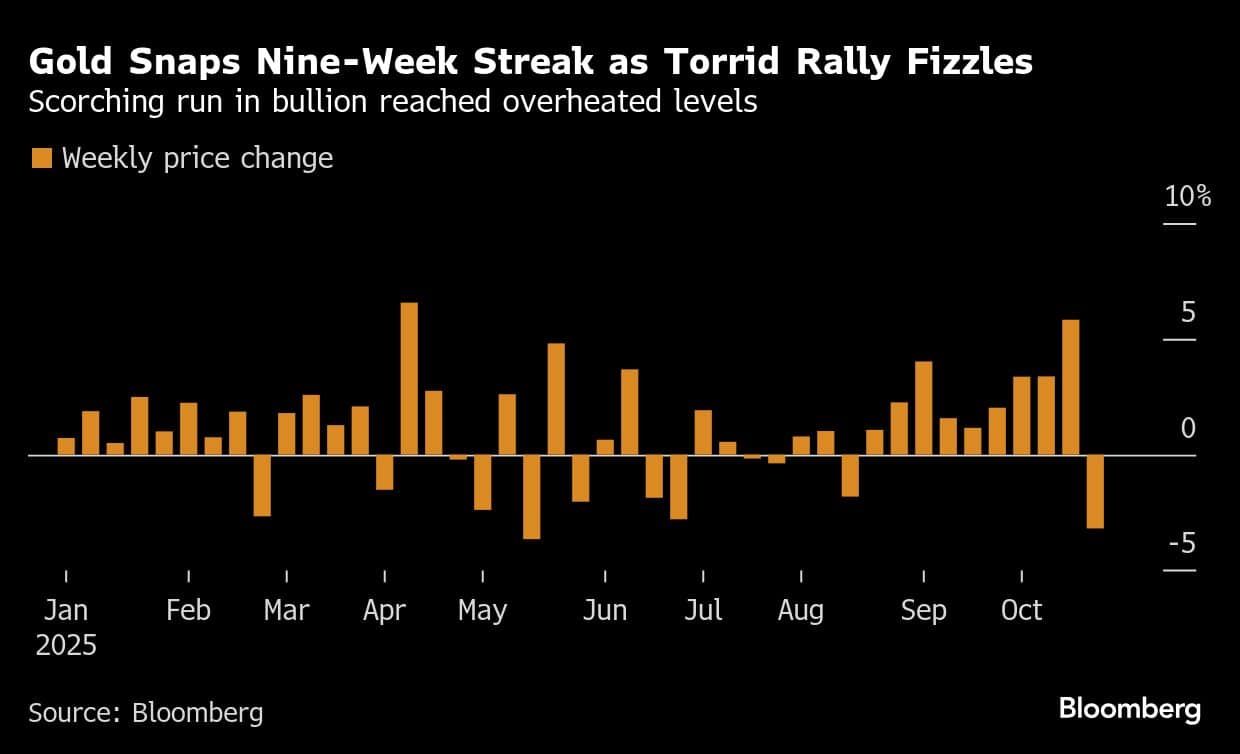

Gold is set to snap a nine-week winning streak, following a sharp correction as traders reassessed a rally that had pushed the metal into overheated territory.

Bullion edged lower to near $4,110 an ounce, putting it on track for a weekly decline of more than 3%. Investors continued to weigh improving prospects for US-China relations, with the White House confirming President Donald Trump and counterpart Xi Jinping are set to meet next week in an effort to deescalate a simmering trade war. A deal would relieve some of the geopolitical tensions that have bolstered demand for haven assets like gold.

A scorching run that began in mid-August and pushed prices to an all-time high of $4,381.52 an ounce on Monday came to a screeching halt the following day, as investors took profits. The slump coincided with a large outflow from gold-backed exchange-traded funds, which on Wednesday posted the biggest single-day decline to holdings in tonnage terms in five months, according to data compiled by Bloomberg.

Still, gold is up by more than 55% so far this year, with the so-called debasement trade — in which investors avoid sovereign debt and currencies to protect themselves from runaway budget deficits — providing support for the haven asset. Bets that the Federal Reserve will deliver more two quarter-point rate cuts by the end of the year have also boosted the appeal of non-interest bearing gold.

Traders have piled into options to protect against the potential for further gyrations in gold prices. One-month implied volatility remains elevated, after surging to its highest since 2022 earlier this week.

Investors are also shifting focus to Friday’s US consumer price index report — the first real glimpse on the state of the economy since the start of the government shutdown.

Meanwhile, the London platinum market is showing signs of significant tightness, with prices spiking to a premium of over $70 an ounce over New York futures on Wednesday. Lease rates have also surged, with the moves mirroring similar dynamics in silver after a dramatic liquidity crisis upended that market earlier this month.

Spot gold was down 0.4% to $4,111.40 an ounce as of 7:30 a.m. in Singapore. Silver, which reached a record last week, also slipped and was on track for a weekly loss of about 6%. The Bloomberg Dollar Spot Index was flat. Palladium was little changed and platinum edged lower.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.