State-run oil marketing major Indian Oil Corp Ltd is expected to report a decline in net profit for the December 2023 quarter because of inventory loss and reduced refining margins, say analysts. The company will report its earnings on Wednesday.

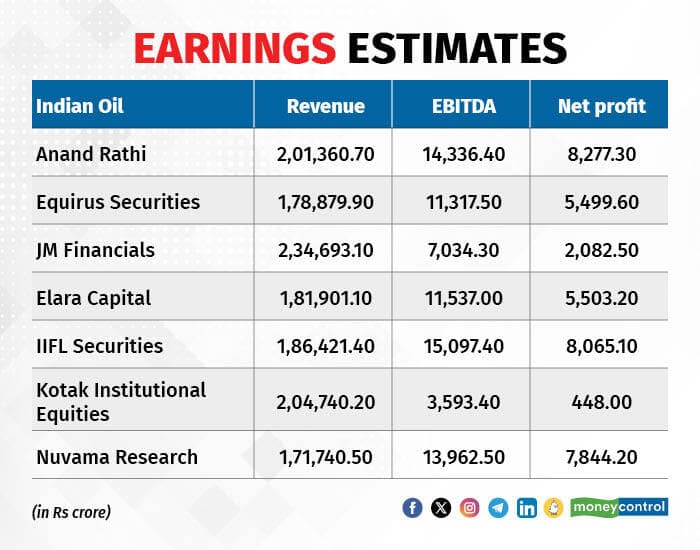

Quarterly net profit of the company is expected to plunge 58 percent on-quarter to Rs 5,388.60 crore from Rs 12,967.30 crore. Its net sales are predicted to stay flat sequentially (4 percent growth), but a 15 percent on-year decline to Rs 19,4248.10 crore, as per estimates from seven analysts compiled by Moneycontrol. EBITDA likely to decrease by 48 percent QoQ to Rs 10,982.60 crore.

"With retail auto fuel prices capped, OMCs effectively cushion oil price and product crack changes. Earnings are highly volatile and difficult to estimate. In the third quarter of FY24, GRMs should moderate, and there should also be large inventory losses. But the impact will be partially offset by improved marketing margins," said Kotak Institutional Equities in its latest note.

In the third quarter, Brent oil averaged $84.3 per barrel, showing a 5 percent YoY decrease. Despite OPEC+ reducing output, prices stayed in a range because the US had exceptionally high oil production. Singapore gross refining margins dropped significantly by 43 percent from the previous quarter and 14 percent from the previous year, mainly due to a sharp decline in gasoline, gasoil, and ATF cracks.

Analysts projection for IOCL include a GRM of $7.5/bbl (compared to $18.1/bbl QoQ), a 3 percent QoQ increase in crude throughput to 18.3mmt, nearly Rs 2 billion auto fuel over-recovery (versus Rs 27 billion under-recoveries in Q2), and an inventory loss of nearly Rs 73 billion, featuring a $5/bbl loss in refining and $1.25/bbl in marketing business (in contrast to Rs 39 billion adventitious gains in Q2).

According to Elara Capital, PSU refiners' GRM will fall to $7-12 per barrel in Q3FY24 from $12-19 in Q2FY24. OMC diesel retail gross margin should witness gains of Rs 5.3 a litre on-year but fall to Rs 1.8 a litre QoQ to Rs 0.5 a litre. Analysts highlight critical factors to watch for: fundraising activities, debt levels, and the progress of capital expenditures.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!