PTC India Financial Services (PFS) is on the lookout for a new Managing Director (MD) and Chief Executive Officer (CEO) amid intensified regulatory scrutiny, after the attempt to appoint one in 2023 did not work out.

In October 2023, the board had given an in-principle approval to a candidate but he withdrew after engaging with the company for five months due to delays and alleged interference by the current management.

The non-banking financial subsidiary of PTC India has been under a regulatory scanner for over two years since three independent directors resigned from the PFS board flagging concerns over corporate governance issues. The position of MD and CEO has not been filled for almost nine months, since Pawan Singh stepped down after being forced to go on leave following a Reserve Bank of India (RBI) directive.

“The recruitment process is being handled by an experienced HR consulting Firm. We expect a good response to the advertisement.,” PFS said in a response to a detailed query from Moneycontrol.

PFS has invited applications from potential candidates to select an MD and CEO, the last date for which is March 15. The appointment is critical since Mahendra Lodha, the company’s Director (Finance) and Chief Financial Officer (CFO), who was handling the additional charge of MD and CEO since June 2023, has resigned and his last day at work is March 15.

Management under the scanner

“The PFS management has remained unstable since 2022. The only constant has been Rajib Mishra, who seems to be influencing appointments and is reluctant to let an outsider take this role,” a senior executive in the know said. This was validated by at least three other sources.

While the PFS board has undergone much change since 2022, when the three independent directors quit, it is still headed by the Chairman, Rajib Kumar Mishra.

In May last year, markets regulator the Securities and Exchange Board of India (SEBI) had issued a show-cause notice to Mishra, who heads PTC India (PTC) and is the Non-Executive Chairman of subsidiary PTC India Financial Services (PFS), for failing in his “prime responsibility” of letting the board function effectively and in discharging his duties. The SEBI notice said that Mishra and Singh, given their roles in the board and the management, were at the “steering wheel” in PFS and therefore, responsible for the failure of corporate governance.

SEBI issued the notice in the matter of alleged corporate governance issues at PFS, including bypassing the board in certain decisions, and changing the terms and conditions of loans.

On June 27 (2023?), the Registrar of Companies said that it found PFS and Singh in violation of the Companies Act, 2013, and penalised both in three separate adjudication orders.

Concerns linger

Sources have said that PFS’ independent directors have communicated their concerns to RBI over issues in appointments to key roles.

PFS did not reply to questions relating to allegations that Mishra may be blocking the appointment. The company referred to its press release dated February 19, which said, “RBI, as part of its due diligence, had sought certain information / documents from the candidate, which was communicated to the candidate and such document was awaited from the candidate. In the meanwhile, the candidate withdrew his candidature. The decision of the candidate to withdraw was his own and PFS had no role in the decision of the candidate.”

In 2022, when PFS’ independent directors quit, they had said that MD and CEO Singh had blocked the on-boarding of Ratnesh (full name), an NTPC executive who was appointed by the board as Director (Finance) and CFO in July 2021. Ratnesh went back to his parent organisation, NTPC, in December 2021, and it was alleged that Mishra and Singh had together ensured that he did not join PFS.

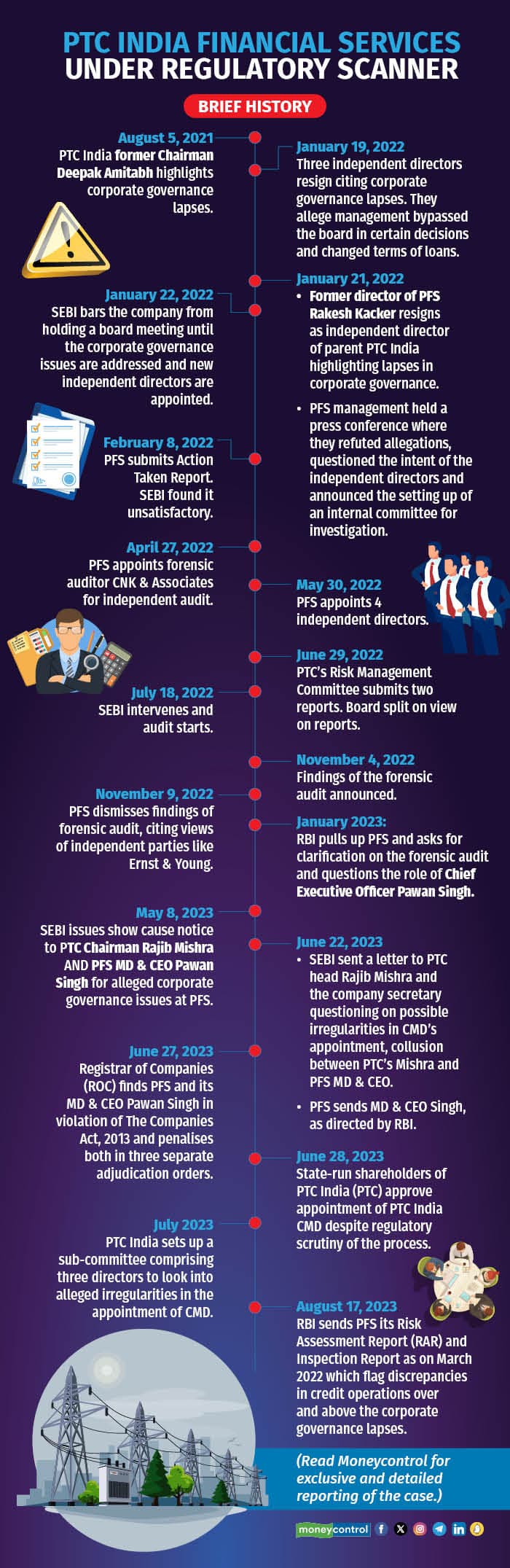

PTC India Financial Services under a regulatory scanner - a brief history

PTC India Financial Services under a regulatory scanner - a brief history

Now, sources say that the company is trying to retain Lodha beyond his last date of March 15. “The Director (Finance) & CFO’s resignation has been communicated to the stock exchanges as required under extant regulations. Any development in this regard will also be shared with the stock exchanges as per regulations,” PFS said in response to the Moneycontrol query.

All eyes On SEBI and RBI

Speculation is rife that SEBI may issue an order after its investigation of allegations relating to the PFS management. In response to a query on this, PFS said, “PFS has not received any notice from SEBI and cannot comment on this.”

In September, the RBI had flagged operational issues at the company over and above corporate governance lapses based on the inspection report (IR), risk assessment report (RAR), and a supervisory meeting. RBI wrote to the PFS Chairman, asking the board and the management to pay immediate attention to “critical gaps” in governance, compliance, business, and operational risk discovered in the supervisory assessment.

On September 22, 2023, Moneycontrol exclusively reported that RBI’s RAR and IR on PFS, as on March 31, 2022, had found that the company had deviated from loan sanction norms and accorded “excessive discretionary power” to a former top official, raising concerns over risk management practices and the robustness of its governance framework.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.