330

February 12, 2024· 12:37 IST

Stock Market LIVE Updates | Morgan Stanley View On MCX

-Underweight call, target Rs 2,070 per share

-Q3 PAT and EBITDA bases were small, absolute deviations were low versus estimate

-Numbers missed consensus

-Operating revenues were higher than estimate, but so were operating expenses

-An important point of focus on call, will be understanding recurring costs better

-330

February 12, 2024· 12:34 IST

-330

February 12, 2024· 12:32 IST

Stock Market LIVE Updates | PSU stocks under pressure

-330

February 12, 2024· 12:30 IST

Stock Market LIVE Updates | Anup Engineering Q3 Results:

Net profit up 44.3% at Rs 20.2 crore versus Rs 14 crore and revenue up 12.2% at Rs 128.4 crore versus Rs 114.4 crore, YoY.

-330

February 12, 2024· 12:30 IST

-330

February 12, 2024· 12:27 IST

Stock Market LIVE Updates | CLSA View On Hero MotoCorp

-Outperform call, target raised to Rs 5,246 per share

-Company to gain market share in 125cc+ segment with launches

-Q3 gross margin expands sequentially

-Management guided for double-digit growth for the industry

-EV business loss-making

-330

February 12, 2024· 12:24 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| SENSEX | 71226.00 -0.52 | -1.40 -0.70 | -1.85 17.37 |

| BSE 200 | 9778.64 -0.8 | 1.45 -0.13 | 0.08 28.55 |

| BSE MIDCAP | 38841.03 -1.84 | 5.43 -0.25 | 2.55 56.05 |

| BSE SMALLCAP | 44617.09 -2.26 | 4.55 -2.46 | 0.25 57.86 |

| BSE BANKEX | 51150.24 -1.13 | -5.94 -1.23 | -4.92 8.83 |

-330

February 12, 2024· 12:21 IST

Stock Market LIVE Updates | Jefferies View On Alkem Laboratories

-Underperform call, target raised to Rs 4,470 per share

-Q3 beat estimates mainly due to lower opex

-Management lowered R&D spend sharply

-Management doesn't expect any major investments in India yet

-Management indicated annual margin improvement of 100 bps

-Believe margin improve is not exciting with stock trading at 25x FY26 PE valuations

-Sharply lowered tax rate guidance leads to 13-14 percent increase in FY25-26 EPS

-330

February 12, 2024· 12:19 IST

Sensex Today | BSE Midcap index down 2 percent dragged by SJVN, NHPC, New India Assurance Company

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| SJVN | 112.50 | -19.99 | 15.11m |

| NHPC | 86.35 | -10.29 | 23.44m |

| New India Assur | 261.80 | -10.02 | 428.70k |

| IOB | 64.41 | -9.42 | 5.94m |

| Oil India | 480.25 | -6.83 | 167.20k |

| UCO Bank | 56.78 | -6.24 | 4.96m |

| IDBI Bank | 83.94 | -5.64 | 2.02m |

| SAIL | 126.40 | -5.42 | 3.21m |

| REC | 459.55 | -4.78 | 1.06m |

| Bank of India | 131.05 | -4.52 | 1.31m |

-330

February 12, 2024· 12:10 IST

Stock Market LIVE Updates | Jefferies View On PB Fintech

-Initiate buy call, target Rs 1,150 per share

-Digital brokers are gaining from rising insurance penetration, customer shift to online channels

-Company should witness 30 percent CAGR in premiums over FY25-27

-Aided by strong operations leverage in its renewal book, deliver 5x EBITDA growth

-Risks are from regulations and emergence of strong competitors

-330

February 12, 2024· 12:07 IST

Stock Market LIVE Updates | IFCI posts Q3 net loss at Rs 10 crore, revenue surges 39%

IFCI has posted net loss at Rs 10.06 crore for third quarter of FY24, against profit of Rs 67.4 crore in same period last year. Revenue from operations increased by 39.3% YoY to Rs 214.7 crore for the quarter.

-330

February 12, 2024· 12:06 IST

Stock Market LIVE Updates | Wipro share price gains 3 percent

-330

February 12, 2024· 12:02 IST

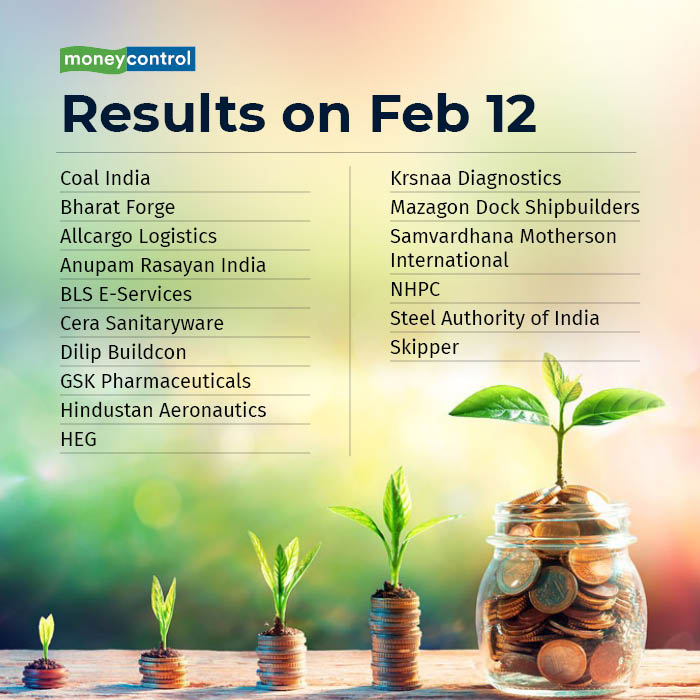

Earnings Today

-330

February 12, 2024· 12:00 IST

Sensex Today | Market at 12 PM

The Sensex was down 246.24 points or 0.34 percent at 71,349.25, and the Nifty was down 95.50 points or 0.44 percent at 21,687. About 858 shares advanced, 2462 shares declined, and 84 shares unchanged.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Wipro | 509.80 | 3.95 | 16.48m |

| Apollo Hospital | 6,644.95 | 3.22 | 441.28k |

| HCL Tech | 1,682.00 | 3.15 | 2.78m |

| Divis Labs | 3,756.90 | 2.86 | 959.86k |

| Dr Reddys Labs | 6,290.00 | 2.18 | 356.31k |

| LTIMindtree | 5,533.10 | 1.46 | 155.71k |

| Infosys | 1,688.50 | 1.15 | 1.72m |

| Tech Mahindra | 1,323.90 | 0.98 | 490.07k |

| Bajaj Auto | 7,818.60 | 0.43 | 126.18k |

| M&M | 1,653.10 | 0.41 | 517.68k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Coal India | 432.10 | -5.28 | 11.33m |

| Hero Motocorp | 4,656.00 | -5.15 | 868.86k |

| BPCL | 587.05 | -4.44 | 4.89m |

| ONGC | 258.40 | -3.42 | 17.18m |

| NTPC | 315.60 | -2.86 | 6.28m |

| Tata Steel | 138.75 | -1.8 | 17.63m |

| HDFC Life | 574.90 | -1.56 | 1.35m |

| SBI | 714.30 | -1.51 | 12.39m |

| Kotak Mahindra | 1,718.95 | -1.35 | 1.55m |

| Adani Ports | 1,255.10 | -1.29 | 1.29m |

-330

February 12, 2024· 11:59 IST

| Company | Price at 11:00 | Price at 11:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Lakshmi Elec | 1,400.00 | 1,180.00 | -220.00 227 |

| Ravi Leela Gran | 39.74 | 35.01 | -4.73 169 |

| First Custodian | 57.76 | 52.28 | -5.48 204 |

| Pradhin | 49.18 | 44.57 | -4.61 2.84k |

| Sunil Ind | 67.00 | 60.79 | -6.21 1000 |

| Marg Techno Pro | 35.00 | 31.93 | -3.07 1.74k |

| Digjam | 97.99 | 90.00 | -7.99 7 |

| Davangere Sugar | 96.04 | 88.40 | -7.64 14.37k |

| IND Renewable | 23.50 | 21.70 | -1.80 4.87k |

| Globe Commercia | 25.24 | 23.32 | -1.92 9.81k |

-330

February 12, 2024· 11:59 IST

| Company | Price at 11:00 | Price at 11:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Nutech Global | 25.40 | 29.00 | 3.60 489 |

| NPR Finance | 20.93 | 23.08 | 2.15 2.41k |

| Samor Reality | 114.00 | 124.95 | 10.95 100 |

| Iykot Hitech | 32.12 | 34.97 | 2.85 5.73k |

| Longview Tea | 32.75 | 35.49 | 2.74 4.12k |

| Hindprakash Ind | 147.70 | 158.60 | 10.90 254 |

| Meera Industrie | 50.01 | 53.67 | 3.66 12.87k |

| JSW Holdings | 6,067.20 | 6,482.90 | 415.70 306 |

| Maxheights | 63.65 | 68.00 | 4.35 1.25k |

| TandI Global | 285.00 | 302.85 | 17.85 782 |

-330

February 12, 2024· 11:58 IST

Stock Market LIVE Updates | Cello World Q3 profit rises 5% QoQ to Rs 907 crore

Cello World has reported consolidated net profit at Rs 906.6 crore for quarter ended December FY24, rising 4.7% over previous quarter. Revenue from operations increased by 7.8% QoQ to Rs 5,270.5 crore for the quarter.

-330

February 12, 2024· 11:57 IST

Stock Market LIVE Updates | Advanced Enzyme Technologies Q3 profit surges 52% YoY to Rs 42.5 crore

Advanced Enzyme Technologies has recorded consolidated net profit at Rs 42.5 crore for third quarter of FY24, growing 52% over a year-ago period, backed by strong operating numbers. Revenue from operations grew by 13% YoY to Rs 160.9 crore for the quarter.

-330

February 12, 2024· 11:56 IST

| Company | CMP Chg(%) | Today Vol 5D Avg Vol | Vol Chg(%) |

|---|---|---|---|

| Hindustan Foods | 553.15 2.09% | 479.89k 6,498.40 | 7,285.00 |

| Keynote Finance | 208.05 19.98% | 80.23k 6,225.60 | 1,189.00 |

| Finolex Ind | 213.00 -2.65% | 3.06m 255,992.00 | 1,094.00 |

| Anuh Pharma | 203.80 18.66% | 568.41k 49,501.60 | 1,048.00 |

| Caspian | 39.28 -2.48% | 411.83k 36,693.00 | 1,022.00 |

| Marg Techno Pro | 31.93 -5% | 12.51k 1,153.00 | 985.00 |

| Amrutanjan Heal | 651.00 11.11% | 32.18k 3,036.20 | 960.00 |

| Mega Nirman | 14.86 4.94% | 11.36k 1,087.80 | 944.00 |

| Jubilant Ind | 673.65 12.02% | 10.73k 1,032.80 | 938.00 |

| Palred Tech | 178.75 -12.31% | 57.20k 5,701.60 | 903.00 |

-330

February 12, 2024· 11:53 IST

Stock Market LIVE Updates | PI Industries Q3 profit jumps 27.5% YoY to Rs 449 crore

PI Industries has registered a 27.5% on-year growth in consolidated net profit at Rs 448.6 crore for October-December period of FY24, with healthy growth in topline and operating numbers. Revenue from operations grew by 17.6% YoY to Rs 1,897.5 crore for the quarter.

-330

February 12, 2024· 11:51 IST

Stock Market LIVE Updates | NHPC down 9 percent ahead of earnings:

-330

February 12, 2024· 11:45 IST

Stock Market LIVE Updates | Gensol Engineering gains 3% on wining PLI bid for electrolyser plant with Matrix Gas

Shares of Gensol Engineering traded over 3 percent higher on February 12.The sustainable energy solutions provider, together with Matrix Gas & Renewables Ltd, a green hydrogen infrastructure developer and natural gas aggregator, announced on bourses the grant of manufacturing capacity for an advanced electrolyser plant under the auspices of the Sustainable Hydrogen Innovation and Green Hydrogen Technologies (SIGHT) programme.

This initiative signifies a pivotal step forward in India's commitment to green hydrogen as a cornerstone of its decarbonisation strategy and net-zero emission commitment.

The filing further states that the awarded project, with a manufacturing capacity of 63 MW per annum, is strategically positioned to contribute significantly to India’s ambitious goal of producing 5 million metric tonnes of green hydrogen annually by 2030.

-330

February 12, 2024· 11:40 IST

Stock Market LIVE Updates | MSCI rejig tomorrow: 5 PSUs likely to be added to standard index, India could see $1 billion inflow

Index provider Morgan Stanley Capital International (MSCI) will announce the results of its quarterly review on February 13 and public sector companies are ruling the list of probable inclusions to MSCI Standard index, said Nuvama Alternative & Quantitative Research.

NMDC, Punjab National Bank, BHEL, Union Bank of India, NHPC are likely to be added to MSCI Standard index, as per the calculations done by the firm. This will bring inflows worth $186 million, $180 million, $156 million, $140 million and $223 million, respectively, to these stocks. Read More

-330

February 12, 2024· 11:35 IST

Stock Market LIVE Updates | SpiceJet likely to reduce employee headcount by 10-15% to save costs, CNBC-TV18 reports

Sources to CNBC-TV18

Spicejet likely to reduce employee headcount by 10-15%

Spicejet currently has an employee headcount between 9,000-9,500

Spicejet is aiming to reduce its fixed cost

Spicejet is aiming to save Rs 100 cr annually from this exercise

Spicejet currently operates 40 aircraft out of which 10 are wet-leased

Spicejet likely to take more measures to reduce cost in coming months