Closing Bell: Nifty above 21,900, Sensex gains 455 pts; oil & gas stocks rally

-330

February 06, 2024· 16:21 IST

Indian benchmark indices erased previous session losses and ended higher with Nifty above 21,900 on February 6. At close, the Sensex was up 454.67 points or 0.63 percent at 72,186.09, and the Nifty was up 157.70 points or 0.72 percent at 21,929.40.

We wrap up today's edition of the Moneycontrol live market blog, and will be back tomorrow morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices/ for all the global market action.

-330

February 06, 2024· 16:18 IST

-330

February 06, 2024· 16:17 IST

Rupak De, Senior Technical Analyst, LKP Securities

The Nifty exhibited a predominantly sideways trend throughout the day, with traders expressing uncertainty regarding the market's direction. A range-bound movement is expected to persist until a breakout occurs on either side. A decisive upward move beyond 21950 has the potential to propel the Nifty towards 22200. Conversely, a decline below 21850 could instigate a correction towards the 21700 level.

-330

February 06, 2024· 16:16 IST

Prashanth Tapse, Senior VP (Research), Mehta Equities

After a weak start, markets quickly rebounded and maintained optimism till the close as buying gained momentum towards the fag end in IT, auto, metals and oil & gas stocks. Despite overnight weakness in US stocks and mixed Asian indices, local investors resorted to buying after yesterday's subdued close. Following the recovery, Nifty will now again aim to revisit its all-time-high at 22127 mark, while the index has a make-or-break support at 21557 mark.

-330

February 06, 2024· 16:13 IST

Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities

The Bank Nifty index experienced a subdued trading session one day ahead of the weekly expiry, with an ongoing struggle between bears and bulls. The lack of a clear trend indicates that a breakout is awaited to determine the market direction. The support is positioned at 45500, while the immediate hurdle lies at 46000. A successful break above 46000 is anticipated to propel the index towards 46500 on the upside.

-330

February 06, 2024· 16:10 IST

Ajit Mishra, SVP - Technical Research, Religare Broking

Markets reversed Monday’s decline and gained nearly a percent, in continuation to the prevailing consolidation range. After the flat start, the Nifty gradually inched higher as the day progressed and finally settled closer to the day’s high. Most sectors traded in sync with the move wherein IT, metal and auto were among the top performers while banking and FMCG remained subdued. The buoyancy returned to the broader indices after a breather and both midcap and smallcap gained in the range of 0.8%-1.2%.

All key sectors, barring banking, are attracting buying on a rotational basis and that is helping the index to maintain a positive tone amid consolidation. The recent price action indicates the prevailing tone to continue and traders should maintain their focus on stock selection. We reiterate our preference for metal, IT, auto and pharma for long trades and suggest staying selective in the others.

-330

February 06, 2024· 15:59 IST

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas

The Nifty opened on a positive note and during the day it traded with a positive bias to close the day up ~165 points. On the daily charts we can observe that the Nifty has been broadly trading within the range in an upward sloping channel. Until the recent swing lows of 21730 is not breached on the downside we can expect the upmove to continue towards 22000 – 22130. The daily and the hourly momentum indicator has a positive crossover which is a a buy signal. Thus, both price and momentum indicator are suggesting towards continuation of the positive momentum, however, considering the recent sharp reversals from the upper boundary (22000) one needs to be cautious on the long side.

Stock specific action and sector rotation is likely to continue during this period of consolidation. Key support levels are 21730 – 21700 while immediate hurdle zone is placed at 22100 - 22130.

Bank Nifty closed in the negative however, seems to be oversold. The positive crossover on the hourly time frame chart suggests that the bank nifty is poised for a pullback after the recent correction. On the upside, we expect the Bank Nifty to retrace till 46500 – 46800. Crucial support is placed at 45370

-330

February 06, 2024· 15:57 IST

Mandar Bhojane, Research Analyst at Choice Broking:

On February 6, Indian benchmark indices rebounded from the previous session's losses, closing higher with Nifty surpassing 21,900 and Sensex gaining 480 points. Both BSE midcap and smallcap indices recorded a 1 percent increase. Despite declines in the bank, FMCG, and power sectors, all other sectoral indices finished in positive territory. Auto, oil & gas, capital goods, healthcare, metal, and IT sectors saw gains ranging from 1 to 3 percent.

A technical analysis of the daily chart revealed a flat opening for the Nifty, followed by a sustained upward movement, forming a hammer candlestick pattern with substantial volume. This pattern suggests a bullish momentum in the index. There is an anticipation that the Nifty could reach an all-time high in the next few sessions, especially as the earnings season progresses into the second week.

Currently, the 21,700 level serves as immediate support for the Nifty. On the upside, resistance levels are identified at 20,200 and 20,500. The overall chart pattern, coupled with positive market breadth and sectoral performance, indicates a favorable outlook for the Nifty, with the potential for further upward movement.

-330

February 06, 2024· 15:39 IST

FSN E-Commerce Ventures (Nykaa) Q3 results:

Net profit rose 97.6% at Rs 16.2 crore versus Rs 8.2 crore and revenue rose 22.3% at Rs 1,788.8 crore versus Rs 1,462.9 crore, YoY.

-330

February 06, 2024· 15:37 IST

Aditya Gaggar Director of Progressive Shares

The markets began the session on a positive note and as the day progressed, the Index extended its journey towards the north to settle at 21,929.40 with gains of 157.70 points.

Based on sectoral performance, IT and Auto were the top performers gaining 2.92% & 1.59% respectively. Buying traction remained in the Metal segment while both Bank Nifty and PSU banking indices experienced a round of correction.

On the daily chart, the Index has formed a bullish candle with the downside being protected at 21,700 while to resume its primary uptrend, it has to breach its hurdle of 22,100.

-330

February 06, 2024· 15:34 IST

Vinod Nair, Head of Research, Geojit Financial Services

The market exhibited a positive breadth, registering moderate gains, with investors showing reluctance to significantly trim their positions ahead of the RBI MPC meeting. Expectations for a dovish monetary policy buoyed sentiment in the bond market. Meanwhile, Oil & Gas stocks held a modest advance as the market weighed down geopolitical risks in the Middle East and awaited improvements in the weekly US crude inventory today.

-330

February 06, 2024· 15:33 IST

Rupee Close:

Indian rupee ended flat at 83.05 per dollar on Tuesday versus previous close of 83.06.

-330

February 06, 2024· 15:30 IST

Market Close:

Indian benchmark indices erased previous session losses and ended higher with Nifty above 21,900 on February 6.

At close, the Sensex was up 454.67 points or 0.63 percent at 72,186.09, and the Nifty was up 157.70 points or 0.72 percent at 21,929.40. About 1983 shares advanced, 1285 shares declined, and 58 shares unchanged.

BPCL, HDFC Life, HCL Technologies, TCS and Maruti Suzuki were among the top gainers on the Nifty, while losers were Power Grid Corporation, Britannia Industries, IndusInd Bank, ITC and Kotak Mahindra Bank.

Among sectors, except bank, FMCG and power, all other sectoral indices ended in the green with auto, oil & gas, capital goods, healthcare, metal and IT up 1-3 percent each.

BSE midcap and smallcap indices rose 1 percent each.

-330

February 06, 2024· 15:26 IST

Sensex Today | Oil steadies after gains, Gaza ceasefire talks in focus

Oil prices held broadly steady on Tuesday as investors waited to see whether a Middle East trip by top U.S. diplomat Antony Blinken will bring a halt to the Gaza war, which has raised concerns about supplies from the major producing region.

Brent crude futures dipped 8 cents to $77.91 a barrel by 0914 GMT, while U.S. West Texas Intermediate crude futures fell 13 cents to $72.65. Both contracts gained nearly 1% on Monday, rising for the first time in four sessions.

-330

February 06, 2024· 15:24 IST

Stock Market LIVE Updates | Emami Paper Mill Q3 Results:

Net profit at Rs 39.4 crore against Rs 1.4 crore and revenue down 12.6% at Rs 493.5 crore versus Rs 564.9 crore, YoY.

-330

February 06, 2024· 15:23 IST

Stock Market LIVE Updates | Morgan Stanley On Astral

-Equal-weight call, target Rs 1,909 per share

-Concall takeaways include guidance on plumbing- volume guidance of 20 percent in FY24

-Plumbing volume guidance likely to be exceeded

-Expansion in guidance as Q4 expected to remain strong

-Sustainable EBITDA margins at 15-17 percent

-Adhesives guidance shows revenue growth of 15-20 percent in FY24

-In paints, sizeable improvement from Q1FY25 onwards is expected, guidance at a later stage

-Capex of Rs 250-300 crore for FY25, mainly towards pipe segment

-PVC prices likely to bottom by Q4 and to stabilise from Q1FY25 onwards

-330

February 06, 2024· 15:21 IST

Sensex Today | BSE Metal index up 1.6 percent led by Jindal Steel, SAIL, Jindal Stainles

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Jindal Stainles | 619.45 | 2.03 | 140.03k |

| SAIL | 136.80 | 1.18 | 2.14m |

| Jindal Steel | 766.35 | 0.43 | 38.66k |

| Tata Steel | 141.95 | 0.32 | 1.06m |

| Vedanta | 273.70 | 0.13 | 138.50k |

| Coal India | 440.70 | 0.1 | 452.61k |

-330

February 06, 2024· 15:17 IST

Stock Market LIVE Updates | JK Tyre Q3 Results:

Net profit at Rs 220.9 crore versus Rs 65.6 crore and revenue up 2.1% at Rs 3,687.7 crore versus Rs 3,612.9 crore, YoY.

-330

February 06, 2024· 15:16 IST

Stock Market LIVE Updates | HSBC View On Alembic Pharma

-Hold call, target Rs 835 per share

-Q3 operationally in-line led by growth in India & row formulations segments

-New launches and pick-up in supplies from new plants to help US sales

-Expect benefits to accrue gradually

-Pick-up in supplies from new plants key for US sales growth

-330

February 06, 2024· 15:12 IST

Stock Market LIVE Updates | Petronet LNG executes long term contract for purchase of 7.5 MMTPA LNG with QatarEnergy

Petronet LNG has successfully concluded and executed a LNG Sale & Purchase Agreement (LNG SPA) for purchase of around 7.5 MMTPA LNG with QatarEnergy on long-term basis today.

This is pursuant to extension of an existing LNG SPA for LNG supply of around 7.5 MMTPA LNG Sale & Purchase Agreement on FOB basis, signed on 31st July 1999 for supplies till 2028. Under the new agreement, LNG supplies will be made on delivered (DES) basis commencing from 2028 till 2048.

-330

February 06, 2024· 15:09 IST

Sensex Today | Anuj Choudhary Research Analyst, Sharekhan by BNP Paribas

Indian Rupee declined by 0.03% on overnight gains in the US Dollar and surge in US bond yields. Recovery in crude oil prices also weighed on the domestic unit. However, positive domestic markets and fresh foreign inflows cushioned the downside. US Dollar rose to a 11-week high on Monday on hawkish comments by Fed Chair, Jerome Powell in an interview as well as improving service sector. US ISM services PMI expanded to 53.4 in January 2024 versus of 50.6 in the previous month. Both the factors have trimmed rate cut expectations in March as well as in May 2024.

We expect Rupee to trade with a slight negative bias on overall strength in the US Dollar and a rise in crude oil prices. Hawkish Fed speak and geopolitical tension in the Middle East may also pressurise Rupee. However, positive European markets and FII inflows may support Rupee at lower levels. Investors may remain cautious ahead of RBI’s monetary policy decision on Thursday. RBI is expected to keep its monetary policy unchanged. USDINR spot price is expected to trade in a range of Rs 82.80 to Rs 83.30.

-330

February 06, 2024· 15:05 IST

Stock Market LIVE Updates | SBI to acquire entire stake of SBI Capital Markets in SBICAP Ventures

The executive committee of the central board (ECCB) of the State Bank of India has accorded final approval for acquiring 100% stake held by SBI Capital Markets Limited in SBICAP Ventures Limited by State Bank of India.

-330

February 06, 2024· 15:03 IST

Stock Market LIVE Updates | Welspun Corp Q3 Results:

Net profit down 24% at Rs 292 crore versus Rs 385 crore and revenue up 17% at Rs 4,750 crore versus Rs 4,059 crore, QoQ.

-330

February 06, 2024· 15:01 IST

Sensex Today | Market at 3 PM

The Sensex was up 434.45 points or 0.61 percent at 72,165.87, and the Nifty was up 154.80 points or 0.71 percent at 21,926.50. About 1975 shares advanced, 1285 shares declined, and 60 shares unchanged.

-330

February 06, 2024· 14:59 IST

| Company | Price at 14:00 | Price at 14:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| Oil India | 505.00 | 482.15 | -22.85 5.00m |

| Nakoda Group | 64.35 | 61.80 | -2.55 101.36k |

| Zuari Ind. | 276.55 | 265.80 | -10.75 25.27k |

| Sonu Infratech | 60.00 | 57.75 | -2.25 4.93k |

| Websol Energy | 429.80 | 415.00 | -14.80 39.38k |

| Upsurge Seeds | 377.90 | 367.00 | -10.90 510 |

| Trident | 46.15 | 44.85 | -1.30 5.80m |

| North Eastern | 33.60 | 32.70 | -0.90 32.02k |

| Maitreya Medica | 189.95 | 185.00 | -4.95 0 |

| Uniphos Ent | 148.70 | 144.85 | -3.85 1.23k |

-330

February 06, 2024· 14:58 IST

| Company | Price at 14:00 | Price at 14:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| Elgi Rubber | 58.00 | 64.50 | 6.50 2.13k |

| Libas Consumer | 22.65 | 25.00 | 2.35 30.00k |

| Inox India | 905.00 | 990.00 | 85.00 91.00k |

| Vaswani Ind | 34.30 | 37.40 | 3.10 9.86k |

| Commercial Syn | 87.75 | 94.80 | 7.05 3.48k |

| Sundram | 1,168.40 | 1,261.70 | 93.30 9.56k |

| Cadsys India | 225.05 | 239.00 | 13.95 1.70k |

| Phoenix Mills | 2,559.50 | 2,715.30 | 155.80 59.76k |

| Ahlada Engineer | 134.05 | 142.00 | 7.95 9.36k |

| Dhunseri Ventur | 510.05 | 540.00 | 29.95 6.69k |

-330

February 06, 2024· 14:56 IST

Stock Market LIVE Updates | HSBC View On UPL

-Buy call, target cut to Rs 550 per share from Rs 730 per share

-Q3 losses widen in Q3FY24 on sustained headwinds

-Expect FY24 to be a loss year and FY25 a year of recovery

-Stability in prices and inventory rebalancing to drive recovery

-Rights issue and other initiatives are levers for debt reduction

-330

February 06, 2024· 14:48 IST

Stock Market LIVE Updates | Birla Corporation reports its Q3 earnings

-- Net Profit at Rs109 cr vs loss of Rs50 cr (YoY)

-- Revenue up 15% at Rs2,312 cr vs Rs2,016 cr (YoY)

-- EBITDA at Rs378 cr vs Rs145 cr (YoY)

-- Margin at 16.3% vs 7.2% (YoY)

-330

February 06, 2024· 14:44 IST

Stock Market LIVE Updates | Indian insurers soar on tax rate rationalization prospects

Indian insurance firms surged on CNBC TV18 news of a parliamentary panel's recommendation to rationalize national sales tax rates, potentially lowering rates for health insurance. HDFC Life rose by 5.1%, New India Assurance by 8.9%, Max Financial by 5.1%, ICICI Prudential Life by 3.3%, and ICICI Lombard General Insurance by 3.9%.

-330

February 06, 2024· 14:38 IST

Stock Market LIVE Updates | ideaForge jumps over 9% after strong Q3

ideaForge surged 9 percent on Q3 FY24 revenues of Rs 90.9 crore, marking a remarkable 1,065 percent YoY increase from Rs 78 crore. EBITDA stood at Rs 26.19 crore, and the company posted a PAT of Rs 14.8 crore, a significant turnaround from a Rs 7.8 crore loss in Q3 FY23.

-330

February 06, 2024· 14:35 IST

Stock Market LIVE Updates | Inox Wind signs pact for launch of 4.xmw wind turbines in India

-330

February 06, 2024· 14:31 IST

-330

February 06, 2024· 14:25 IST

Stock Market LIVE Updates | Thermax to buy 51% stake in TSA Process for Rs 71.14 crore

-330

February 06, 2024· 14:20 IST

-330

February 06, 2024· 14:14 IST

Stock Market LIVE Updates | Chambal Fertilisers and Chemicals Q3 Results:

Net profit up 41.8% at Rs 459.4 crore against Rs 323.9 crore and revenue down 47.6% at Rs 4,348 crore versus Rs 8,296.2 crore, YoY.

-330

February 06, 2024· 14:13 IST

-330

February 06, 2024· 14:11 IST

| Company | CMP | Chg(%) | 3 Days Ago Price |

|---|---|---|---|

| Nagreeka Export | 78.50 | 93.11 | 40.65 |

| Dhruv Consultan | 92.35 | 32.31 | 69.80 |

| Cords Cable Ind | 193.35 | 31.98 | 146.50 |

| MRO-TEK | 82.85 | 30.68 | 63.40 |

| Lagnam Spintex | 119.85 | 30.56 | 91.80 |

| Zodiac Energy | 339.15 | 29.94 | 261.00 |

| KCP Sugar | 50.80 | 25.28 | 40.55 |

| Prakash Steelag | 14.00 | 25.00 | 11.20 |

| Jindal Worldwid | 338.00 | 23.67 | 273.30 |

| Mukta Arts | 98.95 | 22.16 | 81.00 |

-330

February 06, 2024· 14:07 IST

-330

February 06, 2024· 14:05 IST

Sensex Today | European markets trade higher:

-330

February 06, 2024· 13:59 IST

| Company | Price at 13:00 | Price at 12:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| North Eastern | 33.35 | 32.57 | -0.78 6.88k |

| Hawa Engineers | 130.00 | 127.00 | -3.00 5 |

| Natural Capsule | 361.45 | 354.60 | -6.85 1.08k |

| Shree Ajit Pulp | 231.00 | 227.00 | -4.00 66 |

| Classic Leasing | 25.00 | 24.60 | -0.40 115 |

| Jigar Cables | 64.00 | 63.00 | -1.00 4.00k |

| Lancor Holdings | 41.85 | 41.31 | -0.54 5.12k |

| Rubfila Intl | 94.50 | 93.40 | -1.10 11.72k |

| Majestic Auto | 319.50 | 316.25 | -3.25 1.74k |

-330

February 06, 2024· 13:58 IST

| Company | Price at 13:00 | Price at 12:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| South Latex | 18.97 | 20.85 | 1.88 7 |

| Gorani Ind | 133.00 | 140.95 | 7.95 12 |

| Rama Paper Mill | 21.30 | 22.00 | 0.70 232 |

| Precision Elec | 64.00 | 66.00 | 2.00 26 |

| Coral Labs | 441.10 | 454.00 | 12.90 661 |

| Porwal Auto | 53.60 | 54.97 | 1.37 484 |

| Paramone | 56.55 | 57.88 | 1.33 198 |

| Dev Information | 152.60 | 155.65 | 3.05 962 |

| RTCL | 26.40 | 26.89 | 0.49 232 |

| Eimco Elecon | 1,520.00 | 1,545.00 | 25.00 65 |

-330

February 06, 2024· 13:56 IST

Stock Market LIVE Updates |Trident Q3 Earnings:

Net profit down 24% at Rs 109 crore versus Rs 144 crore and revenue up 12% at Rs 1,835 crore against Rs 1,641 crore, YoY.

-330

February 06, 2024· 13:54 IST

Stock Market LIVE Updates |Computer Age Management Services (CAMS) Q3 Earnings:

Net profit rose 21% at Rs 89 crore versus Rs 74 crore and revenue up 19% at Rs 290 crore versus Rs 244 crore, YoY.

-330

February 06, 2024· 13:54 IST

-330

February 06, 2024· 13:51 IST

Stock Market LIVE Updates | Kalpataru Projects International raises Rs 150 crore via NCDs

Kalpataru Projects International on Tuesday raised Rs 150 crore through issuance of Non-Convertible Debentures (NCDs) on private placement basis.

The unsecured, rated, listed, redeemable NCDs will be listed on Wholesale Debt Market Segment of BSE, a regulatory filing stated.

The company raised Rs 150 crore by allotment of 15,000 NCDs of face value of Rs 1,00,000 each on private placement basis.

-330

February 06, 2024· 13:46 IST

-330

February 06, 2024· 13:44 IST

Stock Market LIVE Updates | Akzo Nobel India Q3 Earnings:

Profit up 17% at Rs 114 crore versus Rs 97 crore and revenue up 4% at Rs 1,033 crore versus Rs 989 crore, YoY.

-330

February 06, 2024· 13:38 IST

Britannia Industries shares trade lower ahead of Q3 Earnings:

-330

February 06, 2024· 13:34 IST

| Company | Quantity | Price | Value(Cr) |

|---|---|---|---|

| Yes Bank | 257232 | 25.3 | 0.65 |

| Trent | 50000 | 3019.3 | 15.1 |

| Sarveshwar Food | 284827 | 9.77 | 0.28 |

| Sarveshwar Food | 221426 | 9.77 | 0.22 |

| Yes Bank | 228761 | 25.26 | 0.58 |

| Reliance | 3987 | 2863 | 1.14 |

| BPCL | 18205 | 600.5 | 1.09 |

| Greencrest Fin | 200000 | 1.14 | 0.02 |

| Sarveshwar Food | 353500 | 9.77 | 0.35 |

| FCS Software | 313498 | 6.35 | 0.2 |

-330

February 06, 2024· 13:30 IST

Stock Market LIVE Updates | Usha Martin Q3 Earnings:

Net profit jumped 27.8% at Rs 107.5 crore against Rs 84.1 crore and revenue down 4.4% at Rs 797.1 crore against Rs 833.6 crore, YoY.

-330

February 06, 2024· 13:29 IST

Sensex Today | Nifty PSU Bank index down 1 percent dragged by Bank of India, Bank of Baroda, Indian Bank

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bank of India | 131.50 | -5.12 | 28.41m |

| Bank of Baroda | 249.05 | -3.26 | 12.53m |

| Indian Bank | 543.50 | -2.98 | 1.48m |

| Union Bank | 145.00 | -1.19 | 12.48m |

| PNB | 120.75 | -0.74 | 37.32m |

| JK Bank | 144.30 | -0.59 | 3.57m |

| Canara Bank | 517.90 | -0.45 | 3.60m |

| SBI | 641.00 | -0.3 | 7.83m |

-330

February 06, 2024· 13:25 IST

Stock Market LIVE Updates | Triveni Turbine Q3 profit rises 30% YoY to Rs 68.3 crore

Triveni Turbine has recorded net profit at Rs 68.3 crore for the quarter ended December FY24, growing 30% over a year-ago period. Revenue from operations jumped 33% YoY to Rs 432 crore for the quarter. Order booking stood at Rs 531 crore during Q3FY24, an increase of 26% YoY.

-330

February 06, 2024· 13:24 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY AUTO | 19880.25 1.35 | 6.78 5.31 | 8.00 48.80 |

| NIFTY IT | 38116.65 2.57 | 7.33 4.77 | 9.37 25.34 |

| NIFTY PHARMA | 18421.90 0.7 | 9.45 5.45 | 6.13 51.08 |

| NIFTY FMCG | 54569.10 -0.24 | -4.24 -0.01 | -5.37 17.88 |

| NIFTY PSU BANK | 6502.45 -1.21 | 13.81 6.03 | 11.37 66.81 |

| NIFTY METAL | 8113.55 0.05 | 1.70 3.17 | 3.07 40.56 |

| NIFTY REALTY | 861.20 -0.18 | 9.98 2.88 | 2.00 111.08 |

| NIFTY ENERGY | 38639.90 0.41 | 15.45 6.16 | 12.93 71.90 |

| NIFTY INFRA | 7985.75 0.92 | 9.34 1.88 | 7.95 57.96 |

| NIFTY MEDIA | 2131.65 0.35 | -10.74 -0.55 | -13.63 14.43 |

-330

February 06, 2024· 13:22 IST

Stock Market LIVE Updates | Gulf Oil Lubricants Q3 profit jumps 29% YoY to Rs 81 crore

Gulf Oil Lubricants India has recorded 28.86% on-year growth in net profit at Rs 80.74 crore for October-December period of FY24. Revenue from operations for the quarter at Rs 817.26 crore grew by 4.6% and EBITDA at Rs 111.06 crore increased by 23.38% compared to year-ago period. The company has declared an interim dividend of Rs 16 per equity share.

-330

February 06, 2024· 13:19 IST

Stock Market LIVE Updates | Life Insurance Corporation of India touched 52-week high of Rs 1,032.45

-330

February 06, 2024· 13:17 IST

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| Fortis Health | 469.50 | 469.50 | 461.25 |

| Petronet LNG | 293.30 | 293.30 | 290.40 |

| AstraZeneca | 7208.00 | 7208.00 | 6,984.05 |

| Metropolis | 1811.50 | 1811.50 | 1,758.10 |

| Latent View | 528.70 | 528.70 | 519.45 |

| Aster DM Health | 451.65 | 451.65 | 446.15 |

| HEG | 1975.40 | 1975.40 | 1,945.00 |

| HINDPETRO | 534.90 | 534.90 | 534.75 |

| Gland | 2155.50 | 2155.50 | 2,115.00 |

| Ashoka Buildcon | 192.60 | 192.60 | 191.45 |

-330

February 06, 2024· 13:12 IST

Stock Market LIVE Updates | Motilal Oswal View on Varun Beverages:

Broking house expect company to maintain its earnings momentum, aided by: 1) increased penetration in newly acquired territories in India and Africa, 2) higher acceptance of newly launched products, 3) continued expansion in capacity and distribution reach, 4) growing refrigeration in rural and semi-rural areas, and 5) a scale-up in international operations.

Motilal Oswal expect a CAGR of 23%/23%/29% in revenue/EBITDA/PAT over CY23-25.

While maintain CY24 earnings, and increases CY25 earnings estimate by 7%, on account of integrating the recently acquired South African beverage company BevCo’s financials (assumed only six months of integration in CY24) and also increasing the volume growth estimate of the existing business to 16%/14% for CY24/25 from 14%/13% earlier estimated. However, higher interest cost led by an increase in debt (capex and acquisition led increase) partly offsets the increase in earnings.

Value the stock at 57x CY25E EPS to arrive at a Target Price of Rs 1,500 and reiterate Buy rating on the stock.

-330

February 06, 2024· 13:08 IST

Stock Market LIVE Updates | Go Fashion Q3 results:

Net profit down 3.7% at Rs 23.4 crore versus Rs 24.3 crore and revenue up 15.1% at Rs 202 crore versus Rs 175.5 crore, YoY.

-330

February 06, 2024· 13:07 IST

Stock Market LIVE Updates | Ajmera Realty Q3 results:

Net profit at Rs 30.5 crore versus Rs 10.6 crore and revenue at Rs 206.8 versus Rs 79.1 crore, YoY.

-330

February 06, 2024· 13:01 IST

Sensex Today | Market at 2 PM

The Sensex was up 352.41 points or 0.49 percent at 72,083.83, and the Nifty was up 110.10 points or 0.51 percent at 21,881.80. About 1921 shares advanced, 1308 shares declined, and 66 shares unchanged.

-330

February 06, 2024· 13:01 IST

| Company | Price at 12:00 | Price at 12:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| Diggi Multitrad | 29.50 | 26.25 | -3.25 0 |

| Gujchem Distill | 77.70 | 71.01 | -6.69 0 |

| S V J Enterpris | 53.98 | 49.50 | -4.48 1.20k |

| Euro Leder | 25.00 | 23.06 | -1.94 544 |

| United Credit | 22.24 | 20.57 | -1.67 489 |

| JAFINANCE | 30.25 | 28.02 | -2.23 9 |

| Infronics Syst | 56.00 | 52.24 | -3.76 230 |

| Alfred Herbert | 1,700.00 | 1,592.00 | -108.00 64 |

| Bangalore Fort | 38.00 | 36.00 | -2.00 458 |

| Dhan Jeevan | 22.00 | 20.86 | -1.14 232 |

-330

February 06, 2024· 13:00 IST

| Company | Price at 12:00 | Price at 12:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| Arvind Smart | 555.00 | 653.20 | 98.20 316 |

| Mipco Seamless | 32.35 | 35.59 | 3.24 42 |

| Hindusthan Urba | 2,294.00 | 2,502.00 | 208.00 28 |

| IGC Foils | 36.80 | 39.85 | 3.05 0 |

| SBL Infratech | 33.31 | 35.96 | 2.65 1.03k |

| Superior Ind | 45.51 | 49.00 | 3.49 322 |

| Aban Offshore | 82.40 | 88.61 | 6.21 6.27k |

| Shree Rama News | 19.44 | 20.89 | 1.45 10.29k |

| Bafna Pharma | 94.10 | 101.00 | 6.90 0 |

| Ecoboard Inds | 30.20 | 32.33 | 2.13 143 |

-330

February 06, 2024· 12:56 IST

Stock Market LIVE Updates | TTK Prestige Q3

Net profit up 8.5% at Rs 62.5 crore versus Rs 57.6 crore and revenue rose 6.3% at Rs 738.4 crore versus Rs 694.8 crore, YoY.

-330

February 06, 2024· 12:55 IST

Stock Market LIVE Updates | Godrej Properties Q3 Results:

Consolidated net profit up 5% at Rs 62 crore versus Rs 59 crore and revenue up 68% at Rs 330 crore versus Rs 196 crore, YoY.

-330

February 06, 2024· 12:53 IST

Stock Market LIVE Updates | PNC Infratech Q3 Results:

Net profit up 32.4% at Rs 185 crore against Rs 139.7 crore and revenue up 13.5% at Rs 2,046.6 crore versus Rs 1,803.3 crore, YoY

-330

February 06, 2024· 12:49 IST

Sensex Today | Gold prices edge higher as US dollar, Treasury yields slip

Gold prices inched higher from nearly two-week low levels on Tuesday, as the dollar and Treasury yields slipped, and traders took stock of missing signs of de-escalations in the Middle-East.

Spot gold edged up 0.2% to $2,027.85 per ounce, after hitting its lowest level since Jan. 25 on Monday.

U.S. gold futures rose 0.1% to $2,044.00 per ounce.

-330

February 06, 2024· 12:47 IST

| Company | CMP Chg(%) | Conc. Price Chg% | Volume |

|---|---|---|---|

| Vrundavan Plant | 52.20 -1.51 | 54.35 -3.96 | 0 |

| Vadilal Enter | 3,350.00 -3.60 | 3,504.00 -4.39 | 0 |

-330

February 06, 2024· 12:45 IST

| Company | CMP Chg(%) | Conc. Price Chg% | Volume |

|---|---|---|---|

| Tata Metaliks | 1,125.90 1.34 | 1,058.70 6.35 | 0 |

| SPS Finquest | 70.99 1.56 | 68.17 4.14 | 0 |

| SGBAUG24 | 6,290.00 0.95 | 6,203.72 1.39 | 0 |

-330

February 06, 2024· 12:44 IST

Stock Market LIVE Updates | HSBC View On HDFC Bank

-Buy call, target cut to Rs 1,750 per share from Rs 1,950 per share

-Lower loan growth, increase cost ratios & credit costs to cut EPS by 4.5-8.2 percent for FY25

-Current valuations reflect a bear case

-Scenario analysis reveals an 18-29 percent return potential over 3 years

-Large banks provide better value over consumer names

-In the long run, ongoing improvements in infra could put pressure on high corporate margins

-330

February 06, 2024· 12:37 IST

Stock Market LIVE Updates | Paradeep Phosphates Q3 profit tanks 40% YoY to Rs 109 crore

Paradeep Phosphates has reported consolidated net profit at Rs 108.9 crore for quarter ended December FY24, falling 39.6% compared to corresponding period of last fiscal despite higher operating margin with sharp fall in input cost. Revenue from operations declined 41% YoY to Rs 2,595 crore for the quarter.

-330

February 06, 2024· 12:34 IST

Stock Market LIVE Updates | JK Cement says Acro Paints to be merged with JK Maxx Paints

JK Maxx Paints, a wholly owned subsidiary of JK Cement, and Acro Paints, the step down subsidiary of JK Cement have approved the Scheme of Amalgamation of Acro Paints with JK Maxx Paints on a going concern basis.

-330

February 06, 2024· 12:30 IST

Sensex Today | BSE Midcap index up 0.5 percent led by Petronet LNG, IOB, Biocon

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Petronet LNG | 293.20 | 7.12 | 760.43k |

| IOB | 66.82 | 6.69 | 12.32m |

| Biocon | 300.50 | 5.59 | 478.46k |

| Gland | 2,105.30 | 4.56 | 19.23k |

| Ajanta Pharma | 2,257.20 | 4.32 | 4.75k |

| Vodafone Idea | 14.29 | 4.15 | 34.74m |

| Torrent Power | 1,165.15 | 3.98 | 22.89k |

| Oracle Fin Serv | 6,873.05 | 3.91 | 6.08k |

| Max Financial | 902.00 | 3.38 | 26.00k |

| New India Assur | 273.95 | 3.34 | 248.18k |

-330

February 06, 2024· 12:28 IST

Sensex Today | Dollar drifts, Aussie gains on prospect of rate hike

The U.S. dollar wobbled near a three-month peak as expectations the Federal Reserve is unlikely to cut rates aggressively this year take hold, while the Australian dollar rose after the central bank said it could not rule out another rate hike.

The Reserve Bank of Australia (RBA) on Tuesday left rates unchanged at a 12-year high of 4.35%, as expected, after its February meeting, but cautioned that a further increase in interest rates might be needed to tame inflation.

-330

February 06, 2024· 12:26 IST

Stock Market LIVE Updates | BSE Q3 profit jumps 110% YoY to Rs 108 crore

BSE has registered a 109.5% on-year growth in consolidated profit at Rs 108.2 crore for quarter ended December FY24. Consolidated revenue from operations grew by 82.2% YoY to Rs 371.5 crore for the quarter.

-330

February 06, 2024· 12:21 IST

Stock Market LIVE Updates | Morgan Stanley View On Manappuram Finance

-Overweight call, target Rs 210 per share

-MFI subsidiary results show beat versus estimate by 20 percent on PpOP & 1 percent on PBT

-Higher NII & assignment income drove the PBT beat, but higher provisions made PBT slight

-PAT beat our estimate by 7 percent with a lower effective tax rate

-Await details on asset quality, loan growth, etc

-330

February 06, 2024· 12:16 IST

Sensex Today | BSE oil & Gas index rose 2 percent supported by Petronet LNG, HPCL, BPCL

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Petronet LNG | 288.95 | 5.57 | 659.59k |

| BPCL | 594.55 | 3.31 | 608.81k |

| HINDPETRO | 524.15 | 3.09 | 339.70k |

| ONGC | 270.40 | 2.77 | 1.06m |

| GAIL | 180.55 | 2.53 | 913.83k |

| IOC | 177.50 | 2.1 | 3.06m |

| IGL | 448.25 | 1.85 | 213.02k |

| Linde India | 5,649.10 | 1.64 | 1.22k |

| Adani Total Gas | 999.25 | 0.96 | 152.87k |

-330

February 06, 2024· 12:11 IST

Stock Market LIVE Updates | Suven Pharmaceuticals Q3 profit plunges 56.6% YoY to Rs 46.7 crore

Suven Pharmaceuticals has clocked consolidated net profit at Rs 46.8 crore for October-December period of FY24, growing 56.6% over a year-ago period, with sharp fall in topline as well as operating numbers. Revenue from operations dropped nearly 38% to Rs 219.8 crore compared to year-ago period.

-330

February 06, 2024· 12:07 IST

Stock Market LIVE Updates | Shree Cement says there is no demand for tax deposition in showcause notice

In a clarification note on the news - I-T Department issues final notice to Shree Cement after tax liability probe of Rs 4,000 crore - appeared on Moneycontrol, Shree Cement said a show-cause notice was issued in January 2024 to the company asking the company to sum-up and summarize its response on the inquiry being made. There is no demand for tax deposition in the said notice. The company is in the process of preparing its response and would comply with the said notice.

-330

February 06, 2024· 11:59 IST

| Company | Price at 11:00 | Price at 11:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| PB Fintech | 954.35 | 870.00 | -84.35 202.78k |

| Presstonic | 175.00 | 168.05 | -6.95 - |

| JagsonpalPharma | 315.60 | 303.65 | -11.95 35.28k |

| HMT | 71.70 | 69.10 | -2.60 9.45k |

| Geekay Wires | 115.00 | 110.95 | -4.05 26.04k |

| Uma Exports | 78.80 | 76.10 | -2.70 78.77k |

| Vilin Bio Med | 30.00 | 29.00 | -1.00 10.40k |

| Atlanta | 24.20 | 23.40 | -0.80 5.11k |

| TT | 116.45 | 112.60 | -3.85 3.73k |

| Lagnam Spintex | 123.60 | 119.55 | -4.05 297.28k |

-330

February 06, 2024· 11:59 IST

| Company | Price at 11:00 | Price at 11:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Shanti Overseas | 22.70 | 25.00 | 2.30 9.20k |

| RBM Infracon | 570.00 | 619.90 | 49.90 2.00k |

| PTC India Fin | 52.80 | 57.00 | 4.20 311.24k |

| Foods and Inns | 139.00 | 148.45 | 9.45 121.55k |

| Pritish Nandy | 60.40 | 64.00 | 3.60 21.89k |

| Maitreya Medica | 180.00 | 189.95 | 9.95 3.85k |

| Biocon | 290.00 | 304.95 | 14.95 2.03m |

| Baid Finserv | 28.95 | 30.40 | 1.45 131.06k |

| Udayshivakumar | 56.65 | 59.30 | 2.65 679.54k |

| Aristo Bio-Tech | 89.50 | 93.40 | 3.90 12.19k |

-330

February 06, 2024· 11:57 IST

-330

February 06, 2024· 11:55 IST

India likely to sign multi-billion dollar deal to extend LNG imports from Qatar till 2048 at rates, lower than current prices: PTI

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Mahanagar Gas | 1511.55 | 2.84 | 14972 |

| Bombay Oxygen | 17356 | 2.04 | 17 |

| IGL | 449.05 | 2.03 | 212317 |

| GAIL | 180.1 | 2.27 | 859797 |

| Adani Total Gas | 1000.5 | 1.09 | 151432 |

| Gujarat Gas | 602.3 | 0.94 | 12085 |

| Refex Ind | 680.4 | 0.71 | 4154 |

-330

February 06, 2024· 11:53 IST

Stock Market LIVE Updates | Morgan Stanley View On Bharti Airtel

-Equal-weight call, target Rs 1,015 per share

-Q3 showed steady performance

-Key highlights include beat in India mobile business revenue & EBITDA led by improving subscriber mix

-Flattish capex QoQ coming lower than our estimate

-Robust cash flow generation

-330

February 06, 2024· 11:48 IST

Paytm founder Vijay Shekhar Sharma met with RBI officials yesterday, quoting Sources, reported CNBC-TV18.

-330

February 06, 2024· 11:47 IST

-330

February 06, 2024· 11:46 IST

S. P. Apparels announces strategic acquisition of Young Brand Apparel Pvt Ltd ) for a value of Rs 223 crore

-330

February 06, 2024· 11:41 IST

Stock Market LIVE Updates | Tata Chemicals recovers from early losses despite a disappointing Q3

Shares of Tata Chemicals Limited recovered sharply in morning trade on January 6, gaining 1.7 percent at Rs 995 despite a 60 percent drop in net profit in the October-December quarter.

During the quarter, the company's net profit declined to Rs 158 crore, while its revenue from operations stood at Rs 3,730 crore on a YoY basis, declining 10 percent. The company cited tepid demand across key market segments for its tepid figures.

At 11:40 am, the stock was trading at Rs 993, up 1.5 percent from the previous close on the NSE. Soon after the opening, the stock slid 4.4 percent on the exchanges.

-330

February 06, 2024· 11:33 IST

-330

February 06, 2024· 11:28 IST

Stock Market LIVE Updates | Metropolis has taken price hike in B2B segment effective Jan 1; it expects a good jump in a margin in Q4

-330

February 06, 2024· 11:22 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY AUTO | 19857.60 1.24 | 6.66 5.19 | 7.88 48.63 |

| NIFTY IT | 37890.45 1.96 | 6.69 4.15 | 8.72 24.59 |

| NIFTY PHARMA | 18470.35 0.97 | 9.73 5.73 | 6.40 51.48 |

| NIFTY FMCG | 54594.95 -0.19 | -4.20 0.04 | -5.33 17.93 |

| NIFTY PSU BANK | 6508.90 -1.11 | 13.92 6.14 | 11.48 66.97 |

| NIFTY METAL | 8100.95 -0.11 | 1.54 3.01 | 2.91 40.34 |

| NIFTY REALTY | 865.40 0.31 | 10.52 3.38 | 2.49 112.11 |

| NIFTY ENERGY | 38432.40 -0.13 | 14.83 5.59 | 12.32 70.98 |

| NIFTY INFRA | 7961.20 0.61 | 9.01 1.57 | 7.62 57.47 |

| NIFTY MEDIA | 2144.70 0.97 | -10.19 0.06 | -13.10 15.13 |

-330

February 06, 2024· 11:16 IST

NCLT agrees to hear Zee’s plea w.r.t Sony merger

-330

February 06, 2024· 11:15 IST

Stock Market LIVE Updates | CLSA View On Fusion Micro Finance

-Buy call, target Rs 800 per share

-Credit costs from Punjab dent, otherwise decent quarter

-While company maintains a 75 percent PCR, it reduced management overlay by Rs 20 crore in the quarter

-Apart from asset quality, quarter was strong with 24 percent loan growth

-A 70 bps sequential improvement in spreads

-330

February 06, 2024· 11:12 IST

| Company | CMP | Chg(%) | 3 Days Ago Price |

|---|---|---|---|

| Nagreeka Export | 78.50 | 93.11 | 40.65 |

| Dhruv Consultan | 92.80 | 32.95 | 69.80 |

| Cords Cable Ind | 193.35 | 31.98 | 146.50 |

| Lagnam Spintex | 121.00 | 31.81 | 91.80 |

| MRO-TEK | 82.85 | 30.68 | 63.40 |

| Zodiac Energy | 339.15 | 29.94 | 261.00 |

| Prakash Steelag | 14.00 | 25.00 | 11.20 |

| KCP Sugar | 49.75 | 22.69 | 40.55 |

| Mukta Arts | 98.95 | 22.16 | 81.00 |

| Sumit Woods | 65.70 | 21.78 | 53.95 |

-330

February 06, 2024· 11:10 IST

Stock Market LIVE Updates | TVS Supply Chain Solutions Q3 profit tanks 42% YoY to Rs 10 crore

TVS Supply Chain Solutions has recorded consolidated profit at Rs 9.99 crore for quarter ended December FY24, falling 42% compared to year-ago period despite lower input cost. Revenue from operations for the quarter fell 6.4% YoY to Rs 2,221.8 crore.

-330

February 06, 2024· 11:04 IST

Sensex Today | BSE Power index down 0.6 percent dragged by Power Grid, NHPC, BHEL

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Power Grid Corp | 274.45 | -2.94 | 369.57k |

| BHEL | 231.35 | -1.68 | 1.04m |

| NHPC | 102.50 | -1.22 | 20.08m |

| NTPC | 331.95 | -1.22 | 184.13k |

| Suzlon Energy | 47.69 | -1.16 | 6.56m |

| Tata Power | 391.40 | -0.63 | 324.92k |

-330

February 06, 2024· 11:02 IST

Stock Market LIVE Updates | Sun Pharma arm Taro Pharma incorporates subsidiary Taro Pharma Corporation Inc (USA)

Sun Pharmaceutical Industries' subsidiary company Taro Pharma Corporation, Inc. (USA) is incorporated as a wholly-owned subsidiary of Taro Pharmaceutical Industries (Israel), a subsidiary of Sun Pharma.

-330

February 06, 2024· 10:58 IST

| Company | Price at 10:00 | Price at 10:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Moxsh Overseas | 141.40 | 131.00 | -10.40 12.00k |

| Pattech Fitwell | 66.00 | 62.00 | -4.00 0 |

| Mirc Electronic | 27.45 | 25.80 | -1.65 1.27m |

| Digikore Studio | 500.00 | 470.00 | -30.00 - |

| Geekay Wires | 117.00 | 110.10 | -6.90 27.57k |

| MIC Electronics | 41.65 | 39.30 | -2.35 107.54k |

| Sandur Manganes | 573.20 | 542.00 | -31.20 58.94k |

| NINtec SYSTEMS | 517.85 | 492.45 | -25.40 11.49k |

| Dhruv Consultan | 95.50 | 91.05 | -4.45 135.25k |

| Infinium Pharma | 236.00 | 225.10 | -10.90 0 |

-330

February 06, 2024· 10:58 IST

| Company | Price at 10:00 | Price at 10:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Alphageo | 335.65 | 381.00 | 45.35 8.72k |

| SKP Bearing | 302.00 | 334.00 | 32.00 18.00k |

| Xchanging Sol | 122.55 | 133.85 | 11.30 203.02k |

| Banaras Beads | 108.00 | 116.30 | 8.30 8.44k |

| Lloyds Steels | 49.10 | 52.85 | 3.75 1.53m |

| Holmarc Opto Me | 98.00 | 104.65 | 6.65 - |

| Manugraph Ind | 28.90 | 30.85 | 1.95 53.94k |

| Nitin Spinners | 346.95 | 368.55 | 21.60 50.49k |

| Lagnam Spintex | 114.50 | 121.10 | 6.60 266.10k |

| Khandwala Sec | 31.30 | 32.95 | 1.65 21.51k |

-330

February 06, 2024· 10:54 IST

Stock Market LIVE Updates | Morgan Stanley View On Bank Of India

-Downgrade to underweight from overweight, target cut to Rs 125 per share

-In Q3 NII missed estimate by 6 percent as margin declined 23 bps QoQ

-Margin declined due to sharp moderation in loan spreads

-Opex and credit costs were better than we expected

-Stock has rallied sharply, up 40 percent over past two months

-View valuation at 0.8x P/B as expensive with significant RoA headwinds in FY25

-330

February 06, 2024· 10:51 IST

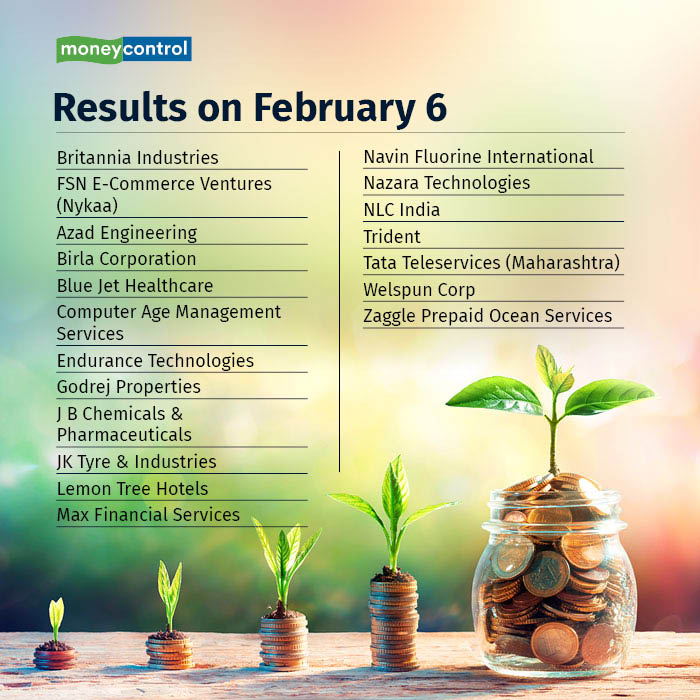

Results Today: