Tata Motors, India's leading electric vehicle manufacturer, is expected to remain in the black with a net profit of Rs 3,215 crore in the second quarter buoyed by softening commodity costs, JLR's volume ramp-up, and operating leverage. The Nexon-maker is slated to announce its Q2 results on November 2.

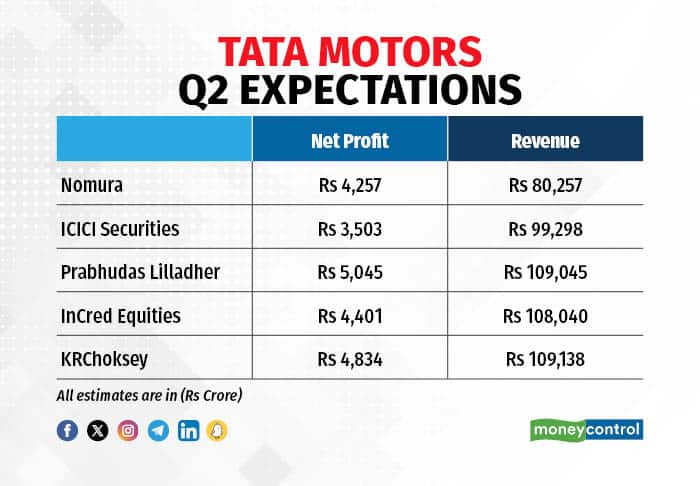

As per the average estimate of five brokerage firms, the company's revenue from operations is expected to increase by 28 percent to Rs 1,01,155 crore. During the same period last year, the company's revenue stood at Rs 79,611 crore.

Follow our market blog for all the live action

Tata Motors' earnings before interest, taxes, depreciation and amortisation or EBITDA margins are expected to increase about 650 basis points year-on-year to 14.3 percent, largely aided by higher operating leverage and superior sales mix at Jaguar Land Rover, its British subsidiary. "We expect Tata Motors to surprise positively on margins, driven by strong JLR sales," analysts at BNP Paribas said in a note.

During the same quarter last year, the company faced multiple challenges arising from Covid-related restrictions in China, a prime market for the premium JLR range. The company, like almost every other, also had to grapple with massive supply chain issues during the same period. In the same quarter last year, Tata Motors reported a net loss of Rs 898 crore.

Also read: Tata Motors wins arbitral award of Rs 766 crore plus interest in Singur plant case

What brokers are saying

As far as the JLR business is concerned, volumes (excluding that of Chery Jaguar Land Rover, its Chinese joint venture) are set to grow 29 percent over the year-ago quarter and 4 percent sequentially. Analysts at IIFL Securities expect the volume share of high-margin "RR + RR Sport + Defender" to remain steady at 64 percent. RR refers to JLR’s Range Rover models, and Defender to the mainstay Land Rover model.

Brokerage firm Prabhudas Lilladher suggests that tailwinds from low commodity costs, low discounting, sustained market share in the passenger vehicle segment led by a revamped portfolio, and leadership position in the fast-growing EV segment bode well for the company.

Analysts at KR Choksey state that the company has continued to see price discipline leading to better average selling prices and margins. The trend is expected to continue in the face of strong demand and the original equipment manufacturers shoring up margins to make way for future investments in higher-order technologies.

In the previous, the company swung back into the black. It posted a consolidated net profit of Rs 3,203 crore, boosted by the improved margin of its passenger vehicle business and robust sales at its JLR luxury car unit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before making any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.