Closing Bell: Nifty around 19,150, Sensex up 490 pts; all sectors in the green

-330

November 02, 2023· 16:29 IST

Benchmark indices erased previous two-session losses and ended higher with Nifty back above 19,100. At close, the Sensex was up 489.57 points or 0.77 percent at 64,080.90, and the Nifty was up 144.10 points or 0.76 percent at 19,133.30.

We wrap up today's edition of the Moneycontrol live market blog, and will be back tomorrow morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices/ for all the global market action.

-330

November 02, 2023· 16:27 IST

-330

November 02, 2023· 16:24 IST

Deepak Jasani, Head of Retail Research, HDFC Securities

Nifty advanced through on Nov 02 almost erasing the previous two-session’s losses. At close, Nifty was up 0.76% or 144.1 points at 19133.3. Volumes on the NSE continued to be on the lower side. Broad market indices rose more than the Nifty even as the advance decline ratio rose to 2.45:1.

Global stocks rallied as investors reacted to the possible peak of the Federal Reserve’s historic tightening campaign.

In Japan, Prime Minister Fumio Kishida announced an economic stimulus package worth about $113 billion that is meant to cushion the blow to household budgets from rising inflation and timed to counter weakening public support for his government.

Nifty recovered after a two day weakness following positive global cues. It formed a high wave type candle; however the Nifty could not close at or near the intra-day high. Nifty could now extend its upmove and head towards 19235 while 18973 could offer support.

-330

November 02, 2023· 16:21 IST

Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities

The Nifty index has formed a doji candle on the daily chart, reflecting a state of indecision as a battle between the bulls and the bears unfolds. Downside support is apparent in the 19,000-18,900 range, with visible fresh put writing for the upcoming weekly expiry. Immediate resistance is situated at the 19,200 level, and a breakthrough at this point could trigger fresh short covering, potentially propelling the index towards 19,300-19,350.

Bank Nifty's daily chart reveals an indecisive doji candle formation, signaling uncertainty in the Index.The index failed to close above its critical 200-day Simple Moving Average (SMA) at 43,200, implying strong resistance at this level. To consider a long position in Bank Nifty, it's advisable to wait for a sustained breakthrough above the 200-day SMA, which could indicate a potential upward trend.

-330

November 02, 2023· 16:08 IST

Prashanth Tapse, Senior VP (Research), Mehta Equities:

The US Federal Reserve's decision to keep policy rates unchanged fuelled a global rally and helped benchmark indices reverse their 2-day losing streak. Across the board buying propelled Sensex to close above the 64k-mark, as investors cheered the US Fed decision in the backdrop of rising global uncertainty further worsened by the ongoing conflict in West Asia, higher inflation and strong FII fund outflows.

-330

November 02, 2023· 16:04 IST

Vinod Nair, Head of Research at Geojit Financial Services:

A pause with dovish commentary from the Fed led to a rebound in the global and domestic market sentiment. Further, the fall in US bond yields indicates a prolonged pause in interest rates hike. And the domestic macros are favourable with positive auto numbers, a surge in GST collection, good factory data and better than estimated Q2 quarter earnings.

-330

November 02, 2023· 16:00 IST

Deven Mehata, Research Analyst at Choice Broking:

Nifty opened with a gap up and moved higher towards 19175 and managed to close at 19133.25 levels. Nifty has made a doji candle on daily charts indicating indecisiveness.

The market has traded positive with the Sensex gaining 0.77 percent and closed at 64080.90 and Nifty was up by 0.76 percent intraday and closed at 19133.2 levels whereas Bank Nifty was up by 0.74 percent and settled at 43017.2.

All the sectors closed in green with Nifty Realty, Nifty PSU Bank and Nifty Metal ended with 2.52%, 1.50% and 1.40% higher respectively. In Nifty stocks, Britannia, Hindalco and IndusInd Bank were the top gainers while Tech Mahindra, Bajaj Auto and Hero Motocorp were the prime laggards.

INDIA VIX was negative by 8.13 percent intraday and settled at 11.07.

Index has strong support around the 18900-19000 zone. Coming to the OI Data, on the call side, the highest OI observed at 19200 followed by 19500 strike prices while on the put side, the highest OI is at 19000 strike price. On the other hand, Bank Nifty has support at 42900-42700 while resistance is placed at 43350-43500 levels.

-330

November 02, 2023· 15:57 IST

Stock Market LIVE Updates | Tata Motors Q2 Results:

Net profit at Rs 3,764 crore versus loss of Rs 945 crore and revenue up 32% at Rs 1.05 lakh crore versus Rs 0.8 lakh crore, YoY.

-330

November 02, 2023· 15:43 IST

Ajit Mishra, SVP - Technical Research, Religare Broking

Market witnessed a rebound after two days of slide and gained over half a percent. Upbeat global cues triggered a gap-up start in Nifty, followed by a range bound move till the end. Most sectors contributed to the move wherein realty, metal and energy were among the top performers. Besides, the rebound in the broader indices further added to the positivity.

Participants are taking comfort from the rebound in the global indices, especially the US however it is too early to say that we are out of the woods citing multiple hurdles between the 19200-19400 zone in Nifty. We thus reiterate our view to follow stock-specific approach and focus more on overnight risk management.

-330

November 02, 2023· 15:38 IST

Aditya Gaggar Director of Progressive Shares:

The markets commenced the weekly expiry day on a strong note above 19,000 but the higher levels did not last for long and erased majority of its gains. In the second half of the trading session, PSU Banks, Metal, and select heavyweights took the lead and helped the Index recover and end the session at 19,133.25 with gains of 144.10 points. With gains of more than 1.30%, Mid and Smallcaps outperformed the Frontliners.

On the daily chart, Nifty50 has made a DOJI candlestick pattern which represents indecisiveness between the bulls and bears, and at present, it is standing in the middle of the range (18,800-19250), awaiting a clear breakout on either side.

-330

November 02, 2023· 15:33 IST

Rupee Close:

Indian rupee ended marginally higher at 83.24 per dollar on Thursday against Wednesday's close of 83.29.

-330

November 02, 2023· 15:30 IST

Market Close:

Benchmark indices erased previous two-session losses and ended higher with Nifty back above 19,100.

At close, the Sensex was up 489.57 points or 0.77 percent at 64,080.90, and the Nifty was up 144.10 points or 0.76 percent at 19,133.30. About 2236 shares advanced, 1287 shares declined, and 140 shares unchanged.

Biggest gainers on the Nifty were Britannia Industries, Hindalco Industries, IndusInd Bank, Apollo Hospitals and Eicher Motors, while losers were Hero MotoCorp, Tech Mahindra, Bajaj Auto, Bajaj Finance and ONGC.

All the sectoral indices ended in the green with metal, capital goods, FMCG, power, oil & gas, realty up 1-2 percent each.

BSE Midcap and smallcap indices up 1 percent each.

-330

November 02, 2023· 15:25 IST

Stock Market LIVE Updates | Nirmal Bang View on Britannia Industries

There is no material change in EPS estimates for FY24 and FY25. Over the medium term, broking firm remain extremely positive about the company considering: (a) incremental growth from enhanced distribution (b) focus on the Hindi belt with right price points (c) addition of new products & categories and (d) premiumisation.

At the current market price (CMP), the stock is trading at ~43x FY25E EPS as we build in ~17% earnings CAGR over FY24E-FY26E.

Broking firm roll forward its target multiple from June’25 to Sept’25E EPS while continuing to value the company at 50x given the structurally attractive opportunity in the Packaged Foods space, high RoE compared to domestic staples peers, healthy dividend payout and potential addition of new categories going ahead.

Buy rating with a Target Price of Rs 5,515.

-330

November 02, 2023· 15:22 IST

Stock Market LIVE Updates | Macquarie View On Hero MotoCorp:

-Neutral call, target Rs 3,180 per share

-Q2 gross margin-led modest EBITDA beat

-EBITDA per unit at a new high

-Board approved voluntary proposal of promoter & chairman, Mr Pawan Munjal

-Board approved voluntary proposal to reduce chairman’s fixed salary by 20 percent for FY23

-330

November 02, 2023· 15:18 IST

Sensex Today | Nifty Bank index rose 0.6 percent led by Bank of Baroda, Punjab National Bank, IndusInd Bank:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bank of Baroda | 199.70 | 2.15 | 12.51m |

| PNB | 74.20 | 1.78 | 41.42m |

| IndusInd Bank | 1,457.95 | 1.77 | 4.31m |

| IDFC First Bank | 82.20 | 1.36 | 16.12m |

| Axis Bank | 981.30 | 0.98 | 4.95m |

| SBI | 571.30 | 0.87 | 10.57m |

| Bandhan Bank | 215.05 | 0.73 | 3.60m |

| Kotak Mahindra | 1,736.20 | 0.68 | 2.37m |

| Federal Bank | 141.40 | 0.64 | 5.21m |

| ICICI Bank | 918.90 | 0.53 | 9.15m |

-330

November 02, 2023· 15:16 IST

Stock Market LIVE Updates | HSBC View On KEI Industries:

-Buy call, target Rs 3,200 per share

-Q2 strong set of results, broadly in-line with expectations

-Demand outlook strong on government and private capex

-Demand outlook strong on housing demand and exports opportunity

-330

November 02, 2023· 15:13 IST

Stock Market LIVE Updates | Dollar lower as traders see US rates peaking, eyes on BoE

The dollar fell broadly on Thursday, with risk-sensitive Asia-Pacific currencies leading gains as investors grew more convinced of a likely peak in U.S. interest rates after the Federal Reserve left them on hold.

Focus now turns to the Bank of England and whether it conveys a similar message at today's policy announcement.

Fed Chair Jerome Powell left the door open to another hike, but with the funds rate target ceiling at 22-year high of 5.5% he said the risks of doing too much or too little were now balanced.

Markets took that as a green light to stick with a sub 20% chance that rates will rise in December. Ten-year Treasury yields are down 23 basis points from Wednesday's highs, equities rallied and risk-sensitive currencies bounced.

-330

November 02, 2023· 15:09 IST

Stock Market LIVE Updates | Minda Corporation Q2 Results:

Net profit up 1.56% at Rs 58.7 crore versus Rs 58 crore and revenue up 4.2% at Rs 1,196 crore versus Rs 1,147 crore, YoY.

-330

November 02, 2023· 15:08 IST

Stock Market LIVE Updates | Jefferies View On Sun Pharmaceutical Industries:

-Buy call, target Rs 1,310 per share

-Q2 revenue in-line but EBITDA 6 percent below estimate due to higher opex

-Global specialty sales at USD 240 million grew 19 percent YoY/3 percent QoQ

-India sales outperformed market (11 percent YoY) after a soft Q1

-US generic sales declined sharply QoQ due to lower sales of Grevlimid

-Core earnings driver remain intact led by specialty sales ramp-up & India/EM presence

-330

November 02, 2023· 15:06 IST

Sensex Today | Colin Shah, MD, Kama Jewelry:

The US Fed has kept the rate unchanged for the second time and is on the much-expected lines in reflection of the uncertainty in the global economy. This move indicates the efforts of the Fed body to keep inflation in control with sustained yet steady momentum towards the goal of bringing down the inflation rate within the range of 2%. Having said that, another rate hike is probable during this financial year. This may result in fluctuations at an international level. However, the mild turbulence will be well absorbed on the domestic front owing to the festive gold buying in India.

-330

November 02, 2023· 15:03 IST

Stock Market LIVE Updates | HSBC View On Godrej Consumer Products:

-Buy call, target Rs 1,220 per share

-Q2 standalone volume growth of +4 percent, flat household insecticides (HI) growth

-Modest decline in personal care paint a weaker picture for Q2

-Indonesia business growth was resilient

-Indonesia business seems to be recovering; Gaum impacted by currency devaluation in Nigeria

-Company needs sustainable trajectory of HI and RCCL business, as key catalysts

-330

November 02, 2023· 15:01 IST

Sensex Today | Market at 3 PM:

The Sensex was up 499.78 points or 0.79 percent at 64,091.11, and the Nifty was up 148.60 points or 0.78 percent at 19,137.80. About 2062 shares advanced, 1109 shares declined, and 103 shares unchanged.

-330

November 02, 2023· 15:00 IST

Stock Market LIVE Updates | Cholamandalam Investment and Finance Company Q2 Results:

Net profit up 35.4% at Rs 762 crore versus Rs 562.8 crore, YoY.

-330

November 02, 2023· 14:58 IST

Stock Market LIVE Updates | Insecticides India Q2 Results:

Net profit up 18.5% at Rs 53.1 crore versus Rs 45 crore and revenue up 19.5% at Rs 696 crore versus Rs 582 crore, YoY.

-330

November 02, 2023· 14:55 IST

Stock Market LIVE Updates | Adani Enterprises Q2 Results:

Revenue down 41% at Rs 22,517 crore versus Rs 38,175 crore and net profit down 50.5% at Rs 228 crore versus Rs 461 crore, YoY.

-330

November 02, 2023· 14:53 IST

Dabur India Q2 net profit at Rs 515 crore and revenue at Rs 3,204 crore.

-330

November 02, 2023· 14:51 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| BSE Auto | 36235.58 0.73 | 25.28 0.01 | -1.07 18.59 |

| BSE CAP GOODS | 45914.23 0.88 | 37.71 1.73 | -3.80 37.79 |

| BSE FMCG | 18605.93 0.79 | 15.74 1.17 | -0.39 14.68 |

| BSE Metal | 22255.59 1.55 | 6.71 0.64 | -4.10 15.10 |

| BSE Oil & Gas | 18523.87 1.25 | -9.24 3.78 | -2.64 -5.57 |

| BSE REALTY | 4983.57 2.77 | 44.58 9.57 | 8.20 42.56 |

| BSE IT | 31106.73 0.91 | 8.49 1.51 | -2.99 6.24 |

| BSE HEALTHCARE | 27586.20 0.86 | 19.76 2.24 | -3.20 13.00 |

| BSE POWER | 4448.66 1.6 | 1.54 3.06 | -4.53 -9.97 |

| BSE Cons Durables | 44663.43 1.09 | 12.44 1.79 | -1.54 4.69 |

-330

November 02, 2023· 14:49 IST

Stock Market LIVE Updates | Quest Capital slips marginally on lacklustre Q2 results

Total revenue from operations at Rs 1 crore in Q2FY24 vs Rs 8 crore in Q2FY23

Profit at Rs 0.9 crore in Q2FY24 vs Rs 1 crore in Q2FY23

-330

November 02, 2023· 14:42 IST

Stock Market LIVE Updates | Strong Q2 results drives Morepen Labs stock 6% higher

Total income at Rs 425 crore in Q2FY24 vs Rs 403 crore in Q2FY23

Net profit at Rs 212 crore in Q2FY24 vs Rs 158 crore in Q2FY23

-330

November 02, 2023· 14:37 IST

Stock Market LIVE Updates | Orient Bell slips 2% on weak Q2FY24 performance

Total income at Rs 159 crore in Q2FY24 versus Rs 173 crore in Q2FY23

Profit at Rs 0.3 crore in Q2FY24 versus Rs 5 crore in Q2FY23

-330

November 02, 2023· 14:30 IST

Stock Market LIVE Updates | Karnataka Bank slumps 4% after net profit sharply declines by 19% YoY in Q2FY24

Total income Rs 2,276 crore in Q2FY24 vs Rs 2,031 crore in Q2FY23

Gross NPA at 3.4% in Q2FY24 vs 3.3% in Q2FY23

Net NPA at 1.3% in Q2FY24 vs 1.7% in Q2FY23

Net interest margin at 3.5% in Q2FY24 vs 3.78% in Q2FY23

-330

November 02, 2023· 14:25 IST

Stock Market LIVE Updates | ATV Projects slips 2% after net profit declines 20% QoQ in Q2FY24

-330

November 02, 2023· 14:16 IST

-330

November 02, 2023· 14:12 IST

| Company | CMP | Chg(%) | 3 Days Ago Price |

|---|---|---|---|

| Natural Biocon | 14.91 | 63.67 | 9.11 |

| Natura Hue | 12.44 | 52.83 | 8.14 |

| Globalspace Tec | 56.43 | 39.06 | 40.58 |

| Starlog Enter | 41.05 | 33.06 | 30.85 |

| Orbit Exports | 221.20 | 30.58 | 169.40 |

| City Crops Agro | 25.94 | 29.70 | 20.00 |

| Apollo Micro Sy | 97.17 | 27.39 | 76.28 |

| Apollo Micro Sy | 97.17 | 27.39 | 76.28 |

| BNR Udyog | 53.56 | 26.95 | 42.19 |

| Riddhi Steel & | 72.30 | 26.80 | 57.02 |

-330

November 02, 2023· 14:06 IST

Stock Market LIVE Updates | Macquarie View On Sun Pharmaceutical Industries:

-Outperform call, target Rs 1,275 per share

-Q2 branded businesses shine

-Revenue & adjusted EBITDA largely in-line, while adjusted profit/reported profit beat estimate by 6 percent/4 percent

-Management sounded positive about its innovation medicines business

-Major products including Ilumya, Winlevi, Cequa witnessing encouraging prescription growth trends

-330

November 02, 2023· 14:00 IST

Sensex Today | Sameer Kaul, Managing Director & CEO – TrustPlutus Wealth (India):

We believe that the message from the Fed is that they are highly attentive to inflation risks and while job gains have moderated and economic activity remains strong, the extent of the effect of their past actions on financial conditions and its impact on the economy, hiring and inflation will determine future direction of Fed policy.

As we now we are cautiously optimistic that the rate cycle seems to have peaked.

-330

November 02, 2023· 14:00 IST

| Company | Price at 13:00 | Price at 13:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| Deepak Fert | 632.50 | 600.00 | -32.50 17.71k |

| Century Enka | 453.30 | 431.60 | -21.70 6.50k |

| ASL Industries | 38.00 | 36.25 | -1.75 0 |

| Airo Lam | 117.80 | 112.55 | -5.25 6.58k |

| JHS Svendgaard | 21.65 | 20.75 | -0.90 1.33k |

| Hindustan Media | 85.00 | 81.75 | -3.25 2.10k |

| Viviana Power | 138.00 | 133.00 | -5.00 500 |

| Arvind and Comp | 67.50 | 65.10 | -2.40 8.42k |

| NRB Industrial | 30.65 | 29.75 | -0.90 507 |

| Baheti Recyclin | 206.00 | 200.00 | -6.00 600 |

-330

November 02, 2023· 13:56 IST

Stock Market LIVE Updates | Sundaram Finance Q2

Net profit at Rs 90.7 crore versus Rs 33.3 crore and revenue up 45% at Rs 2,439 crore versus Rs 1,682.4 crore, YoY.

-330

November 02, 2023· 13:55 IST

| Company | Price at 13:00 | Price at 13:53 | Chg(%) Hourly Vol |

|---|---|---|---|

| Kakatiya Cement | 214.00 | 228.25 | 14.25 114 |

| Modison | 81.35 | 86.40 | 5.05 5.85k |

| Ndr Auto Compon | 650.00 | 679.80 | 29.80 1.92k |

| Aurionpro Solut | 1,571.00 | 1,641.55 | 70.55 2.18k |

| Global Surfaces | 206.75 | 215.75 | 9.00 4.25k |

| Transindia Real | 39.10 | 40.80 | 1.70 22.91k |

| TRF | 267.40 | 278.80 | 11.40 101.51k |

| Adani Power | 366.25 | 381.35 | 15.10 179.50k |

| Monarch Net | 409.00 | 425.85 | 16.85 221.60k |

| Lotus Eye Care | 86.20 | 89.50 | 3.30 123 |

-330

November 02, 2023· 13:54 IST

Stock Market LIVE Updates | Indian Metals & Ferro Alloys Q2 Earnings:

Net profit at Rs 89.2 crore versus Rs 16.3 crore and revenue up 3% at Rs 692.6 crore versus Rs 672.5 crore, YoY.

-330

November 02, 2023· 13:53 IST

Stock Market LIVE Updates | Deepak Fertilisers And Petrochemicals Corporation Q2 Results:

Net profit down 78% at Rs 60.1 crore versus Rs 272 crore and revenue down 10.9% at Rs 2,424 crore versus Rs 2,719 crore, YoY.

-330

November 02, 2023· 13:51 IST

Stock Market LIVE Updates | Adani Power Q2 Results:

Net profit at Rs 6,594 crore versus Rs 696 crore and revenue up 84% at Rs 12,990 crore versus Rs 7,044 crore, YoY.

-330

November 02, 2023· 13:48 IST

Stock Market LIVE Updates | REC up 7% powered by strong Q2 performance

REC was trading almost 7 percent higher at mid-day on November 2, a day after the state-run company reported a good set of numbers for the September quarter of the current financial year.

REC, formerly Rural Electrification Corporation, reported a 30.72 percent year-on-year increase in profit at Rs 3,789.90 crore, the company said in a regulatory filing.

Its earnings before interest, taxes, depreciation and amortisation (EBITDA) were at R. 12,193.52 crore, up 32.98 percent from the year-ago period. Net sales of Rs 11,688.24 crore were 17.4 percent higher than the year-ago quarter. Read More

-330

November 02, 2023· 13:45 IST

Stock Market LIVE Updates | Berger Paints Q2 results:

Net profit rose 32.9 percent at Rs 291.6 crore versus Rs 219 crore and revenue up 3.6% at Rs 2,767 crore versus Rs 2,671 crore, YoY.

-330

November 02, 2023· 13:44 IST

Sensex Today | Nifty Auto index rose 0.5 percent supported by MRF, Ashok Leyland, Eicher Motors:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| MRF | 110,630.00 | 1.88 | 3.49k |

| Ashok Leyland | 167.80 | 1.64 | 3.32m |

| Eicher Motors | 3,330.05 | 1.46 | 299.05k |

| Tata Motors | 636.40 | 1.39 | 6.27m |

| M&M | 1,467.00 | 0.85 | 1.46m |

| Maruti Suzuki | 10,294.00 | 0.65 | 376.68k |

| Bosch | 19,477.00 | 0.61 | 7.58k |

| Tube Investment | 3,122.70 | 0.56 | 33.97k |

| Bharat Forge | 1,031.65 | 0.43 | 316.97k |

| MOTHERSON | 92.20 | 0.33 | 2.53m |

-330

November 02, 2023· 13:39 IST

Stock Market LIVE Updates | Dr Lal PathLabs Q2 Earnings:

Net profit jumped 52.4 percent at Rs 109.3 crore versus Rs 72 crore and revenue up 12.6 percent at Rs 601 crore versus Rs 534 crore, YoY.

-330

November 02, 2023· 13:36 IST

| Company | 52-Week High | Day’s High | CMP |

|---|---|---|---|

| REC | 307.35 | 307.35 | 303.25 |

| Power Finance | 259.25 | 259.25 | 257.20 |

| Vodafone Idea | 13.75 | 13.75 | 13.51 |

| Macrotech Dev | 850.00 | 850.00 | 835.25 |

| Oberoi Realty | 1214.65 | 1214.65 | 1,208.00 |

| Esab India | 5933.30 | 5933.30 | 5,905.65 |

| IndusInd Bank | 1479.10 | 1479.10 | 1,458.30 |

| Global Health | 830.30 | 830.30 | 815.10 |

| Colgate | 2138.10 | 2138.10 | 2,120.55 |

| KPIT Tech | 1279.05 | 1279.05 | 1,232.45 |

-330

November 02, 2023· 13:34 IST

Stock Market LIVE Updates | Morgan Stanley View On Navin Fluorine International:

-Overweight call, target Rs 4,951 per share

-Company’s Q2 earnings highlighted uncertainty around demand

-Uncertainty amid multiple offtake deferrals and unplanned outages

-Better offtake expected in H2 but a full recovery in volume deferred appears challenging

-330

November 02, 2023· 13:31 IST

Stock Market LIVE Updates | Sapphire Foods India Q2 Results:

Net profit down 43% at Rs 15.3 crore versus Rs 27 crore and revenue up 14.2% at Rs 643 crore versus Rs 563 crore, YoY.

-330

November 02, 2023· 13:29 IST

Stock Market LIVE Updates | Infibeam Avenues acquires Sintex Corporate House from Aavas Trust for Rs 100 crore

Infibeam Avenues Ltd’s subsidiary Infibeam Projects Management Pvt Ltd has successfully acquired the partially constructed Sintex Corporate House from Aavas Trust, owned by Aditya Birla Group. The deal has been concluded with an investment of approximately Rs 1 Billion, securing a plot area spanning about 76,250 square feet, along with a partially constructed building covering an area of 420,000 square feet.

With this the company has moved one step closer towards successfully executing its plan for fostering the development of an AI and tech ecosystem, which can be finely tuned to meet the specific requirement of the company’s Artificial Intelligence (AI) operations while facilitating AI startups and businesses flourishing independently in a mutually beneficial ‘symbiotic’ framework.

-330

November 02, 2023· 13:27 IST

| Company | CMP | High Low | Fall from Day's High |

|---|---|---|---|

| Triveni Turbine | 372.40 | 372.45 358.00 | -0.01% |

| Interglobe Avi | 2,479.20 | 2,480.00 2,422.70 | -0.03% |

| Zydus Wellness | 1,545.55 | 1,546.10 1,529.25 | -0.04% |

| Radico Khaitan | 1,258.85 | 1,259.40 1,223.65 | -0.04% |

| Borosil Renew | 417.75 | 418.00 408.85 | -0.06% |

| SRF | 2,239.75 | 2,241.00 2,187.75 | -0.06% |

| Hikal | 282.90 | 283.10 279.00 | -0.07% |

| Hindustan Aeron | 1,845.05 | 1,846.75 1,823.00 | -0.09% |

| Power Grid Corp | 202.10 | 202.30 201.00 | -0.1% |

| Grasim | 1,894.90 | 1,897.00 1,880.00 | -0.11% |

-330

November 02, 2023· 13:23 IST

Sensex Today | Mamaearth IPO subscribed 1.24 times, QIB portion booked 1.86 times on Final day

Mamaearth’s parent, Honasa Consumer IPO has been subscribed 1.24 times so far on November 2, the final day of bidding, receiving bids for 3.58 crore shares against the issue size of 2.89 crore shares. Retail investors bought 0.76 times, high net worth individuals (HNI) bought 0.31 times and qualified institutional buyers (QIB) picked 1.86 times of the allotted quota.

Varun Alagh and Ghazal Alag owned firm has reserved 75 percent of the net issue size for QIBs, 15 percent for HNIs and the remaining 10 percent for retail investors. The price band for the offer, which opened on October 31, has been fixed at Rs 308-324 per share.

Employees, who have Rs 1 crore worth of shares reserved in the IPO, have bought 3.72 times the allotted quota. Employees will get the reserved shares at a discount of Rs 30 per share to the final issue price. Read More

-330

November 02, 2023· 13:18 IST

Sensex Today | BSE Power index gained 1 percent led by BHEL, JSW Energy, Tata Power:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| BHEL | 125.95 | 3.66 | 786.22k |

| JSW Energy | 388.20 | 2.96 | 131.71k |

| Tata Power | 241.90 | 2.11 | 254.84k |

| Adani Green Ene | 895.40 | 1.82 | 17.56k |

| Siemens | 3,376.70 | 1.56 | 4.57k |

| NTPC | 235.40 | 1.16 | 111.11k |

| NHPC | 49.93 | 0.91 | 271.75k |

| Adani Energy | 756.95 | 0.87 | 26.41k |

| Adani Power | 367.50 | 0.68 | 259.04k |

| ABB India | 4,079.00 | 0.64 | 1.11k |

-330

November 02, 2023· 13:16 IST

Stock Market LIVE Updates | Akzo Nobel India Q2:

Net profit up 44 percent at Rs 94.2 crore versus Rs 11.5 crore and revenue up 3.2 percent at Rs 956.3 crore versus Rs 926 crore, YoY.

-330

November 02, 2023· 13:16 IST

Stock Market LIVE Updates | Clean Science & Technology Q2 Results

Net profit down 23.1 percent at Rs 52.2 crore versus Rs 67.9 crore and revenue down 26.8 percent at Rs 181.1 crore versus Rs 247.5 crore, YoY.

-330

November 02, 2023· 13:13 IST

Stock Market LIVE Updates | Citi View On Sun Pharmaceutical Industries:

-Buy call, target raised to Rs 1,380 per share from Rs 1,275 per share

-Q2 saw healthy underlying margin trends

-Current margin trends along with traction across businesses

-Potential recovery in US generics suggest a better margin outlook

-Management remains confident on specialty outlook

-Raise FY24/25 estimate by 9 percent/4 percent

-330

November 02, 2023· 13:08 IST

Stock Market LIVE Updates | Minda Corporation forms JV with HSIN Chong Machinery Works

Minda Corporation has entered into agreement for forming a Joint Venture (JV) with HSIN Chong Machinery Works Co. Ltd. (HCMF) from Taiwan, a leading global manufacturer of automotive Sunroof and closure systems.

This partnership aims to provide cutting-edge technology backed by state-of-the-art manufacturing of Sunroof and Closure Technology Products for passenger cars by localization in India.

-330

November 02, 2023· 13:06 IST

Stock Market LIVE Updates | Jtekt India Q2:

Net profit down 3% at Rs 27 crore versus Rs 28 crore and revenue up 2.3% at Rs 584 crore versus Rs 571 crore, YoY.

-330

November 02, 2023· 13:04 IST

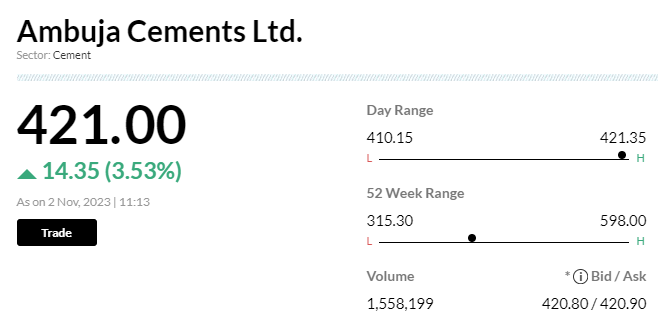

Stock Market LIVE Updates | Morgan Stanley View On Ambuja Cements

-Equal-weight call, target Rs 390 per share

-Both standalone & consolidated Q2 EBITDA weaker than expected

-EBITDA came weaker given weak volumes and realisations

-Medium-term expansion plans are intact and execution on various initiatives is key

-Near-term growth is expected to remain challenging

-Risk-reward looks balanced on a relative basis

-330

November 02, 2023· 13:01 IST

Sensex Today | Market at 1 PM

The Sensex was up 373.94 points or 0.59 percent at 63,965.27, and the Nifty was up 116.70 points or 0.61 percent at 19,105.90. About 2049 shares advanced, 1069 shares declined, and 106 shares unchanged.

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| IndusInd Bank | 1,459.50 | 1.93 | 38.05k |

| Sun Pharma | 1,135.50 | 1.73 | 32.92k |

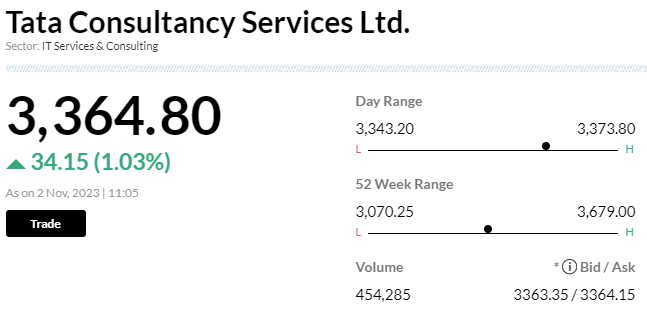

| TCS | 3,369.10 | 1.1 | 27.88k |

| Bharti Airtel | 923.60 | 1.09 | 25.76k |

| NTPC | 235.20 | 1.07 | 109.52k |

| Tata Motors | 633.70 | 1.01 | 176.69k |

| Infosys | 1,366.50 | 0.96 | 44.00k |

| HCL Tech | 1,271.70 | 0.96 | 20.06k |

| Reliance | 2,317.50 | 0.91 | 61.37k |

| Axis Bank | 979.90 | 0.87 | 58.00k |

-330

November 02, 2023· 13:00 IST

Sensex Today | Madhavi Arora, Lead Economist, Emkay Global Financial Services:

As widely expected, the Fed unanimously kept rates on hold, retaining its guidance for potential “additional policy firming.” However, the policy message is becoming “more two-sided.” The statement did add that “financial” as well as credit conditions should weigh on the outlook, and in his presser, Chair Powell acknowledged the Fed is monitoring how long tighter conditions might persist. Owing to this, yields fell and stocks rose while USD weakened too. Powell also avowed that the Fed could afford to be more careful given how much policy has tightened already, but noted the debate going forward is whether the data would confirm that the current stance is sufficiently restrictive to sustainably return inflation to the Fed’s 2% target. He thus left open the door for additional rate hikes even though he didn’t defend the Sept Dot plot which implies one more hike in Dec. We continue to think that the Fed is done hiking.

Powell sounded quite pleased with the effort to bring down inflation, where he saw “pretty significant progress.” He sounded optimistic that fading pandemic distortions and rising labor supply (notably from immigration) could help this process—although Powell noted that he, like most of the FOMC, still believes some further softening of the labor market and slowing of growth will be necessary. While we continue to see Fed on hold in December and through the first half of next year, we think the UST bear steepening would find some solace as Fed’s tone gets softer. However, the rising term premium will likely be the next structural driver of higher yields in coming years.

-330

November 02, 2023· 12:57 IST

| Company | Price at 12:00 | Price at 12:56 | Chg(%) Hourly Vol |

|---|---|---|---|

| Ndr Auto Compon | 694.00 | 650.00 | -44.00 338 |

| Jay Jalaram | 310.00 | 299.00 | -11.00 445 |

| Naga Dhunseri | 1,973.00 | 1,903.50 | -69.50 116 |

| Fert and Chem | 778.35 | 751.00 | -27.35 649.69k |

| A G Universal | 104.50 | 101.00 | -3.50 1000 |

| Pulz Electronic | 88.20 | 85.60 | -2.60 7.09k |

| SHUBHLAXMI | 91.00 | 88.50 | -2.50 0 |

| Nirman Agri | 220.00 | 214.00 | -6.00 2.36k |

| Precot | 214.30 | 208.55 | -5.75 354 |

| Felix Industrie | 122.20 | 119.05 | -3.15 810 |

-330

November 02, 2023· 12:55 IST

| Company | Price at 12:00 | Price at 12:54 | Chg(%) Hourly Vol |

|---|---|---|---|

| Lincoln Pharma | 499.50 | 547.00 | 47.50 3.82k |

| Rane Brake | 817.00 | 860.00 | 43.00 1.15k |

| Plada Infotech | 43.30 | 45.45 | 2.15 6.00k |

| AVT Natural | 88.00 | 91.75 | 3.75 68.95k |

| Hi-Green Carbon | 144.95 | 150.95 | 6.00 - |

| SIL Invest | 365.20 | 380.00 | 14.80 3.32k |

| Agro Tech Foods | 788.20 | 818.50 | 30.30 320 |

| Globesecure | 69.60 | 72.25 | 2.65 17.50k |

| Arvind and Comp | 65.10 | 67.50 | 2.40 15.31k |

| Global Pet | 83.00 | 86.00 | 3.00 5.88k |

-330

November 02, 2023· 12:54 IST

Stock Market LIVE Updates | Godrej Consumer Products Q2 Results:

Consolidated net profit up 22% at Rs 67 crore versus Rs 55 crore and revenue at Rs 343 crore versus Rs 165 crore, YoY.

-330

November 02, 2023· 12:52 IST

Stock Market LIVE Updates | Tata Motors likely to turn profitable on benign commodity costs, operating leverage

Tata Motors, India's leading electric vehicle manufacturer, is expected to remain in the black with a net profit of Rs 3,215 crore in the second quarter buoyed by softening commodity costs, JLR's volume ramp-up, and operating leverage. The Nexon-maker is slated to announce its Q2 results on November 2.

As per the average estimate of five brokerage firms, the company's revenue from operations is expected to increase by 28 percent to Rs 1,01,155 crore. During the same period last year, the company's revenue stood at Rs 79,611 crore. Read More

-330

November 02, 2023· 12:49 IST

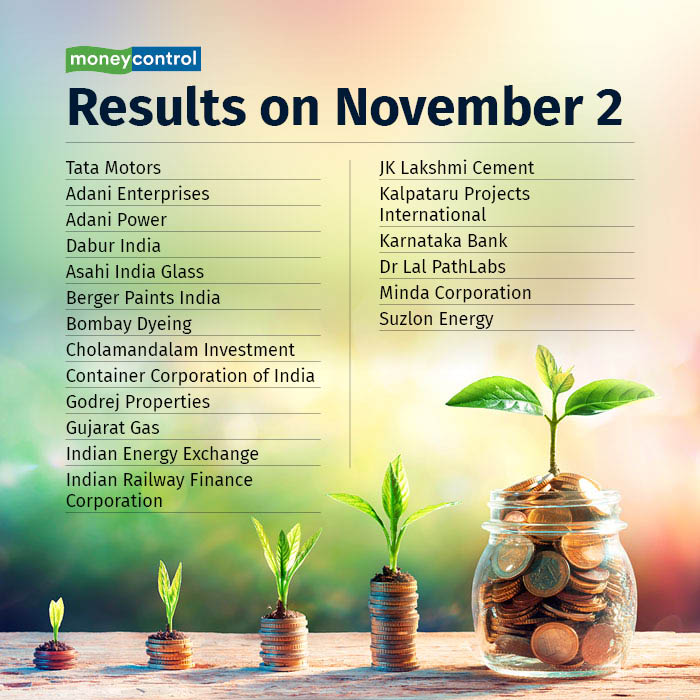

Earnings Today:

-330

November 02, 2023· 12:47 IST

Stock Market LIVE Updates | Lupin receives tentative approval from USFDA for Selexipag for injection

Lupin has received tentative approval from the United States Food and Drug Administration (USFDA) for its Abbreviated New Drug Application for Selexipag for Injection, 1800 mcg/vial, Single-Dose Vial, to market a generic equivalent of Uptravi for Injection, 1800 mcg/vial, of Actelion Pharmaceuticals US, Inc. This product will be manufactured at Lupin’s Nagpur facility in India.

-330

November 02, 2023· 12:44 IST

Stock Market LIVE Updates | Godrej Consumer Products Q2 profit rises 20.6% YoY to Rs 433 crore with fall in input cost

Godrej Consumer Products has registered a 20.6% on-year growth in consolidated profit at Rs 432.8 crore for quarter ended September FY24, driven by healthy operating performance post decline in input cost. Consolidated revenue from operations grew by 6.2% year-on-year to Rs 3,602 crore in Q2FY24, led by volume growth of 10 percent. Constant currency growth stood at 16% year-on-year.

-330

November 02, 2023· 12:40 IST

Stock Market LIVE Updates | Lincoln Pharmaceuticals Q2 Earnings:

Net profit up 16.5% at Rs 27.6 crore versus Rs 24 crore and revenue up 11% at Rs 156 crore versus Rs 141 crore, YoY.

-330

November 02, 2023· 12:39 IST

-330

November 02, 2023· 12:38 IST

Stock Market LIVE Updates | HDFC Bank appoints Sachin Suryakant Rane as Bank’s Chief of Internal Vigilance

HDFC Bank has received board approval for appointment of Sachin Suryakant Rane as bank’s Chief of Internal Vigilance for three years, with effect from November 1, after the end of tenure of Prasun Singh as Chief of Internal Vigilance of the bank on October 31.

-330

November 02, 2023· 12:35 IST

Sensex Today | Gold firms as dollar, yields slip after Fed keeps rates steady

Gold prices edged higher on Thursday, buoyed by a weaker U.S. dollar and fall in Treasury yields after the Federal Reserve held interest rates steady and as investors stepped up bets that the central bank may be done with rate hikes.

Spot gold was up 0.2% to $1,986.29 per ounce by 0540 GMT. U.S. gold futures gained 0.3% to $1,993.90.

-330

November 02, 2023· 12:27 IST

Stock Market LIVE Updates | Citi View On LIC Housing Finance

-Buy call, target raised to Rs 535 per share from Rs 490 per share

-Q2 NIM at >3 percent, RoA at 1.7 percent, growth muted

-Earnings beat once again in Q2 was buoyed by NIM sustaining at >3 percent

-NIM sustaining leading to a PPOP beat of 15 percent

-Credit cost was also well contained at approximately 60 bps

-Credit cost well contained despite technical write-offs of Rs 925 crore

-Disbursements picked up post Q1 disruptions

-Disbursements higher but still down 12 percent YoY, leading to muted loan growth of 6 percent YoY/Flat QoQ

-330

November 02, 2023· 12:24 IST

Sensex Today | Dollar slips as traders see US rates peaking

The dollar fell broadly on Thursday, with risk-sensitive Asian currencies leading gains, as investors cheered a likely peak in U.S. interest rates after the Federal Reserve left them on hold.

Focus now turns to the Bank of England and sterling crept 0.3% higher to $1.2180 and firmed to 86.98 per euro in anticipation of rates being held at high levels.

The Australian dollar jumped 0.9% on Wednesday and another 0.7% on Thursday to touch a three-week high of $0.6439. The New Zealand dollar hit a two-week peak of $0.5896.

Bitcoin, sometimes traded as a proxy for risk-taking, broke above $35,000 for the first time since May 2022.

-330

November 02, 2023· 12:19 IST

Sensex Today | Nifty PSU Bank index rose 1 percent led by Bank of India, Bank of Maharashtra, Union Bank of India:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Bank of India | 100.40 | 2.4 | 9.06m |

| Bank of Mah | 42.10 | 1.81 | 20.00m |

| Union Bank | 104.95 | 1.65 | 18.69m |

| IOB | 39.70 | 1.53 | 34.58m |

| Central Bank | 43.80 | 1.51 | 9.83m |

| Punjab & Sind | 40.20 | 1.26 | 1.31m |

| Bank of Baroda | 197.85 | 1.2 | 5.95m |

| PNB | 73.70 | 1.1 | 30.36m |

| JK Bank | 106.25 | 1.09 | 2.05m |

| Canara Bank | 386.00 | 0.7 | 4.35m |

-330

November 02, 2023· 12:14 IST

Stock Market LIVE Updates | Kansai Nerolac Paints trades lower on profit taking after strong Q2 numbers

Kansai Nerolac dropped nearly a percent on November 2 morning as investors booked profit, a day after the paint company registered a 56 percent year-on-year jump in profit in the September quarter at Rs 177 crore.

Kansai Nerolac Paints' profit grew despite tepid growth in topline, driven by strong operating performance with a fall in input cost. Revenue grew by 1.3 percent on-year at Rs 1,957 crore, the company said on November 2 in an after-market-hours announcement. Read More

-330

November 02, 2023· 12:11 IST

-330

November 02, 2023· 12:06 IST

Stock Market LIVE Updates | Chirag Shah resigns as Head – Telco at Nazara Technologies, Siddharth Kedia resigns as CEO of Nodwin Gaming

Chirag Shah has resigned as the Head – Telco of Nazara Technologies that operates gaming and sports media platform, with effect from October 31, to pursue new challenges and opportunities.

Siddharth Kedia has also resigned as the Chief executive officer of Nodwin Gaming, subsidiary of Nazara, with effect from October 31, to pursue new challenges and opportunities.

Karandeep Singh, the CFO of Nodwin, will assume responsibilities related to acquisitions and investor relations which were previously held by Sidharth Kedia, while Gautam Singh Virk, the Co-CEO of Nodwin, will take charge of the operational aspects of the role.

-330

November 02, 2023· 12:00 IST

Sensex Today | Market at 12 PM

The Sensex was up 270.20 points or 0.42 percent at 63,861.53, and the Nifty was up 86.80 points or 0.46 percent at 19,076. About 2042 shares advanced, 1016 shares declined, and 122 shares unchanged.

-330

November 02, 2023· 11:57 IST

| Company | Price at 11:00 | Price at 11:53 | Chg(%) Hourly Vol |

|---|---|---|---|

| Ducol Organics | 149.90 | 141.50 | -8.40 6.78k |

| Newjaisa Tech | 141.50 | 135.00 | -6.50 - |

| Surani Steel Tu | 314.90 | 301.90 | -13.00 5.40k |

| Pansari Develop | 76.80 | 73.65 | -3.15 341 |

| Dynacons Sys | 672.00 | 645.55 | -26.45 33.21k |

| Plada Infotech | 45.00 | 43.30 | -1.70 20.52k |

| Poddar Housing | 155.90 | 150.00 | -5.90 757 |

| Cupid | 697.85 | 674.15 | -23.70 329.57k |

| Pudumjee Ind | 26.45 | 25.65 | -0.80 1.30k |

| Infinium Pharma | 264.00 | 256.10 | -7.90 840 |

-330

November 02, 2023· 11:55 IST

| Company | Price at 11:00 | Price at 11:53 | Chg(%) Hourly Vol |

|---|---|---|---|

| Ushanti Colour | 58.55 | 62.40 | 3.85 13.72k |

| Jindal Drilling | 650.15 | 689.00 | 38.85 49.20k |

| Holmarc Opto Me | 123.00 | 130.00 | 7.00 - |

| PTC India Fin | 29.70 | 31.25 | 1.55 1.93m |

| Digispice Tech | 26.55 | 27.80 | 1.25 23.64k |

| Bohra Industrie | 48.00 | 50.00 | 2.00 596 |

| UFO Moviez | 111.00 | 115.40 | 4.40 13.50k |

| Max Estates | 254.90 | 264.00 | 9.10 77.78k |

| AYM Syntex | 67.40 | 69.75 | 2.35 1.76k |

| Hercules Hoists | 315.50 | 326.25 | 10.75 6.18k |

-330

November 02, 2023· 11:53 IST

Sensex Today | Ghazal Jain, Fund Manager, Quantum Mutual fund:

The Federal Reserve’s decision to skip a hike again even while the US economy continues to show unexpected strength and inflation slows sluggishly, tells us that the central bank is in a tricky spot. The recent rise in market-based interest rates have made financial conditions very restrictive, possibly doing some of the Fed’s work for them. Additionally, the full impact of their tightening is yet to be felt, making it appropriate to pause. Additional rate hikes at this juncture could result in overtightening and seriously damage the ‘soft landing’ that the Fed is aiming for.

However, the Fed cannot declare tightening over with growth this strong and inflation still above target, which keeps the door open for another hike. The ‘higher for longer’ stance should keep markets on edge. Gold prices are currently supported by geopolitical tensions in the Middle East and prospects of the Fed easing policy in 2024.

-330

November 02, 2023· 11:49 IST

Stock Market LIVE Updates | Coal India October production up 15.4% at 61.1 mt against 52.9 mt and Offtake up 14.8% at 61.6 mt versus 53.7 mt, YoY.

-330

November 02, 2023· 11:47 IST

Sensex Today | V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services:

Even though the pause decision of the Fed was on expected lines, the commentary was not hawkish as the market feared. The Fed chief Jerome Powell’s comment that “despite elevated inflation, the longer term inflation expectations remain well anchored” was taken by the market as a slightly dovish statement. The implication of this statement is that the Fed may not hike rates again in this rate hiking cycle. Consequently the bond yields declined sharply. The benchmark 10-year bond yield declined by 17 bp to 4.75 % and the equity markets responded positively.

This subtle dovish commentary surprised the market which was expecting a hawkish pause in the light of the 4.9% Q3 GDP growth.

In the near-term, the dollar index at around 106, Brent crude at around $ 85 and the 10-year US bond yield at 4.75 % are favourable for stock markets, globally.

There is a possibility that the FIIs who were sustained sellers in October may turn buyers and if that happens, short-covering can take markets higher despite the uncertainty surrounding the Israel-Hamas conflict. The fact that Brent crude has corrected sharply from the recent peak of $ 93.5 to $ 85 now indicates that the market doesn’t expect the Israel-Hamas conflict to widen impacting crude prices.

From the valuation and growth perspective, leading banks provide good buying opportunities. IT can stage a comeback. Automobiles, capital goods, select pharma and construction related segments will do well. There is lot of investor enthusiasm in digital stocks like Zomato and Paytm.

-330

November 02, 2023· 11:45 IST

Sensex Today | BSE Realty index rose 1 percent supported by Macrotech Developers, Oberoi Realty, Godrej Properties:

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Macrotech Dev | 830.95 | 3.17 | 83.82k |

| Oberoi Realty | 1,190.35 | 2.15 | 21.43k |

| Godrej Prop | 1,700.60 | 2.13 | 13.51k |

| Phoenix Mills | 1,926.00 | 1.68 | 2.43k |

| Sobha | 731.00 | 1.21 | 8.53k |

| Mahindra Life | 483.50 | 1.11 | 5.13k |

| Brigade Ent | 627.60 | 1.05 | 750 |

| Prestige Estate | 752.80 | 0.76 | 10.19k |

| Indiabulls Real | 73.51 | 0.07 | 207.73k |

-330

November 02, 2023· 11:42 IST

Stock Market LIVE Updates | Pfizer transfers property in Thane to Zoetis Pharma for Rs 264 crore

Pfizer has entered into an agreement for transferring and assigning unexpired leasehold rights in the MIDC land in Turbhe, Thane and sale of structures & buildings constructed thereon, to Zoetis Pharmaceutical Research, for Rs 264.40 crore.

-330

November 02, 2023· 11:40 IST

Stock Market LIVE Updates | Bondada Engineering bags work order worth Rs 381 crore from Bharat Sanchar Nigam

Bondada Engineering has received work order worth Rs 381 crore from Bharat Sanchar Nigam. The firm will provide infrastructure as a service (IaaSP) for supply and erection of GBT, supply installation of infrastructure item and subsequent operation & maintenance for 5 years.

-330

November 02, 2023· 11:38 IST

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY AUTO | 15881.35 0.29 | 25.93 -0.45 | -1.87 19.25 |

| NIFTY IT | 30533.40 0.62 | 6.68 1.02 | -3.94 4.79 |

| NIFTY PHARMA | 14860.95 0.85 | 17.97 1.45 | -3.64 9.62 |

| NIFTY FMCG | 51303.75 0.42 | 16.15 0.71 | -0.58 15.20 |

| NIFTY PSU BANK | 5008.15 1.17 | 15.97 5.96 | -4.76 46.86 |

| NIFTY METAL | 6411.50 0.81 | -4.64 0.21 | -6.26 5.53 |

| NIFTY REALTY | 619.85 1.22 | 43.55 8.39 | 7.68 41.15 |

| NIFTY ENERGY | 26897.40 0.82 | 3.97 3.27 | -1.55 -0.08 |

| NIFTY INFRA | 6121.70 0.85 | 16.56 2.43 | -1.94 16.74 |

| NIFTY MEDIA | 2229.40 0.49 | 11.91 4.88 | -1.71 7.48 |

-330

November 02, 2023· 11:36 IST

-330

November 02, 2023· 11:32 IST

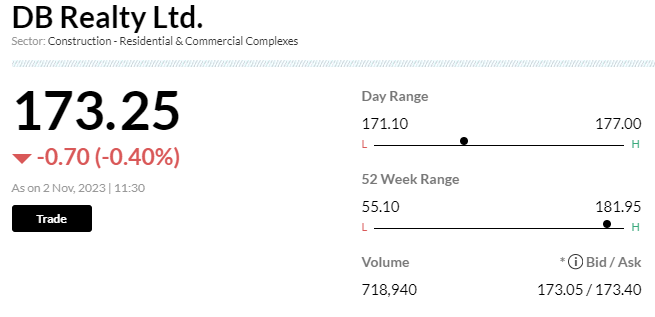

Stock Market LIVE Updates | DB Realty sells arm Siddhivinayak Realties to Reliance Commercial Fin for Rs 376.18 cr

Realty major DB Realty sold its arm Siddhivinayak Realties to Reliance Commercial Fin for a total of Rs 376.18 crore in order to settle a part of its liabilities.

-330

November 02, 2023· 11:27 IST

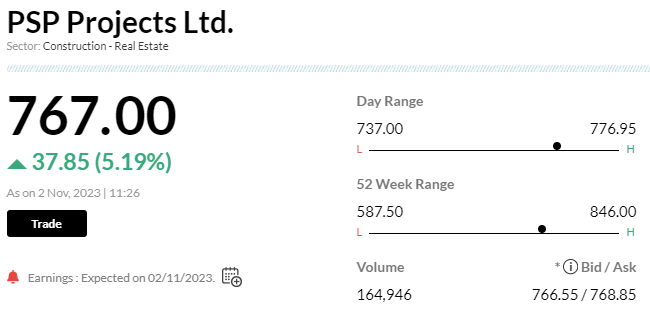

Stock Market LIVE Updates | PSP Projects Q2 net profit surges 79.1% to Rs 38.50 crore

PSP Projects reported a 79.1 percent on year surge in Q2 net profit to Rs 38.50 crore while its revenue jumped 72.2 percent to Rs 620 crore. The company had posted a net profit and revenue of Rs 22 crore and Rs 360 crore in the same quarter of the previous fiscal.

EBITDA margin also expanded to 11.7 percent in July-September as against 11 percent recorded in the year ago period.

-330

November 02, 2023· 11:23 IST

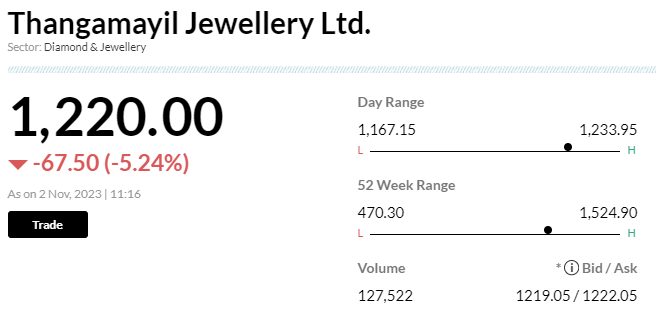

Stock Market LIVE Updates | Thangamayil Jewellery crashes 18% in 2 days after weak Q2 results

Investors dumped shares of Thangamayil Jewellery as it crashed 18 percent in two days after the company’s weak second quarter (Q2FY24) performance.

The company’s net profit sharply dropped by 47 percent year-on-year to Rs 8 crore in Q2FY24 as compared to Rs 15 crore in the year-ago period.

Total income, however, rose 22 percent YoY to Rs 993 crore in Q2FY24 led by strong sales of gold jewellery and non-gold items such as silver and diamond.

Volume-wise, gold ornaments increased 16 percent YoY, while silver products dropped 10 percent YoY, and diamond products climbed 38 percent YoY in the September-ended quarter.

“We posted highest half yearly sales in the company’s history. We expect festive season to keep this bullish momentum intact going ahead. We are projecting revenue at Rs 4,000 crore by the end of this year. We expect margins at 6 percent at FY24, while same-store-sales growth (SSSG) will be maintained at 26 percent. Since prices of gold have increased in Q3 so far, inventory benefits will start to trickle in,” said SM Lakshmanan, VP – Finance & Accounts, Thangamayil Jewellery.

-330

November 02, 2023· 11:14 IST

Stock Market LIVE Updates | Citi slashes price target for Ambuja Cements

-Buy call, target cut to Rs 500/share from Rs 535/share

-Q2 mkt share loss, mgmt expects volumes & EBITDA upside

-Buy on Adani’s ambitions to double capacity (most near-term capex appears to be in Ambuja)

-Buy on upsides from cost efficiencies (Ambuja expects ₹1,400-₹1,500/tonne EBITDA improvement)

-Buy on a favorable swap ratio for co should there be a merger with ACC

-Ambuja trades at $145 EV/tonne (57 MT attributable capacity)

-Pending clarity on alignment of grinding capacities with clinker

-Stock may be range bound in near-term

-330

November 02, 2023· 11:08 IST

Stock Market LIVE Updates | Cognizant forecasts quarterly revenue below estimates on weak corporate spending

Cognizant Technology Solutions forecast fourth-quarter revenue below Wall Street estimates on Wednesday, as clients tighten their IT budgets in an uncertain economy, sending its shares down more than 3 percent in extended trading.

The Teaneck, New Jersey-based company expects current-quarter revenue between $4.69 billion and $4.82 billion, compared with market estimates of $4.86 billion, according to LSEG data.

Rising borrowing costs and fears of a slowdown are driving most companies to keep a tight leash on their spending, especially on non-core IT functions, which have been a lucrative revenue stream for technology service providers.

Indian IT services giants Infosys cut the upper end of its annual revenue forecast earlier in Oct, raising concerns about near-term demand, while Tata Consultancy Services reported weaker-than-expected quarterly revenue. Read More

-330

November 02, 2023· 11:06 IST

Stock Market LIVE Updates | TCS launches new generation AI-powered cyber insights platform on Amazon Security Lake

-330

November 02, 2023· 11:02 IST

-330

November 02, 2023· 10:59 IST

| Company | Price at 10:00 | Price at 10:58 | Chg(%) Hourly Vol |

|---|---|---|---|

| Innovassynth | 26.42 | 24.02 | -2.40 2.08k |

| Premier Polyfil | 174.00 | 158.40 | -15.60 1.71k |

| Cybele Ind | 26.50 | 24.25 | -2.25 0 |

| JISL | 29.50 | 27.11 | -2.39 108 |

| Phyto Chem | 42.50 | 39.55 | -2.95 49 |

| Betex | 196.00 | 183.35 | -12.65 955 |

| Ganga Papers | 82.40 | 77.10 | -5.30 543 |

| Kaycee Ind | 12,380.00 | 11,593.30 | -786.70 14 |

| Nimbus Projects | 32.49 | 30.45 | -2.04 46 |

| Pioneer Invest | 34.10 | 32.05 | -2.05 15 |

-330

November 02, 2023· 10:57 IST

| Company | Price at 10:00 | Price at 10:55 | Chg(%) Hourly Vol |

|---|---|---|---|

| BDH Industries | 186.15 | 211.00 | 24.85 150 |

| Precision Elec | 54.55 | 60.00 | 5.45 63 |

| Sarthak Ind | 23.55 | 25.58 | 2.03 300 |

| Sharp India | 47.00 | 50.79 | 3.79 52 |

| SOLARA ACTIVE P | 324.00 | 349.05 | 25.05 3.78k |

| Bhagwati Oxygen | 36.00 | 38.69 | 2.69 0 |

| Transglobe | 88.21 | 94.50 | 6.29 697 |

| Margo Finance | 35.45 | 37.89 | 2.44 534 |

| Prevest Denpro | 451.15 | 482.00 | 30.85 4.00k |

| S V J Ent. | 60.09 | 64.00 | 3.91 0 |

-330

November 02, 2023· 10:56 IST

Sensex Today | Sarvjeet Virk, Co-founder & MD, Finvasia:

There are several factors which are causing market volatility not just in India but also globally. US Treasury yields have become attractive once again, which may cause diversion of funds from stock to bonds, the US dollar has been robust against the Indian rupee, there are concerns with escalating inflation, lower-than-expected corporate earnings, rising interest rates, and most importantly the existing middle-eastern geopolitical tensions.

Even in such a situation, the Indian economy is well insulated by regulatory oversight and I see these as minor blips before stability comes in again. Not to mention, we will soon be in the midst of a festive season which is likely to uplift the general mood of the markets.

-330

November 02, 2023· 10:54 IST

Stock Market LIVE Updates | GMDC Q2 profits plummet 50% YoY to Rs 76 crore; stock tanks 9%

Shares of Gujarat Mineral Development Corporation (GMDC) dropped more than 9 percent in early trade on November 2 as the Mining and Minerals company reported dismal Q2 numbers. At 9:19 am the GMDC stock was trading 9.35 percent lower at Rs 318.63 on NSE.

GMDC, the mining company, recorded profit of Rs 76 crore for the July-September period of FY24, falling sharply by 50 percent compared to the corresponding period last fiscal, with weakness in operating performance as well as top-line. Read More