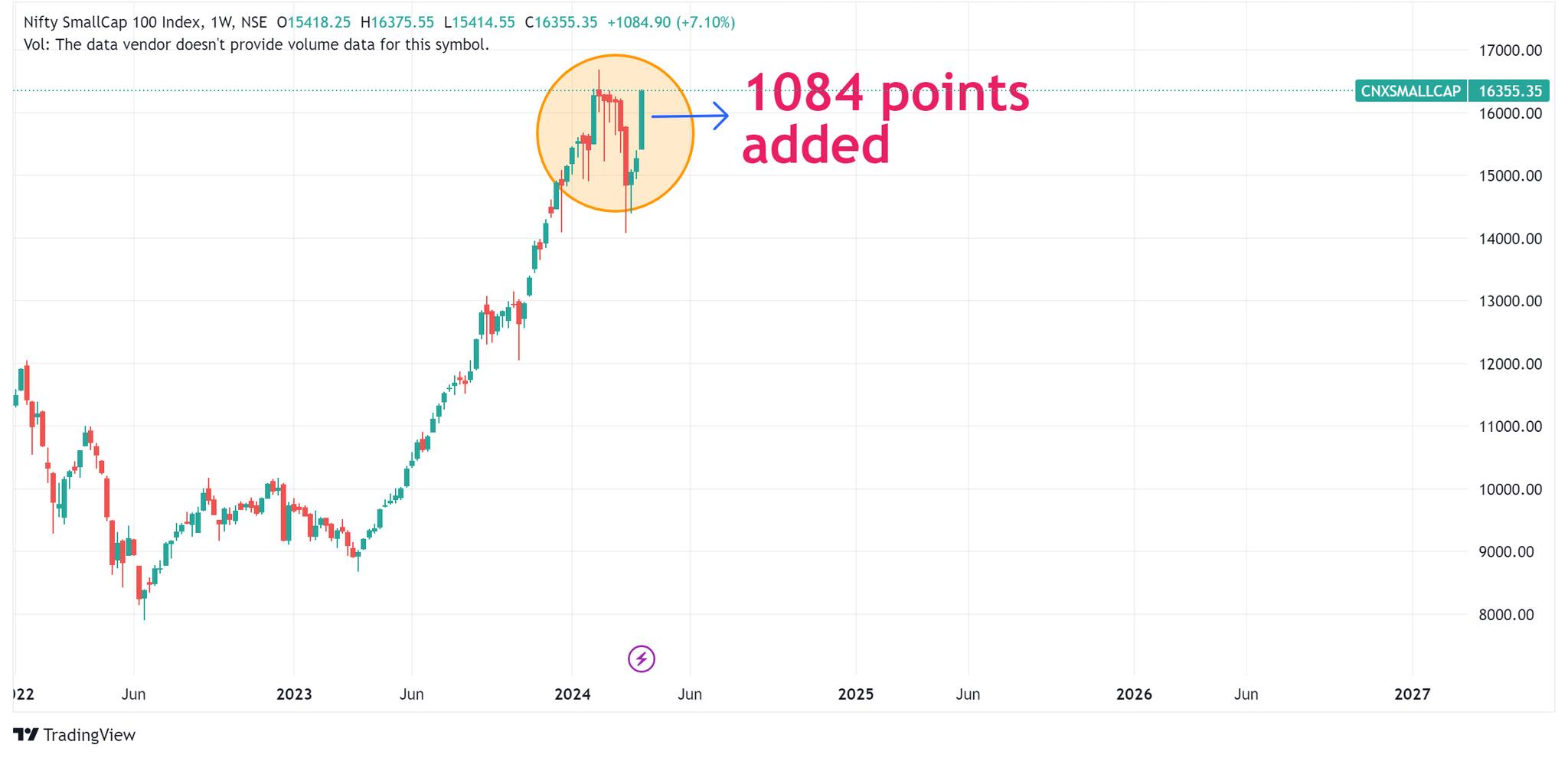

After the March mayhem, small-cap stocks made a big-bang revival in the first week of April with the Nifty Smallcap 100 index, rallying 1,000 points and restoring investor confidence.

The rally in smallcaps also reinforced the buy-on-dip strategy that's in play since the Covid pandemic.

Can you ignore the big boom in small-caps? Here's why you can't do so...

1. Best of the pack: The Nifty Smallcap index rallied 7.10 percent in the past one week, turning out to be one of the top-performing indices during the week. Only Nifty Microcap 250 index with a 7.87 percent surge bettered the returns of Nifty Smallcap 100 index. The Nifty 50 paled in comparison with a weekly gain of only 0.64 percent.

2. Pace of comeback: The Nifty Smallcap index managed to close at levels of 16,355, adding 1,084 points over the past week. This is the first time in its history that the index has gained more than 1,000 points in a week’s time frame. Although the absolute number does not matter as the base is far higher currently, the strong momentum is visible. Also in percentage terms by recording gains of over 7 percent in the first week of April, the index has delivered one of the best weekly performances in 180 weeks of 45 months. In the week starting June 1, 2020, Nifty Smallcap 100 index gained more than 10 percent.

Nifty smallcap 100 index adds 1084 points in 1st week of April

Nifty smallcap 100 index adds 1084 points in 1st week of April

3. Making history: This is also the ninth best weekly performance of the Nifty Smallcap 100 index in the past 20 years. The top three best gains were seen in 2009, 2014 and 2020 (See table: Nifty Smallcap 100: Best weekly returns in 20 years). Again, considering the higher base, a 7 percent move indicates strong momentum when looked at over a longer time-frame.

Nifty Smallcap 100 index delivers one of the best weekly performances

Nifty Smallcap 100 index delivers one of the best weekly performances

4. Broad-based rally: It’s not only a handful of stocks that are running up. The rally has had participation from a large number of stocks. Ujjivan Small Finance Bank, Cochin Shipyard, PNB Housing, Aavas Financiers from the Nifty Smallcap 100 index showed strong uptrend, rocketing more than 20 percent in the past week. The list of stocks that gained between 10 to 20 percent included IIFL , NCC, Tejas Network , CUB , Tata Investments, NBCC, Nalco, Hindustan Copper, IRB , BSE, GNFC, Tanla Solutions, GMDC, NMDC, NAM-India, BLS, Welspun Living, Castrol India, Trident, CESC, Chambal fertilisers, Data Patterns, Alok Industries, HSCL, IOB, Manapuram Finance, Happiest Minds, HUDCO, TTML, Renuka Sugars and CDSL. At least 66 stocks from the 100 index stocks gained by more than 5 percent in the record breaking week.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.