Indian equity markets have seen a positive momentum in November, with several indices scripting fresh lifetime highs amid easing yields, dollar and positive global cues. The cheer spread to the BSE Midcap and BSE Smallcap indices as well, seeing them claim record highs of 34,155 and 40,172 points, respectively, on November 30. However, analysts cautioned that the upside may be limited from here in broader indices as valuations turn stretched.

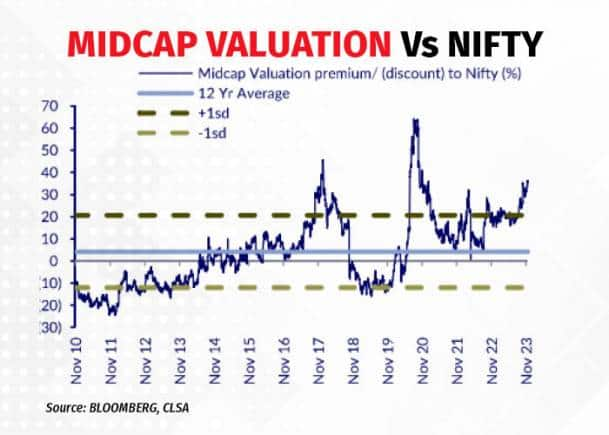

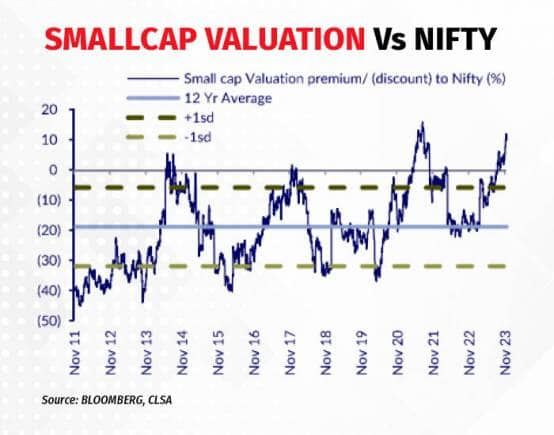

"The valuation scenario in India has turned aggressive, with mid- and smallcaps exhibiting high valuations from 10-20 percent above the long-term average, respectively. Large-caps, however, remain around the long-term average, suggesting a better risk or reward ratio on biggies," said Vinod Nair, head of research at Geojit Financial Services.

Vinod further said that he expects outperformance of midcaps to narrow over large-caps in the next six months. He noted that since large-cap earnings growth in H1FY24 exhibited exuberance, with profit after tax (PAT) growing in double digits, the same was not reflective in the Nifty100 index, a typical gauge of India's large-cap companies. “There is plenty of catch-up left,” he added.

ALSO READ: With Nifty above 20k, time to move money from smallcap to large stocks, say fund managers

Similarly, Deepak Jasani, head of retail research at HDFC Securities, flagged expensive valuations seen in mid-and small-cap pockets. "The main reason behind this may be due to the fact that these indices include some loss- or small profit-making companies whose growth rate in earnings overall is faster than that of the Nifty. Lower float value and reduced institutional holding in the small- and midcap space may also be the reason for rich valuations," he added.

So far in November, the BSE Midcap index has surged 9 percent, while the BSE Smallcap index has ticked up 8.3 percent. In comparison, the BSE Sensex was up 4.7 percent during the same period, data suggested.

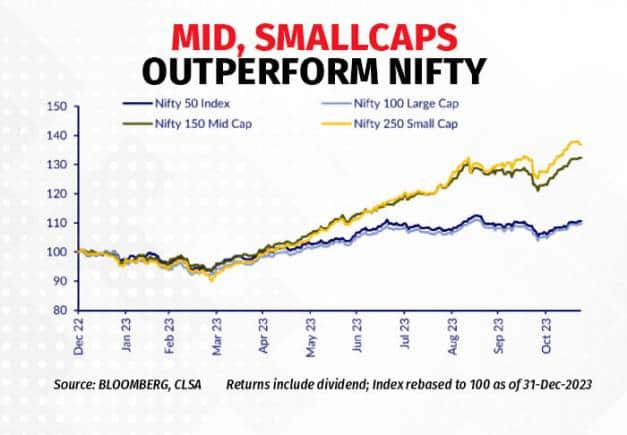

Understanding the rally in small-, midcaps so far in 2023The story of the year has been a spike in small- and midcaps as 2023 could record nearly their highest calendar-year outperformance versus the Nifty. On a year-to-date (YTD) basis, the Nifty Smallcap 250 index has surged over 38 percent, while the Nifty Midcap 150 index climbed over 33 percent. In comparison, the Nifty50 index rose 10 percent.

This has now taken relative valuation of both midcaps and small-caps versus the Nifty to well above +1 standard deviation of the long-term average premium, and further large outperformance may not be easy, noted analysts at CLSA.

“A closer perusal of this rally shows that this love for smallcaps and midcaps may have been guided by strong investor preference for some sectors that have a large portion of stocks in the small and midcaps category and smaller presence in largecaps space,” the global brokerage firm said.

Among the top 500 stocks, real estate, power and autos have shown a near-secular outperformance versus their respective market-cap based category, added CLSA. On the other hand, chemicals, media, logistics, cement, consumer staples and consumer discretionary have been the main underperformers.

Midcap, small-caps: The way forwardNarender Singh, smallcase manager and founder of Growthinvesting.in, believes that the outperformance in mid- and small-cap segments in the medium term will depend on a few critical factors like the state election results, ongoing global conflicts, crude oil prices and interest rate trajectory.

On his part, Kedar Kadam, director, listed investments, Waterfield Advisors, said that the party in small- and midcaps may continue but breadth is expected to narrow from here on as many highflying stocks look ahead of their fundamentals and are expensive. He suggests accumulating select names from the capital goods, building materials, specialty chemicals and pharma sectors.

Alternatively, Tanvi Kanchan, head, corporate strategy of Anand Rathi Share and Stock Brokers, remained positive on the manufacturing, FMCG, and travel and tourism segments.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.