India’s booming market for exchange-traded currency derivatives is headed for a sudden demise.

A new rule set to take effect on April 5 is expected to force out most of the market’s most active players, drying up volumes that reached $5 billion-a-day.

Brokerages have started asking clients to close out contracts after exchanges on Monday reaffirmed the ruling from the central bank that participants must have an actual foreign-exchange exposure. That rules out individual traders and speculators who comprise a large portion of the volume.

“At least 70% or more of the volume will dry up — half the market is arbitragers,” said Sajal Gupta, executive director and head of forex and commodities at Nuvama Institutional. “Those traders won’t take fresh positions and have to square off existing positions.”

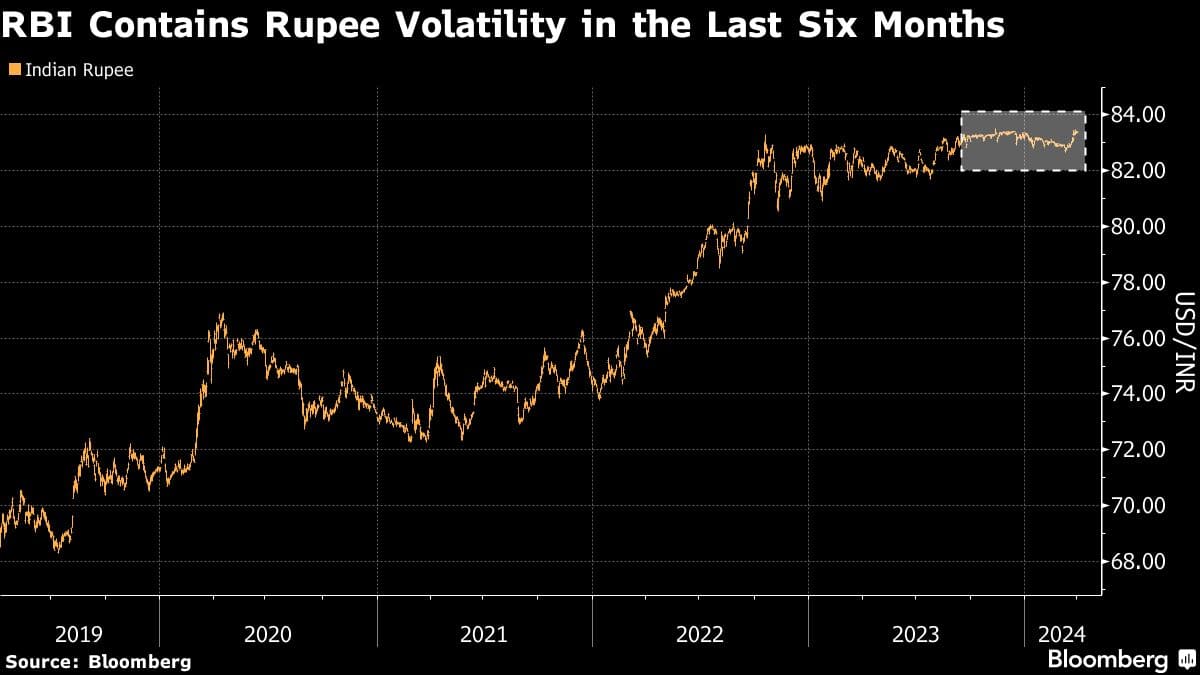

The rule aligns with the Reserve Bank of India’s broader foreign exchange management policy that has seen the authority tamp down on swings in the rupee in the run up to the inclusion of the nation’s bond markets in global indexes from June. The rupee has been one of the least volatile currencies among emerging market currencies globally.

At the heart of the matter is whether rupee-based currency contracts below $100 million traded on the National Stock Exchange and BSE Ltd. need an underlying exposure. The exchanges reaffirmed the RBI’s Jan. 5 circular mandating the requirement on Monday, catching several market participants offguard with unhedged positions.

The clarification followed am email from the RBI to the Commodity Participants Association of India on March 28 that anyone undertaking such contracts without an actual exposure would be in breach of foreign exchange rules, Bloomberg News reported, citing people familiar with the matter.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.